Rocket Companies Investor Presentation Deck

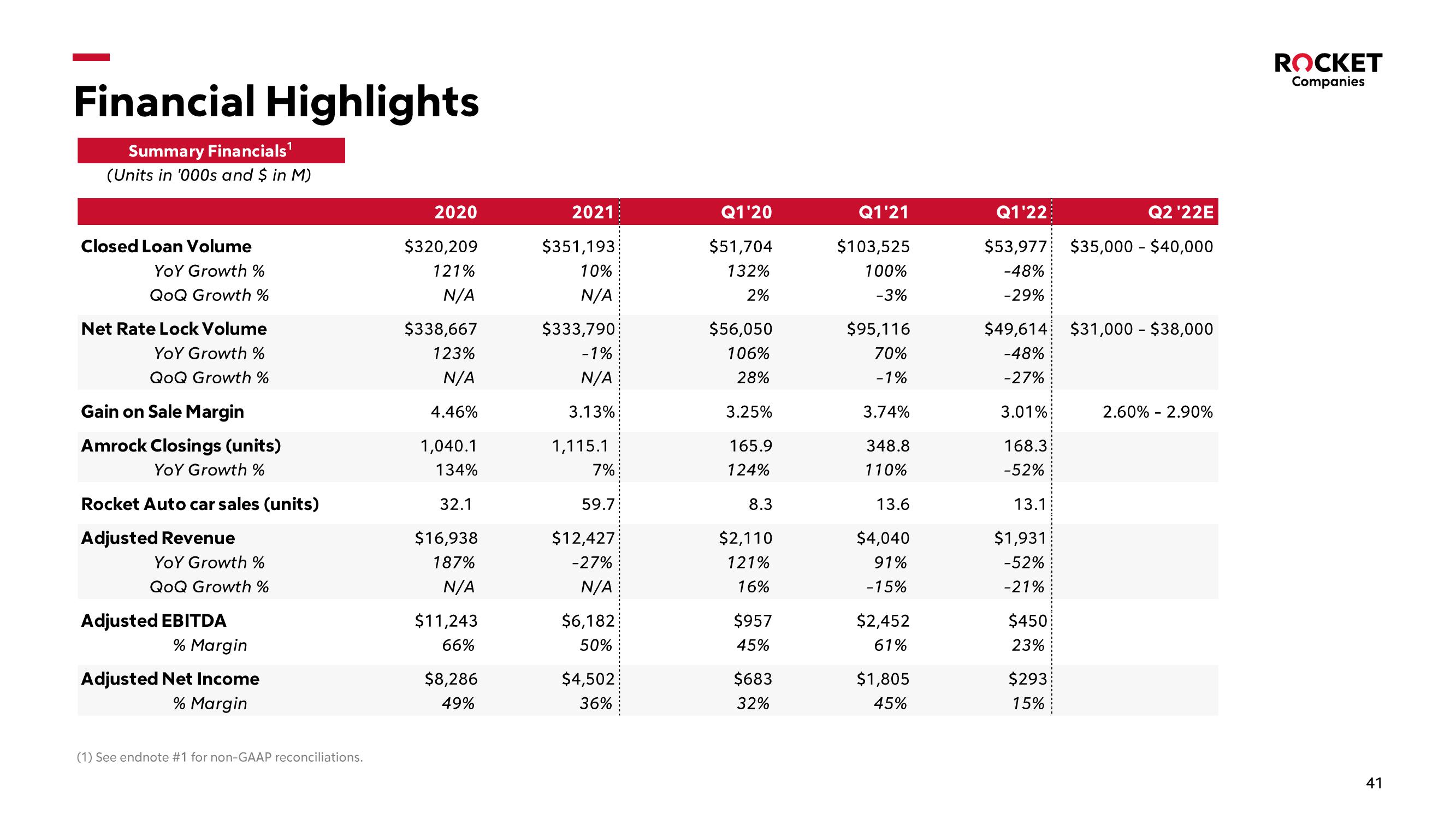

Financial Highlights

Summary Financials¹

(Units in '000s and $ in M)

Closed Loan Volume

YOY Growth %

QoQ Growth %

Net Rate Lock Volume

YOY Growth %

QoQ Growth %

Gain on Sale Margin

Amrock Closings (units)

YOY Growth %

Rocket Auto car sales (units)

Adjusted Revenue

YOY Growth %

QoQ Growth %

Adjusted EBITDA

% Margin

Adjusted Net Income

% Margin

(1) See endnote #1 for non-GAAP reconciliations.

2020

$320,209

121%

N/A

$338,667

123%

N/A

4.46%

1,040.1

134%

32.1

$16,938

187%

N/A

$11,243

66%

$8,286

49%

2021

$351,193

10%

N/A

$333,790

-1%

N/A

3.13%

1,115.1

7%

59.7

$12,427

-27%

N/A

$6,182

50%

$4,502

36%

Q1'20

$51,704

132%

2%

$56,050

106%

28%

3.25%

165.9

124%

8.3

$2,110

121%

16%

$957

45%

$683

32%

Q1'21

$103,525

100%

-3%

$95,116

70%

-1%

3.74%

348.8

110%

13.6

$4,040

91%

-15%

$2,452

61%

$1,805

45%

Q1'22

Q2 '22E

$53,977 $35,000 - $40,000

-48%

-29%

$49,614 $31,000 - $38,000

-48%

-27%

3.01%

168.3

-52%

13.1

$1,931

-52%

-21%

$450

23%

$293

15%

2.60% - 2.90%

ROCKET

Companies

41View entire presentation