Bank of America Investment Banking Pitch Book

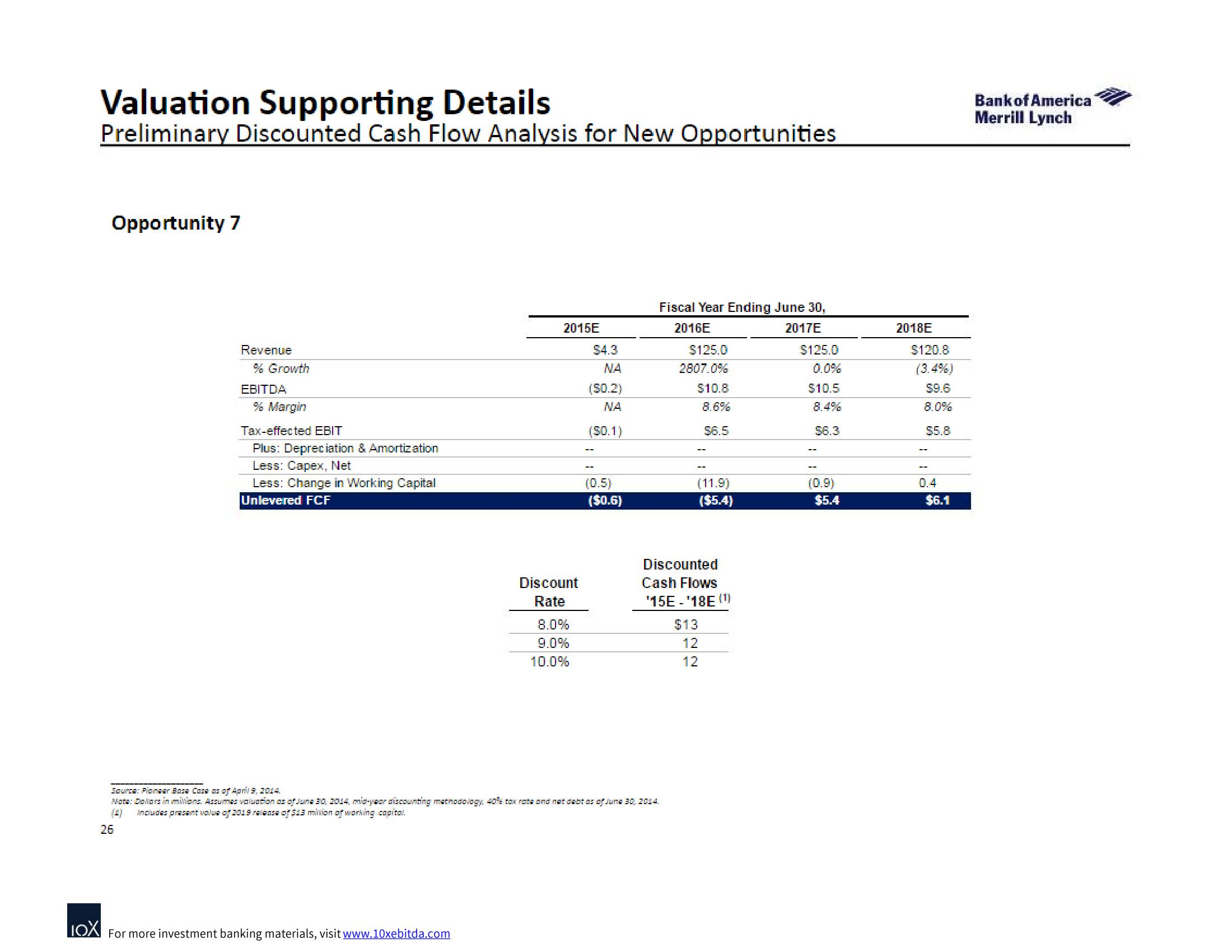

Valuation Supporting Details

Preliminary Discounted Cash Flow Analysis for New Opportunities

Opportunity 7

Revenue

26

% Growth

EBITDA

% Margin

Tax-effected EBIT

Plus: Depreciation & Amortization

Less: Capex, Net

Less: Change in Working Capital

Unlevered FCF

2015E

LOX For more investment banking materials, visit www.10xebitda.com

Discount

Rate

8.0%

9.0%

10.0%

$4.3

NA

(S0.2)

ΝΑ

(S0.1)

(0.5)

($0.6)

Fiscal Year Ending June 30,

2016E

2017E

Source: Pioneer Basa Casa as of April 9, 2014.

Note: Dollars in millions. Assumes valuation as of June 30, 2014, mid-year discounting methodology, 40% tax rate and net debt as of June 30, 2014.

Includes present value of 2019 nelaose of $13 million of working capital.

$125.0

2807.0%

$10.8

8.6%

$6.5

(11.9)

($5.4)

Discounted

Cash Flows

¹15E - ¹18E (¹)

$13

12

12

$125.0

$10.5

56.3

(0.9)

$5.4

2018E

$120.8

(3.4%)

$9.6

8.0%

$5.8

0.4

$6.1

Bank of America

Merrill LynchView entire presentation