Bakkt Results Presentation Deck

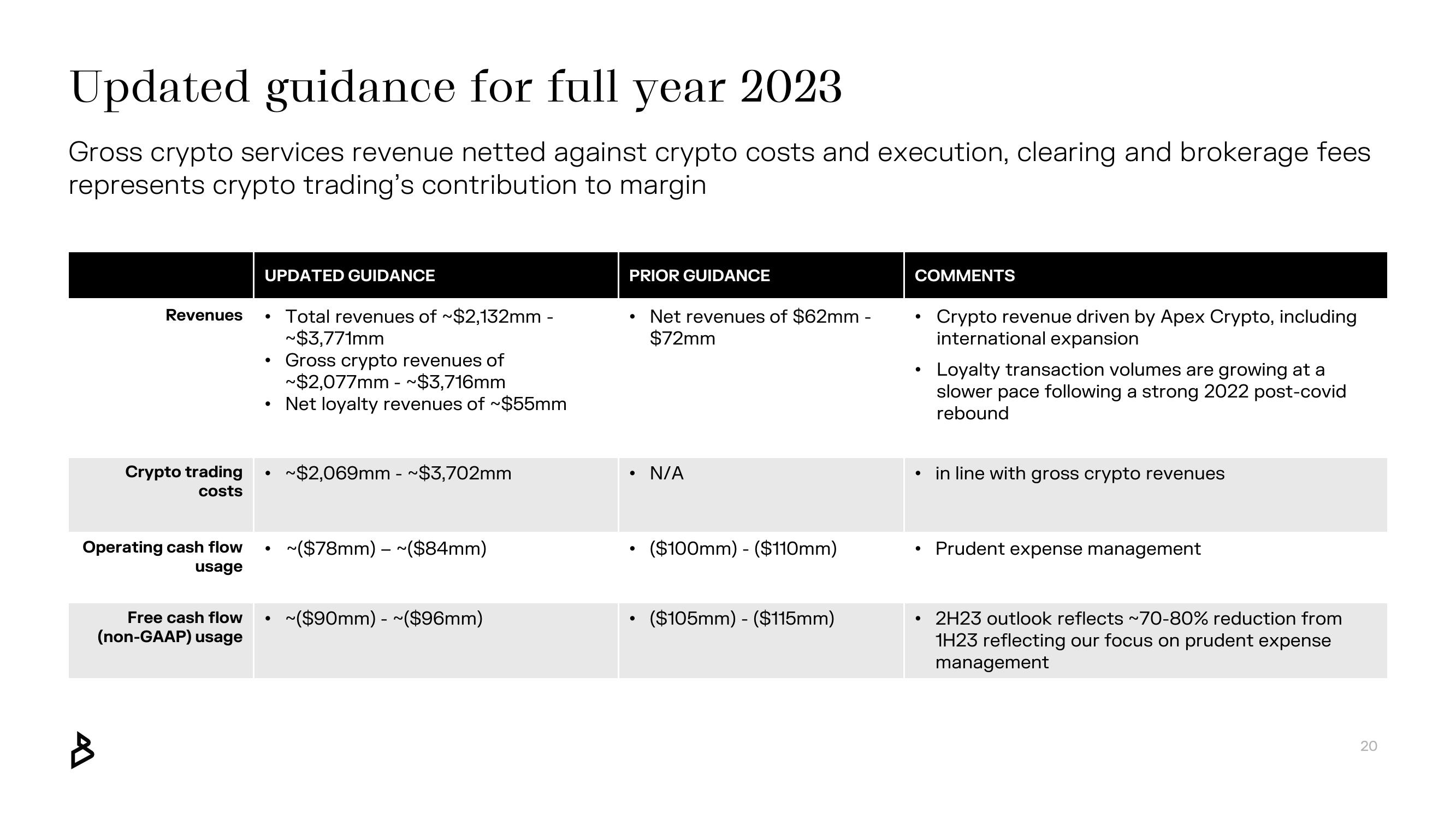

Updated guidance for full year 2023

Gross crypto services revenue netted against crypto costs and execution, clearing and brokerage fees

represents crypto trading's contribution to margin

Revenues

A

Crypto trading

costs

Operating cash flow

usage

Free cash flow

(non-GAAP) usage

UPDATED GUIDANCE

●

●

●

Total revenues of ~$2,132mm -

~$3,771mm

Gross crypto revenues of

~$2,077mm - ~$3,716mm

Net loyalty revenues of ~$55mm

~$2,069mm - ~$3,702mm

~($78mm) - ~($84mm)

~($90mm) - ~($96mm)

PRIOR GUIDANCE

●

●

Net revenues of $62mm -

$72mm

●

N/A

• ($100mm) - ($110mm)

($105mm) - ($115mm)

COMMENTS

●

●

●

Crypto revenue driven by Apex Crypto, including

international expansion

Loyalty transaction volumes are growing at a

slower pace following a strong 2022 post-covid

rebound

in line with gross crypto revenues

Prudent expense management

2H23 outlook reflects ~70-80% reduction from

1H23 reflecting our focus on prudent expense

management

20View entire presentation