PJT Partners Investment Banking Pitch Book

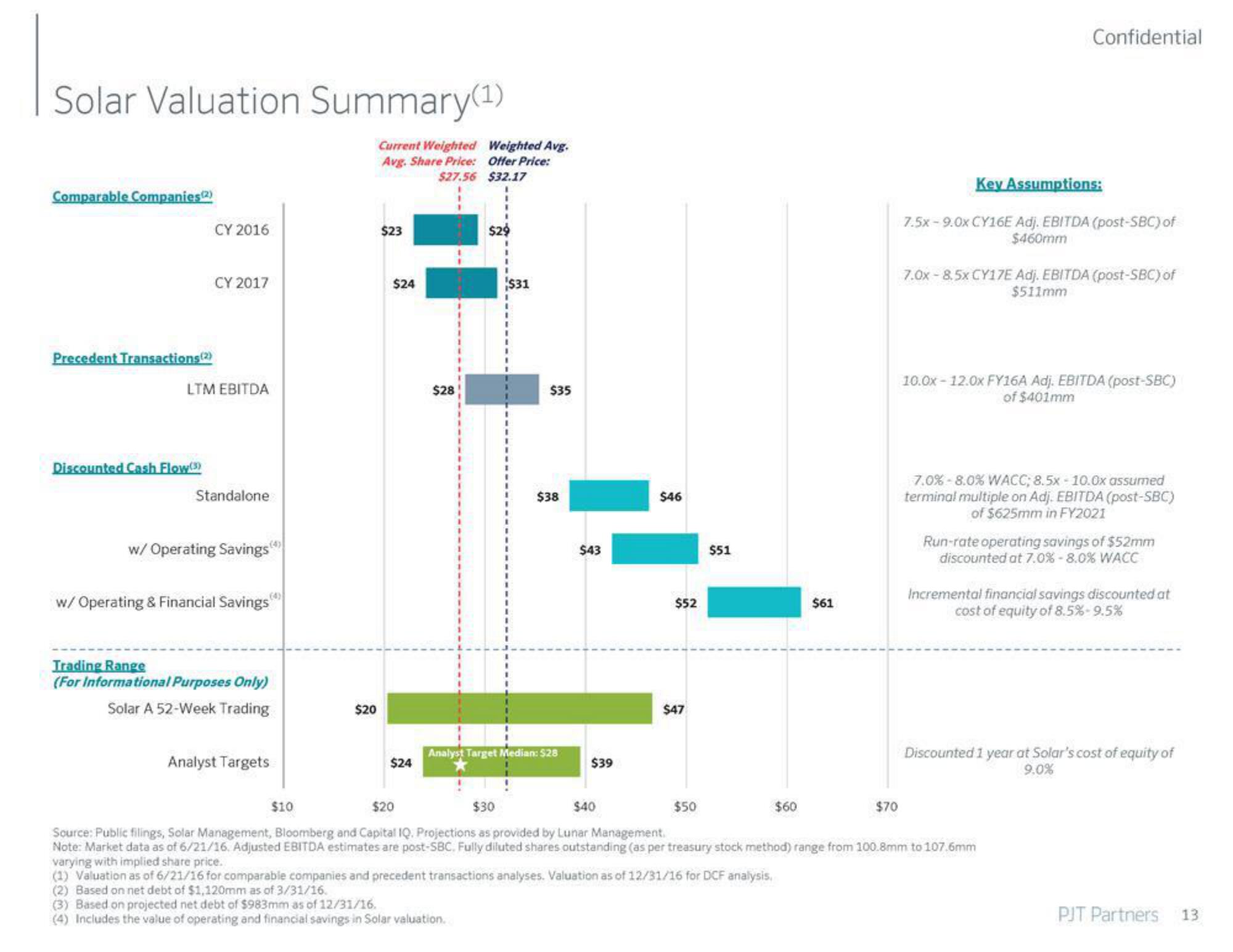

Solar Valuation Summary(¹)

Comparable Companies(2)

Precedent Transactions (2)

CY 2016

Discounted Cash Flow(3)

CY 2017

LTM EBITDA

Standalone

w/ Operating Savings

w/ Operating & Financial Savings

Trading Range

(For Informational Purposes Only)

Solar A 52-Week Trading

Analyst Targets

$20

Current Weighted Weighted Avg.

Avg. Share Price: Offer Price:

$27.56 $32.17

$23

$24

$24

$28

$29

$31

$35

$38

Analyst Target Median: $28

$43

$39

$46

$52

$47

$51

$50

$61

$60

$70

Confidential

Key Assumptions:

7.5x-9.0x CY16E Adj. EBITDA (post-SBC) of

$460mm

7.0x-8.5x CY17E Adj. EBITDA (post-SBC) of

$511mm

10.0x-12.0x FY16A Adj. EBITDA (post-SBC)

of $401mm

7.0% -8.0% WACC; 8.5x - 10.0x assumed

terminal multiple on Adj. EBITDA (post-SBC)

of $625mm in FY2021

$10

$20

$30

$40

Source: Public filings, Solar Management, Bloomberg and Capital IQ. Projections as provided by Lunar Management.

Note: Market data as of 6/21/16. Adjusted EBITDA estimates are post-SBC. Fully diluted shares outstanding (as per treasury stock method) range from 100.8mm to 107.6mm

varying with implied share price.

(1) Valuation as of 6/21/16 for comparable companies and precedent transactions analyses. Valuation as of 12/31/16 for DCF analysis,

(2) Based on net debt of $1,120mm as of 3/31/16.

(3) Based on projected net debt of $983mm as of 12/31/16.

(4) Includes the value of operating and financial savings in Solar valuation.

Run-rate operating savings of $52mm

discounted at 7.0% -8.0% WACC

Incremental financial savings discounted at

cost of equity of 8.5%-9.5%

Discounted 1 year at Solar's cost of equity of

9.0%

PJT Partners

13View entire presentation