LSE Results Presentation Deck

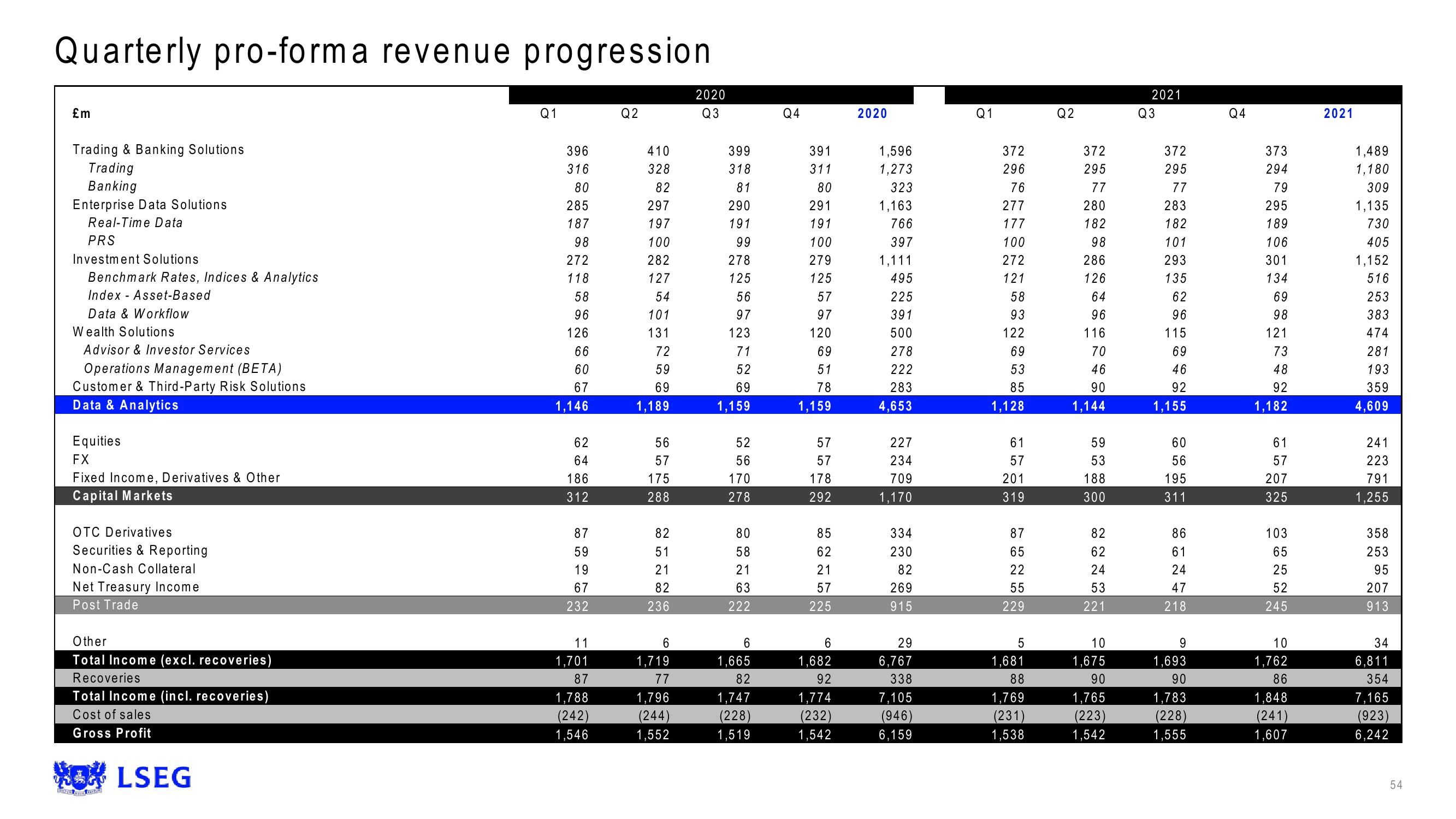

Quarterly pro-forma revenue progression.

£m

Trading & Banking Solutions

Trading

Banking

Enterprise Data Solutions

Real-Time Data

PRS

Investment Solutions

Benchmark Rates, Indices & Analytics

Index Asset-Based

Data & Workflow

Wealth Solutions

Advisor & Investor Services

Operations Management (BETA)

Customer & Third-Party Risk Solutions

Data & Analytics

Equities

FX

Fixed Income, Derivatives & Other

Capital Markets

OTC Derivatives

Securities & Reporting

Non-Cash Collateral

Net Treasury Income

Post Trade

Other

Total Income (excl. recoveries)

Recoveries

Total Income (incl. recoveries)

Cost of sales

Gross Profit

WOLSEG

Q1

396

316

80

285

187

98

272

118

58

96

126

66

60

67

1,146

62

64

186

312

87

59

19

67

232

11

1,701

87

1,788

(242)

1,546

Q2

410

328

82

297

197

100

282

127

54

101

131

72

59

69

1,189

56

57

175

288

82

51

21

82

236

6

1,719

77

1,796

(244)

1,552

2020

Q3

399

318

81

290

191

99

278

125

56

97

123

71

52

69

1,159

52

56

170

278

80

58

21

63

222

6

1,665

82

1,747

(228)

1,519

Q4

391

311

80

291

191

100

279

125

57

97

120

69

51

78

1,159

57

57

178

292

85

62

21

57

225

6

1,682

92

1,774

(232)

1,542

2020

1,596

1,273

323

1,163

766

397

1,111

495

225

391

500

278

222

283

4,653

227

234

709

1,170

334

230

82

269

915

29

6,767

338

7,105

(946)

6,159

Q1

372

296

76

277

177

100

272

121

58

93

122

69

53

85

1,128

669

CO LO

61

57

201

319

ܗ ܗ

87

65

22

55

229

5

1,681

88

1,769

(231)

1,538

Q2

372

295

77

280

182

98

286

126

64

96

116

70

46

90

1,144

59

53

188

300

82

62

24

53

221

10

1,675

90

1,765

(223)

1,542

2021

Q3

372

295

77

283

182

101

293

135

62

96

115

69

46

92

1,155

60

56

195

311

86

61

24

47

218

9

1,693

90

1,783

(228)

1,555

Q4

373

294

79

295

189

106

301

134

69

98

121

73

48

92

1,182

61

57

207

325

103

65

25

52

245

10

1,762

86

1,848

(241)

1,607

2021

1,489

1,180

309

1,135

730

405

1,152

516

253

383

474

281

193

359

4,609

241

223

791

1,255

358

253

95

207

913

34

6,811

354

7,165

(923)

6,242

54View entire presentation