Maersk Results Presentation Deck

Maersk Group

- Interim Report 03 2015

MAERSK GROUP

PERFORMANCE

For Q3 2015

Contents

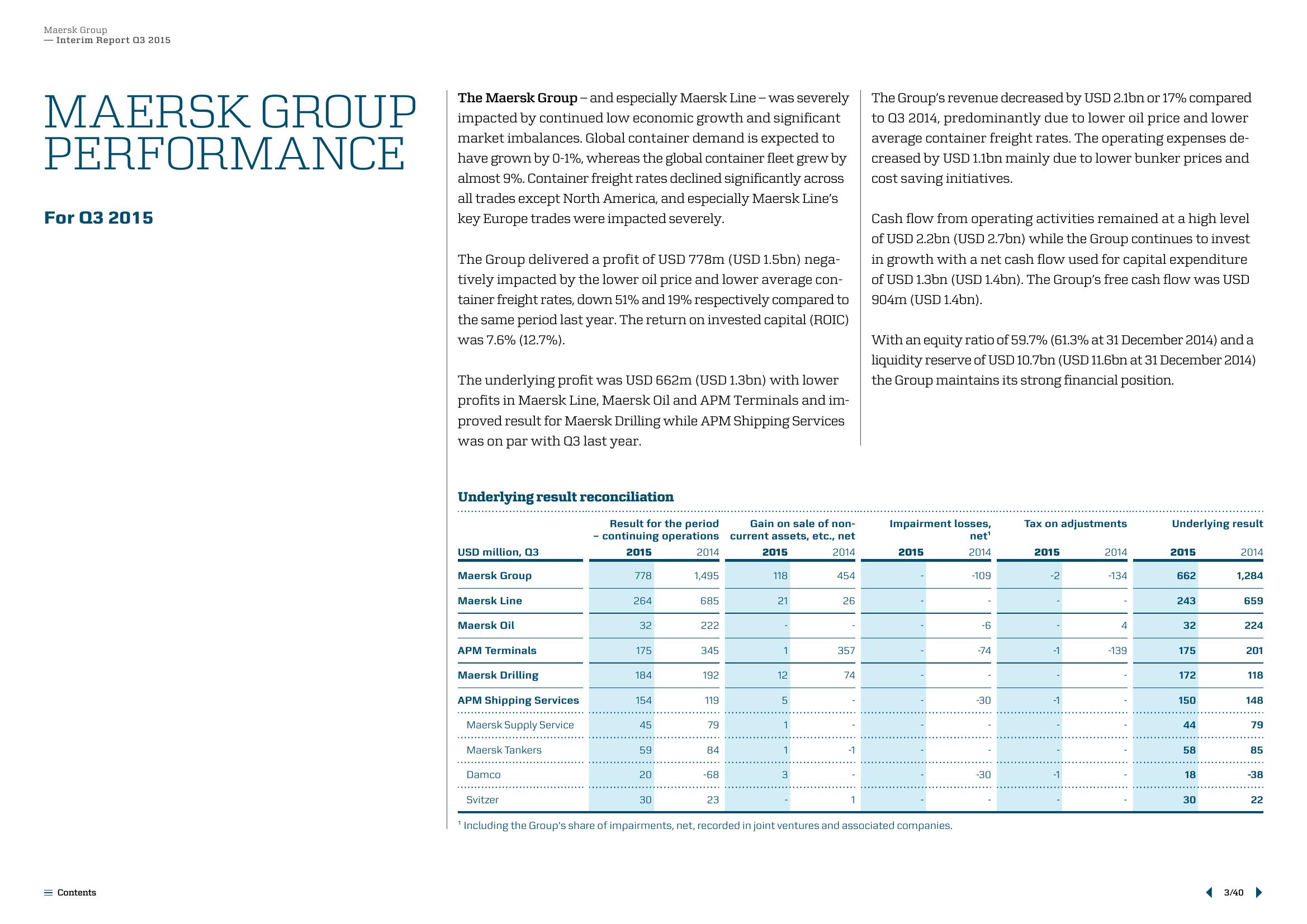

The Maersk Group- and especially Maersk Line - was severely

impacted by continued low economic growth and significant

market imbalances. Global container demand is expected to

have grown by 0-1%, whereas the global container fleet grew by

almost 9%. Container freight rates declined significantly across

all trades except North America, and especially Maersk Line's

key Europe trades were impacted severely.

The Group delivered a profit of USD 778m (USD 1.5bn) nega-

tively impacted by the lower oil price and lower average con-

tainer freight rates, down 51% and 19% respectively compared to

the same period last year. The return on invested capital (ROIC)

was 7.6% (12.7%).

The underlying profit was USD 662m (USD 1.3bn) with lower

profits in Maersk Line, Maersk Oil and APM Terminals and im-

proved result for Maersk Drilling while APM Shipping Services

was on par with Q3 last year.

Underlying result reconciliation

USD million, Q3

Maersk Group

Maersk Line

Maersk Oil

APM Terminals

Maersk Drilling

APM Shipping Services

Maersk Supply Service

Maersk Tankers

Damco

Svitzer

Result for the period

- continuing operations

2015

778

264

32

175

184

154

45

59

20

30

2014

1,495

685

222

345

192

119

79

84

-68

23

Gain on sale of non-

current assets, etc., net

2014

2015

118

21

1

12

5

1

1

3

454

26

357

74

1

-1

1

The Group's revenue decreased by USD 2.1bn or 17% compared

to 03 2014, predominantly due to lower oil price and lower

average container freight rates. The operating expenses de-

creased by USD 1.1bn mainly due to lower bunker prices and

cost saving initiatives.

Cash flow from operating activities remained at a high level

of USD 2.2bn (USD 2.7bn) while the Group continues to invest

in growth with a net cash flow used for capital expenditure

of USD 1.3bn (USD 1.4bn). The Group's free cash flow was USD

904m (USD 1.4bn).

With an equity ratio of 59.7% (61.3% at 31 December 2014) and a

liquidity reserve of USD 10.7bn (USD 11.6bn at 31 December 2014)

the Group maintains its strong financial position.

Impairment losses,

net¹

2014

2015

'Including the Group's share of impairments, net, recorded in joint ventures and associated companies.

-109

-6

-74

-30

-30

Tax on adjustments

2015

-2

-1

-1

-1

2014

-134

4

-139

Underlying result

2015

662

243

32

175

172

150

44

58

18

30

2014

1,284

3/40

659

224

201

118

148

79

85

-38

22View entire presentation