Trian Partners Activist Presentation Deck

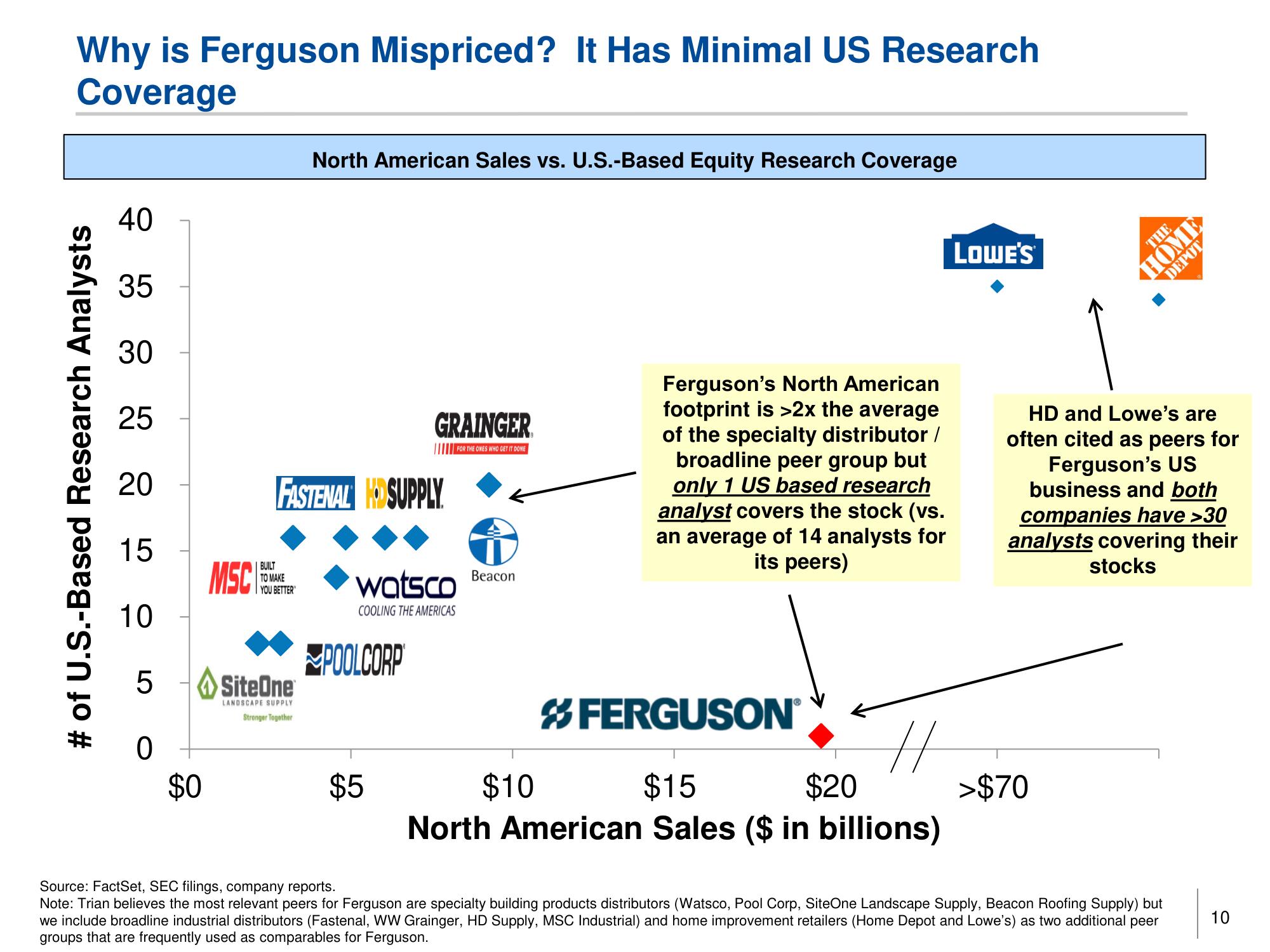

Why is Ferguson Mispriced? It Has Minimal US Research

Coverage

# of U.S.-Based Research Analysts

40

35

30

25

20

15

10

5

0

$0

MSC

BUILT

TO MAKE

YOU BETTER"

North American Sales vs. U.S.-Based Equity Research Coverage

FASTENAL KD SUPPLY

SiteOne

LANDSCAPE SUPPLY

Stronger Together

GRAINGER

FOR THE ONES WHO GET IT DONE

watsco

COOLING THE AMERICAS

POOLCORP

$5

Beacon

Ferguson's North American

footprint is >2x the average

of the specialty distributor /

broadline peer group but

only 1 US based research

analyst covers the stock (vs.

an average of 14 analysts for

its peers)

FERGUSONⓇ

$10

$15

$20

North American Sales ($ in billions)

LOWE'S

>$70

THE

HOME

DEPOT

HD and Lowe's are

often cited as peers for

Ferguson's US

business and both

companies have >30

analysts covering their

stocks

Source: FactSet, SEC filings, company reports.

Note: Trian believes the most relevant peers for Ferguson are specialty building products distributors (Watsco, Pool Corp, SiteOne Landscape Supply, Beacon Roofing Supply) but

we include broadline industrial distributors (Fastenal, WW Grainger, HD Supply, MSC Industrial) and home improvement retailers (Home Depot and Lowe's) as two additional peer

groups that are frequently used as comparables for Ferguson.

10View entire presentation