Investor Presentation

GREENLANE

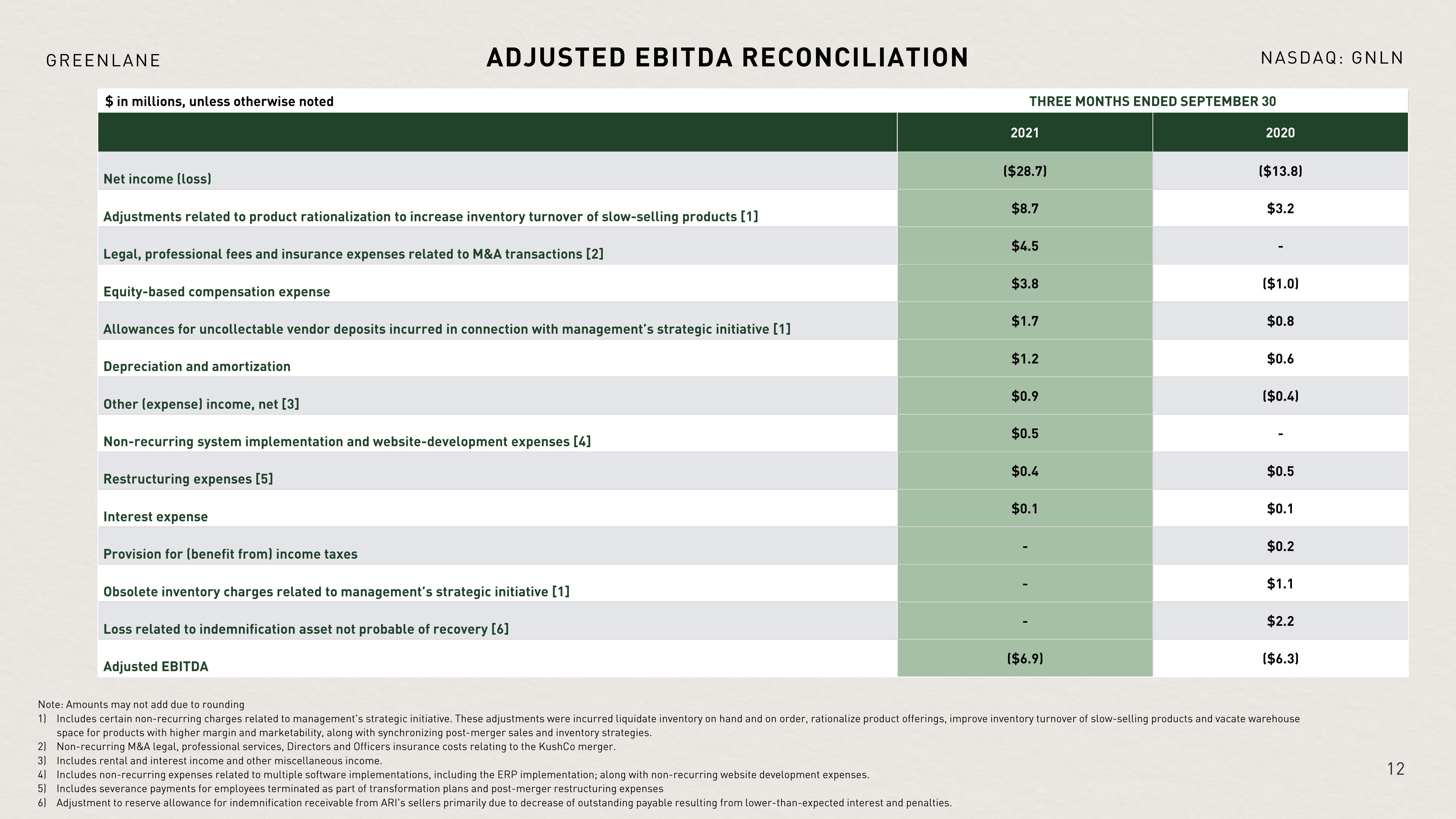

$ in millions, unless otherwise noted

Net income (loss)

Adjustments related to product rationalization to increase inventory turnover of slow-selling products [1]

Legal, professional fees and insurance expenses related to M&A transactions [2]

ADJUSTED EBITDA RECONCILIATION

Equity-based compensation expense

Allowances for uncollectable vendor deposits incurred in connection with management's strategic initiative [1]

Depreciation and amortization

Other (expense) income, net [3]

Non-recurring system implementation and website-development expenses [4]

Restructuring expenses [5]

Interest expense

Provision for (benefit from) income taxes

Obsolete inventory charges related to management's strategic initiative [1]

Loss related to indemnification asset not probable of recovery [6]

Adjusted EBITDA

THREE MONTHS ENDED SEPTEMBER 30

2021

($28.7)

$8.7

$4.5

$3.8

$1.7

$1.2

$0.9

$0.5

$0.4

$0.1

NASDAQ: GNLN

($6.9)

2020

($13.8)

$3.2

($1.0)

$0.8

$0.6

($0.4)

$0.5

$0.1

$0.2

$1.1

$2.2

($6.3)

Note: Amounts may not add due to rounding

1] Includes certain non-recurring charges related to management's strategic initiative. These adjustments were incurred liquidate inventory on hand and on order, rationalize product offerings, improve inventory turnover of slow-selling products and vacate warehouse

space for products with higher margin and marketability, along with synchronizing post-merger sales and inventory strategies.

2] Non-recurring M&A legal, professional services, Directors and Officers insurance costs relating to the KushCo merger.

3) Includes rental and interest income and other miscellaneous income.

4] Includes non-recurring expenses related to multiple software implementations, including the ERP implementation; along with non-recurring website development expenses.

5) Includes severance payments for employees terminated as part of transformation plans and post-merger restructuring expenses

6) Adjustment to reserve allowance for indemnification receivable from ARI's sellers primarily due to decrease of outstanding payable resulting from lower-than-expected interest and penalties.

12View entire presentation