Cyxtera SPAC Presentation Deck

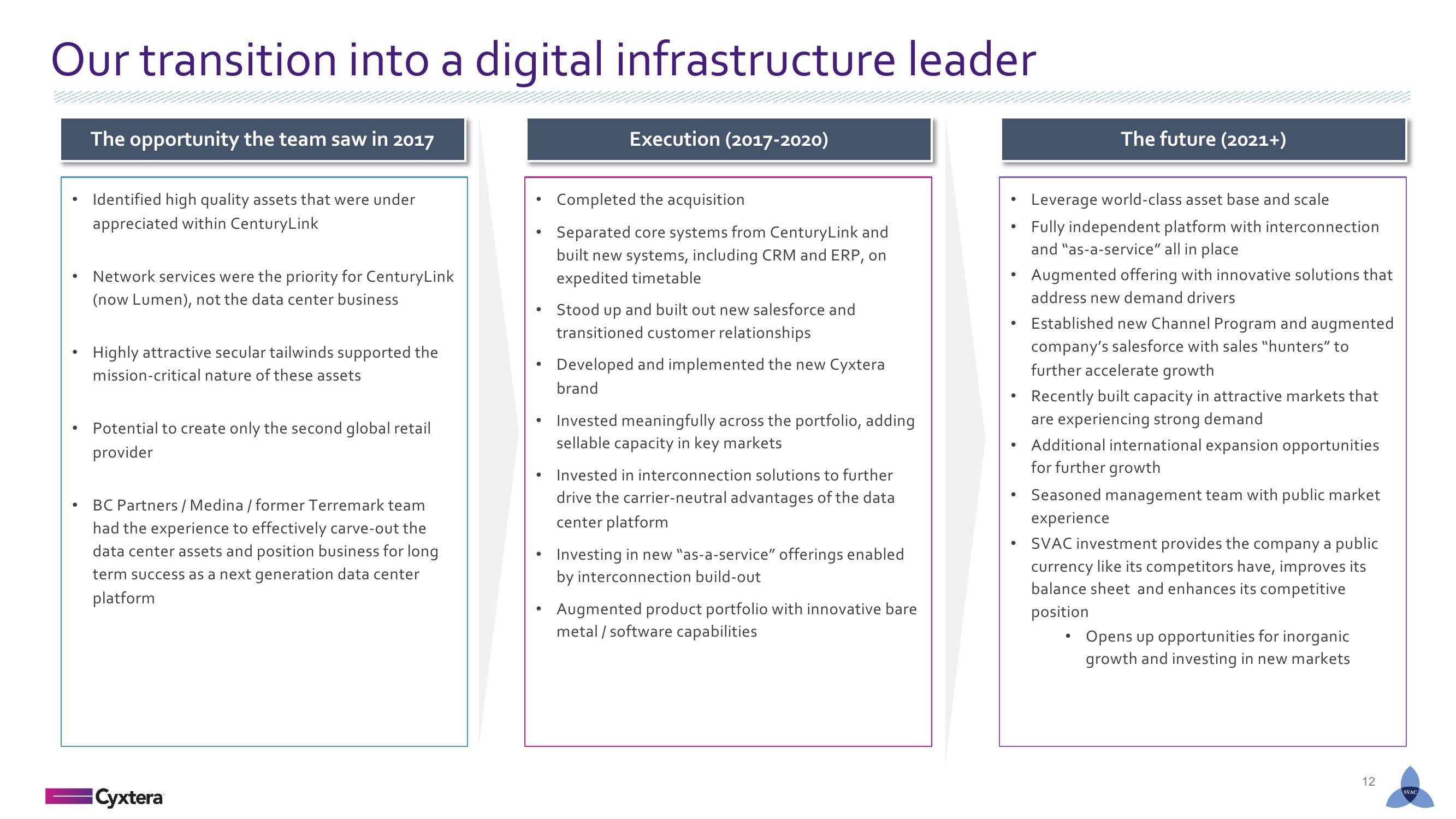

Our transition into a digital infrastructure leader

The opportunity the team saw in 2017

Identified high quality assets that were under

appreciated within CenturyLink

Network services were the priority for CenturyLink

(now Lumen), not the data center business

• Highly attractive secular tailwinds supported the

mission-critical nature of these assets

Potential to create only the second global retail

provider

BC Partners / Medina / former Terremark team

had the experience to effectively carve-out the

data center assets and position business for long

term success as a next generation data center

platform

Cyxtera

●

●

●

Execution (2017-2020)

Completed the acquisition

Separated core systems from CenturyLink and

built new systems, including CRM and ERP, on

expedited timetable

Stood up and built out new salesforce and

transitioned customer relationships

Developed and implemented the new Cyxtera

brand

Invested meaningfully across the portfolio, adding

sellable capacity in key markets

Invested in interconnection solutions to further

drive the carrier-neutral advantages of the data

center platform

Investing in new "as-a-service" offerings enabled

by interconnection build-out

Augmented product portfolio with innovative bare

metal / software capabilities

●

The future (2021+)

Leverage world-class asset base and scale

Fully independent platform with interconnection

and "as-a-service" all in place

Augmented offering with innovative solutions that

address new demand drivers

Established new Channel Program and augmented

company's salesforce with sales "hunters" to

further accelerate growth

Recently built capacity in attractive markets that

are experiencing strong demand

Additional international expansion opportunities

for further growth

Seasoned management team with public market

experience

SVAC investment provides the company a public

currency like its competitors have, improves its

balance sheet and enhances its competitive

position

Opens up opportunities for inorganic

growth and investing in new markets

12

SVACView entire presentation