Bridge Investment Group Results Presentation Deck

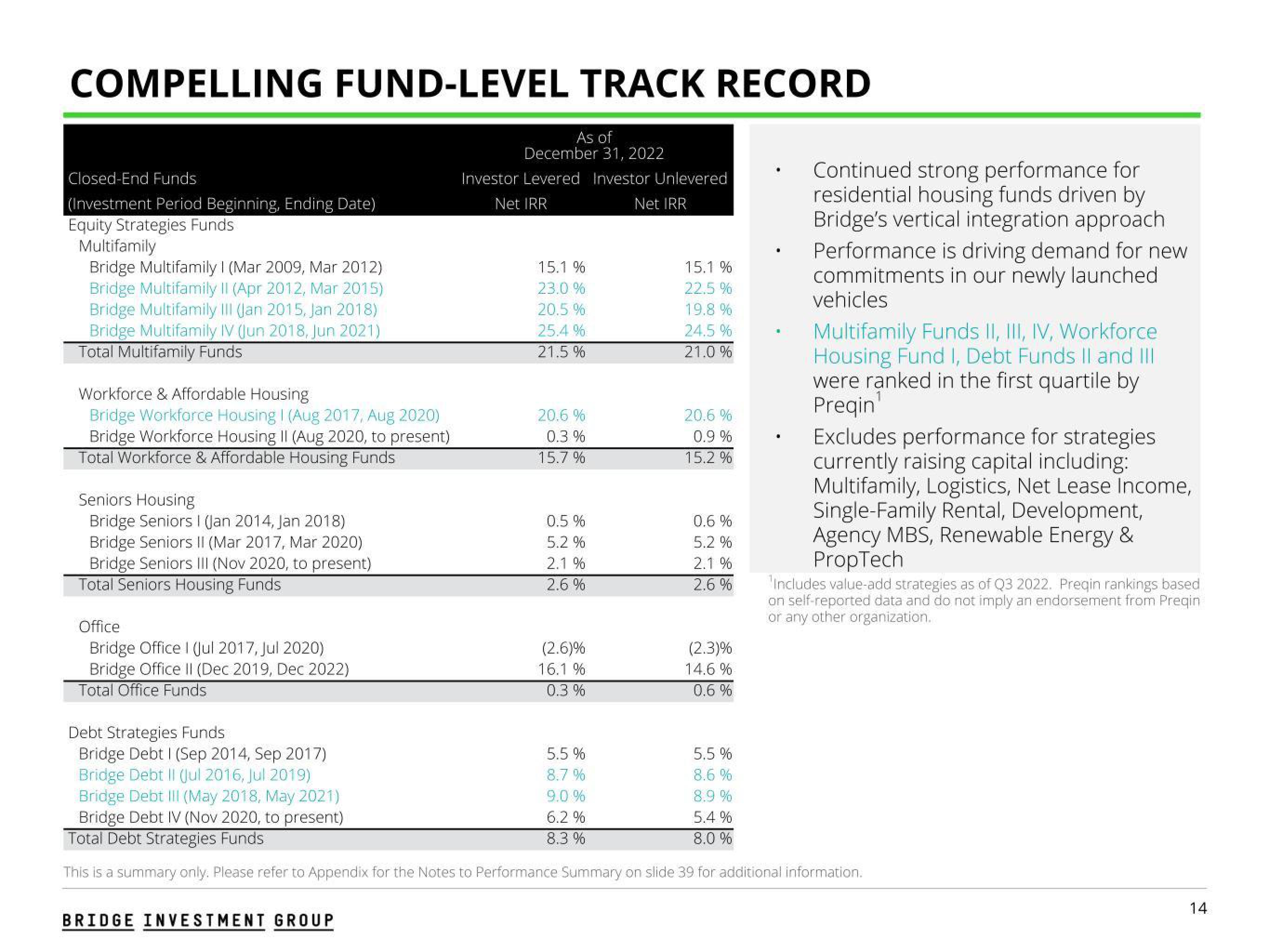

COMPELLING FUND-LEVEL TRACK RECORD

As of

December 31, 2022

Investor Levered Investor Unlevered

Net IRR

Net IRR

Closed-End Funds

(Investment Period Beginning, Ending Date)

Equity Strategies Funds

Multifamily

Bridge Multifamily I (Mar 2009, Mar 2012)

Bridge Multifamily II (Apr 2012, Mar 2015)

Bridge Multifamily III (Jan 2015, Jan 2018)

Bridge Multifamily IV (Jun 2018, Jun 2021)

Total Multifamily Funds

Workforce & Affordable Housing

Bridge Workforce Housing I (Aug 2017, Aug 2020)

Bridge Workforce Housing II (Aug 2020, to present)

Total Workforce & Affordable Housing Funds

Seniors Housing

Bridge Seniors I (Jan 2014, Jan 2018)

Bridge Seniors II (Mar 2017, Mar 2020)

Bridge Seniors III (Nov 2020, to present)

Total Seniors Housing Funds

Office

Bridge Office I (Jul 2017, Jul 2020)

Bridge Office II (Dec 2019, Dec 2022)

Total Office Funds

15.1 %

23.0 %

20.5%

25.4 %

21.5%

BRIDGE INVESTMENT GROUP

20.6 %

0.3%

15.7%

0.5%

5.2 %

2.1 %

2.6%

(2.6)%

16.1%

0.3%

5.5%

8.7%

15.1 %

22.5 %

19.8 %

24.5 %

21.0%

9.0 %

6.2 %

8.3 %

20.6%

0.9 %

15.2 %

0.6 %

5.2 %

2.1%

2.6%

(2.3)%

14.6%

0.6 %

Debt Strategies Funds

Bridge Debt I (Sep 2014, Sep 2017)

Bridge Debt II (Jul 2016, Jul 2019)

Bridge Debt III (May 2018, May 2021)

Bridge Debt IV (Nov 2020, to present)

Total Debt Strategies Funds

This is a summary only. Please refer to Appendix for the Notes to Performance Summary on slide 39 for additional information.

Continued strong performance for

residential housing funds driven by

Bridge's vertical integration approach

Performance is driving demand for new

commitments in our newly launched

vehicles

5.5%

8.6 %

8.9 %

5.4 %

8.0 %

Multifamily Funds II, III, IV, Workforce

Housing Fund I, Debt Funds II and III

were ranked in the first quartile by

Preqin'

1

Excludes performance for strategies

currently raising capital including:

Multifamily, Logistics, Net Lease Income,

Single-Family Rental, Development,

Agency MBS, Renewable Energy &

PropTech

Includes value-add strategies as of Q3 2022. Preqin rankings based

on self-reported data and do not imply an endorsement from Preqin

or any other organization.

14View entire presentation