Comcast Results Presentation Deck

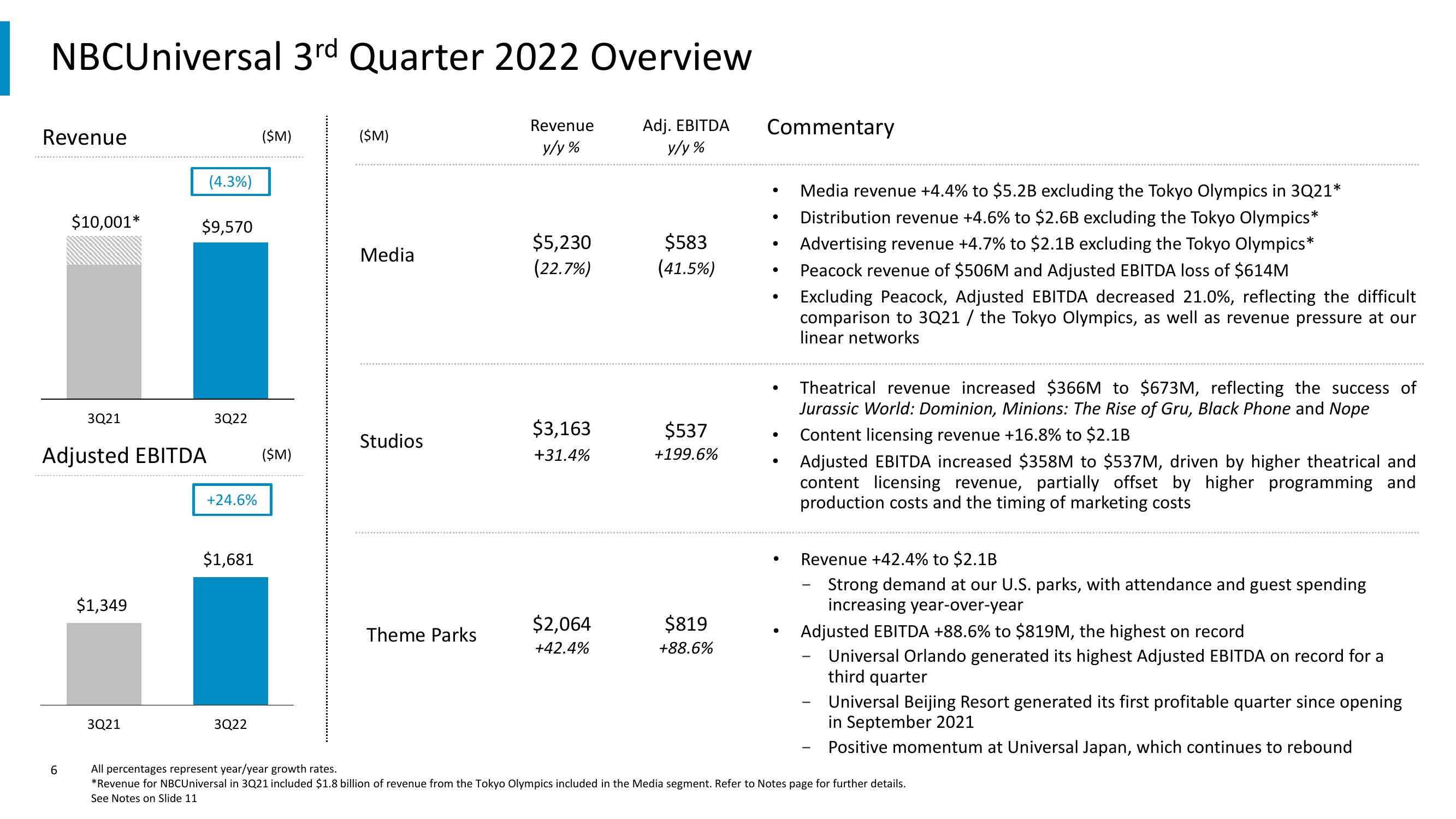

NBCUniversal 3rd Quarter 2022 Overview

Revenue

y/y%

Adj. EBITDA

y/y%

Revenue

$10,001*

6

3Q21

$1,349

(4.3%)

3Q21

$9,570

Adjusted EBITDA ($M)

3Q22

+24.6%

$1,681

($M)

3Q22

($M)

Media

Studios

Theme Parks

$5,230

(22.7%)

$3,163

+31.4%

$2,064

+42.4%

$583

(41.5%)

$537

+199.6%

$819

+88.6%

Commentary

●

●

●

●

Media revenue +4.4% to $5.2B excluding the Tokyo Olympics in 3Q21*

Distribution revenue +4.6% to $2.6B excluding the Tokyo Olympics*

Advertising revenue +4.7% to $2.1B excluding the Tokyo Olympics*

Peacock revenue of $506M and Adjusted EBITDA loss of $614M

Excluding Peacock, Adjusted EBITDA decreased 21.0%, reflecting the difficult

comparison to 3Q21 / the Tokyo Olympics, as well as revenue pressure at our

linear networks

Theatrical revenue increased $366M to $673M, reflecting the success of

Jurassic World: Dominion, Minions: The Rise of Gru, Black Phone and Nope

Content licensing revenue +16.8% to $2.1B

Adjusted EBITDA increased $358M to $537M, driven by higher theatrical and

content licensing revenue, partially offset by higher programming and

production costs and the timing of marketing costs

Revenue +42.4% to $2.1B

Strong demand at our U.S. parks, with attendance and guest spending

increasing year-over-year

Adjusted EBITDA +88.6% to $819M, the highest on record

Universal Orlando generated its highest Adjusted EBITDA on record for a

third quarter

Universal Beijing Resort generated its first profitable quarter since opening

in September 2021

Positive momentum at Universal Japan, which continues to rebound

All percentages represent year/year growth rates.

*Revenue for NBCUniversal in 3Q21 included $1.8 billion of revenue from the Tokyo Olympics included in the Media segment. Refer to Notes page for further details.

See Notes on Slide 11View entire presentation