HPS Specialty Loan Fund VI

Specialty Loan Fund VI

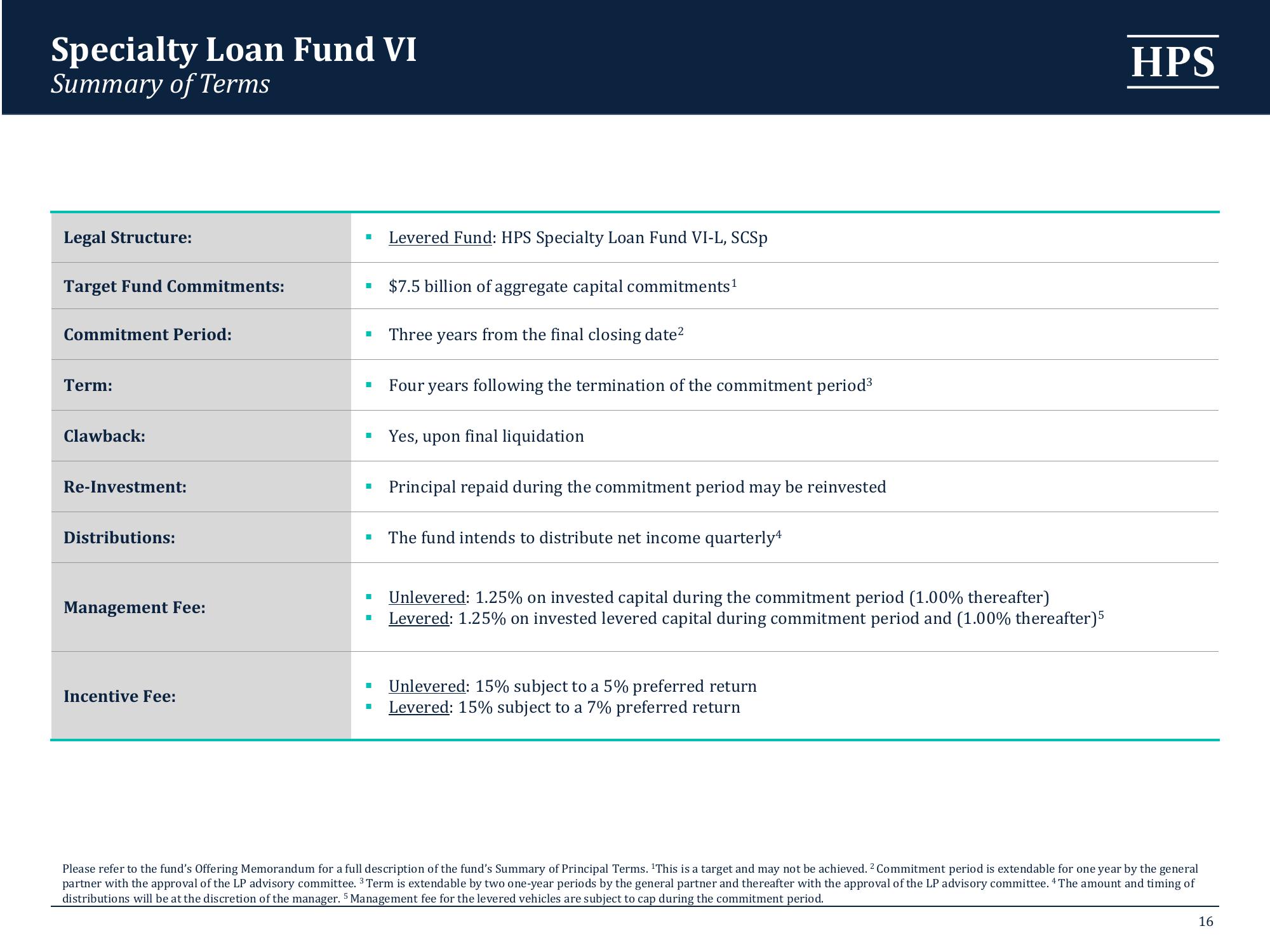

Summary of Terms

Legal Structure:

Target Fund Commitments:

Commitment Period:

Term:

Clawback:

Re-Investment:

Distributions:

Management Fee:

Incentive Fee:

I

I

I

I

Levered Fund: HPS Specialty Loan Fund VI-L, SCSp

$7.5 billion of aggregate capital commitments ¹

Three years from the final closing date²

Four years following the termination of the commitment period³

Yes, upon final liquidation

Principal repaid during the commitment period may be reinvested

The fund intends to distribute net income quarterly4

Unlevered: 1.25% on invested capital during the commitment period (1.00% thereafter)

Levered: 1.25% on invested levered capital during commitment period and (1.00% thereafter)5

Unlevered: 15% subject to a 5% preferred return

Levered: 15% subject to a 7% preferred return

HPS

Please refer to the fund's Offering Memorandum for a full description of the fund's Summary of Principal Terms. This is a target and may not be achieved. ² Commitment period is extendable for one year by the general

partner with the approval of the LP advisory committee. ³ Term is extendable by two one-year periods by the general partner and thereafter with the approval of the LP advisory committee. 4 The amount and timing of

distributions will be at the discretion of the manager. 5 Management fee for the levered vehicles are subject to cap during the commitment period.

16View entire presentation