GlobalFoundries Results Presentation Deck

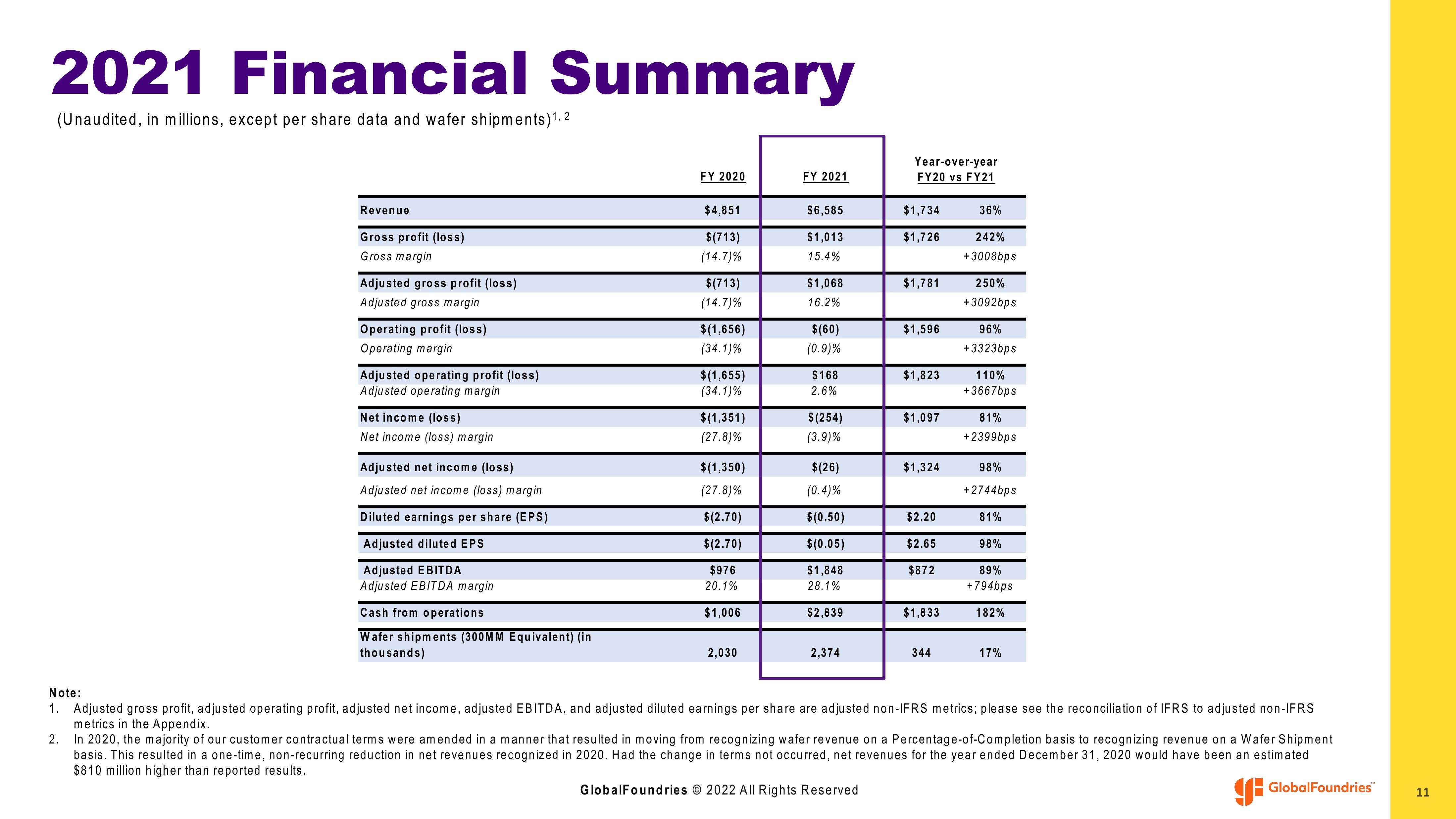

2021 Financial Summary

(Unaudited, in millions, except per share data and wafer shipments) 1,2

Revenue

Gross profit (loss)

Gross margin

Adjusted gross profit (loss)

Adjusted gross margin

Operating profit (loss)

Operating margin

Adjusted operating profit (loss)

Adjusted operating margin

Net income (loss)

Net income (loss) margin

Adjusted net income (loss)

Adjusted net income (loss) margin

Diluted earnings per share (EPS)

Adjusted diluted EPS

Adjusted EBITDA

Adjusted EBITDA margin

Cash from operations

Wafer shipments (300MM Equivalent) (in

thousands)

FY 2020

$4,851

$(713)

(14.7)%

$(713)

(14.7)%

$(1,656)

(34.1)%

$(1,655)

(34.1)%

$(1,351)

(27.8)%

$(1,350)

(27.8)%

$(2.70)

$(2.70)

$976

20.1%

$1,006

2,030

FY 2021

$6,585

$1,013

15.4%

$1,068

16.2%

$(60)

(0.9)%

$168

2.6%

$(254)

(3.9)%

$(26)

(0.4)%

$(0.50)

$(0.05)

$1,848

28.1%

$2,839

2,374

Year-over-year

FY20 vs FY21

$1,734

$1,726

GlobalFoundries © 2022 All Rights Reserved

$1,781

$1,596

$1,823

$1,097

$1,324

$2.20

$2.65

$872

$1,833

344

36%

242%

+3008bps

250%

+3092bps

96%

+3323bps

110%

+3667bps

81%

+2399bps

98%

+2744bps

81%

98%

89%

+794bps

182%

17%

Note:

1. Adjusted gross profit, adjusted operating profit, adjusted net income, adjusted EBITDA, and adjusted diluted earnings per share are adjusted non-IFRS metrics; please see the reconciliation of IFRS to adjusted non-IFRS

metrics in the Appendix.

2.

In 2020, the majority of our customer contractual terms were amended in a manner that resulted in moving from recognizing wafer revenue on a Percentage-of-Completion basis to recognizing revenue on a Wafer Shipment

basis. This resulted in a one-time, non-recurring reduction in net revenues recognized in 2020. Had the change in terms not occurred, net revenues for the year ended December 31, 2020 would have been an estimated

$810 million higher than reported results.

GlobalFoundries™

11View entire presentation