Terran Orbital SPAC Presentation Deck

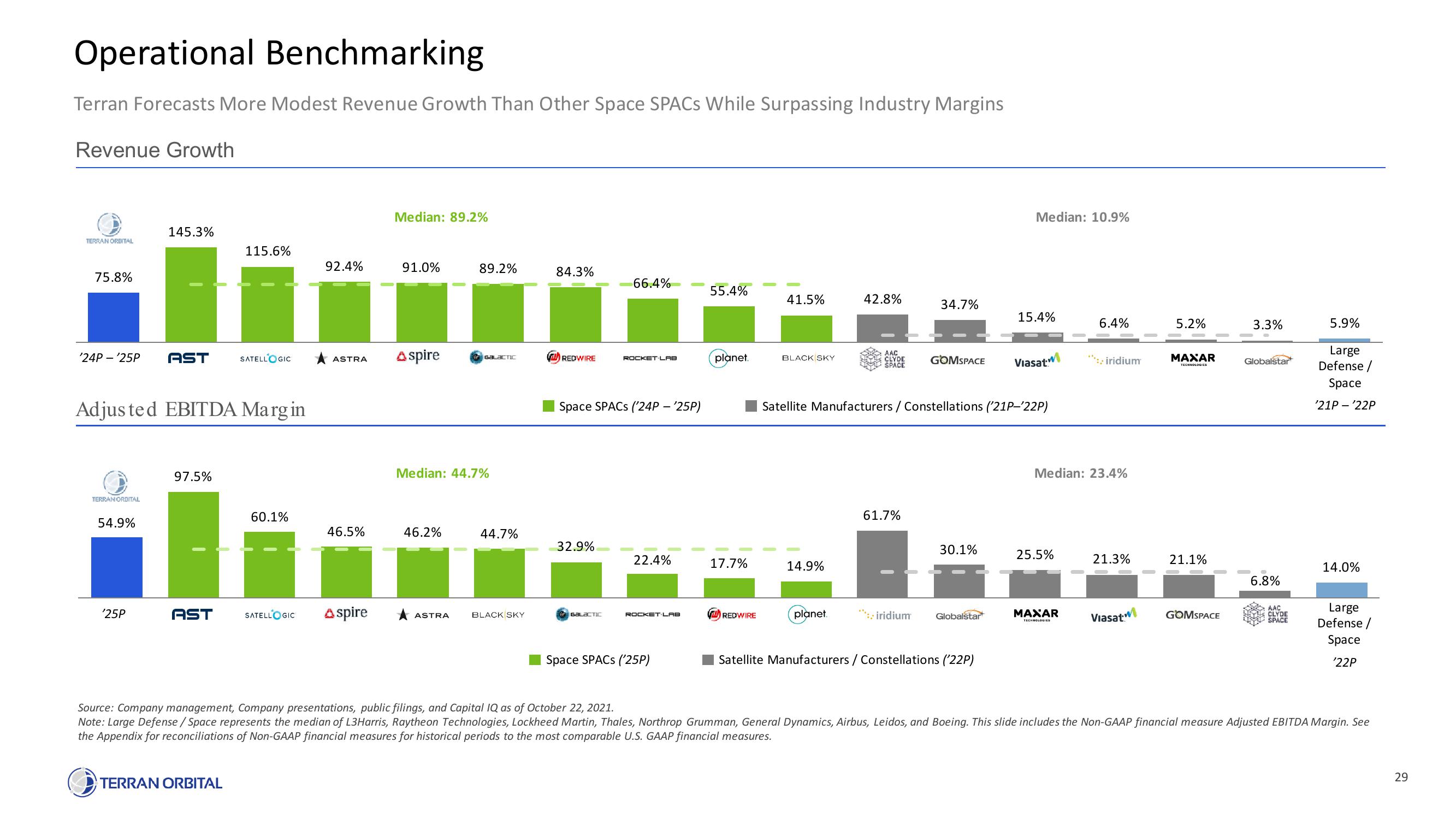

Operational Benchmarking

Terran Forecasts More Modest Revenue Growth Than Other Space SPACS While Surpassing Industry Margins

Revenue Growth

TERRAN ORDITAL

75.8%

'24P-'25P AST SATELLOGIC

TERRANORDITAL

145.3%

Adjusted EBITDA Margin

54.9%

'25P

115.6%

97.5%

60.1%

AST SATELLOGIC

TERRAN ORBITAL

92.4%

ASTRA

46.5%

Aspire

Median: 89.2%

91.0%

Aspire

46.2%

89.2%

Median: 44.7%

ASTRA

GALACTIC

44.7%

BLACK SKY

84.3%

REDWIRE

32.9%

66.4%

Space SPACS ('24P - '25P)

GALACTIC

ROCKET LAB

22.4%

ROCKET LAB

Space SPACS (25P)

55.4%

planet.

17.7%

REDWIRE

41.5%

BLACK SKY

14.9%

42.8%

planet.

AAC

CLYDE

SPACE

61.7%

34.7%

***: iridium

GOMSPACE

Satellite Manufacturers / Constellations ('21P-'22P)

30.1%

Globalstar

Median: 10.9%

Satellite Manufacturers / Constellations ('22P)

15.4%

Viasat.

25.5%

6.4%

Median: 23.4%

MAXAR

TECHNOLOGIES

***:: iridium

21.3%

Viasat

5.2%

MAXAR

TECHNOLOGIES

21.1%

GOMSPACE

3.3%

Globalstar

6.8%

AAC

CLYDE

SPACE

5.9%

Large

Defense /

Space

'21P - '22P

14.0%

Large

Defense /

Space

'22P

Source: Company management, Company presentations, public filings, and Capital IQ as of October 22, 2021.

Note: Large Defense /Space represents the median of L3Harris, Raytheon Technologies, Lockheed Martin, Thales, Northrop Grumman, General Dynamics, Airbus, Leidos, and Boeing. This slide includes the Non-GAAP financial measure Adjusted EBITDA Margin. See

the Appendix for reconciliations of Non-GAAP financial measures for historical periods to the most comparable U.S. GAAP financial measures.

29View entire presentation