Bank of America Investment Banking Pitch Book

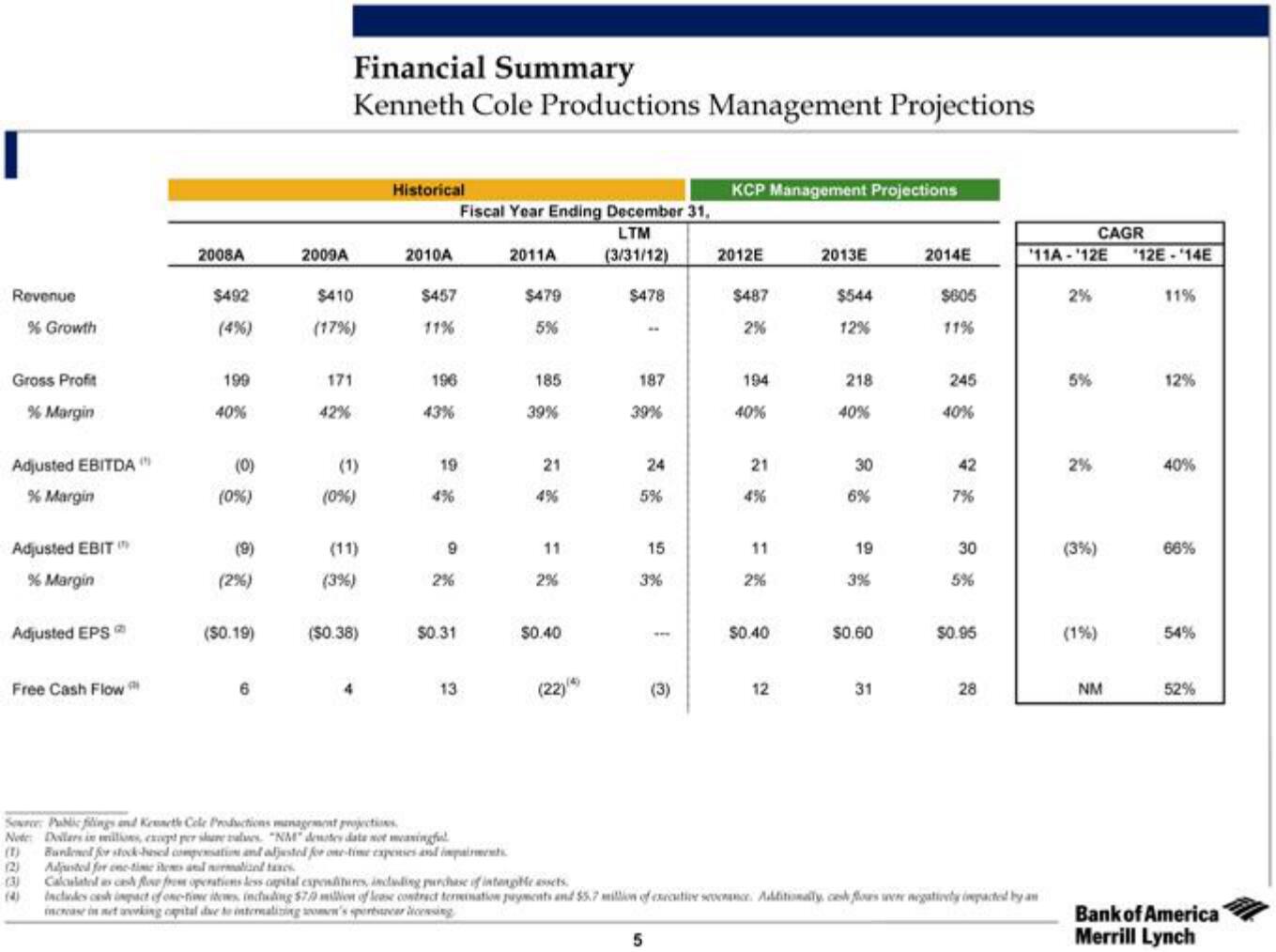

Revenue

% Growth

Gross Profit

% Margin

Adjusted EBITDA

% Margin

Adjusted EBIT

% Margin

Adjusted EPS

Free Cash Flow

(4)

2008A

$492

199

40%

(0)

(0%)

(9)

(2%)

($0.19)

6

2009A

Financial Summary

Kenneth Cole Productions Management Projections

$410

(17%)

171

42%

(0%)

(11)

(3%)

($0.38)

4

Historical

2010A

$457

11%

196

43%

19

4%

9

2%

$0.31

13

Fiscal Year Ending December 31,

LTM

(3/31/12)

Source: Public filings and Kenneth Cole Productions management projections

Note: Dollars in millions, et per share values. NM dentes date not meaningful

(1) Bunlenel for stock-based compensation and adjusted for one-time expenses and impairments

2011A

$479

5%

185

39%

21

4%

11

2%

$0.40

(22)

$478

-

187

39%

24

5%

5

15

3%

-

(3)

KCP Management Projections

2012E

$487

2%

194

40%

21

4%

11

2%

$0.40

12

2013E

$544

12%

218

40%

30

6%

19

3%

$0.60

31

2014E

$605

11%

245

40%

42

7%

30

5%

$0.95

28

Adjusted for one-time items and nirmalized taxes

Calculated as cash flow from operations less opital expenditures, including purchase of intanghe assets.

Includes cash impact of one-time items including $70 million of lease contract termination payments and $5.7 million of executive sevce. Additionally, cash flows were negatively impacted by an

increase in net arking capital due to internalizing women's sportswear licensing

'11A-'12E *12E-14E

2%

5%

2%

(3%)

CAGR

(1%)

NM

11%

12%

40%

66%

54%

52%

Bank of America

Merrill LynchView entire presentation