Matson Results Presentation Deck

19

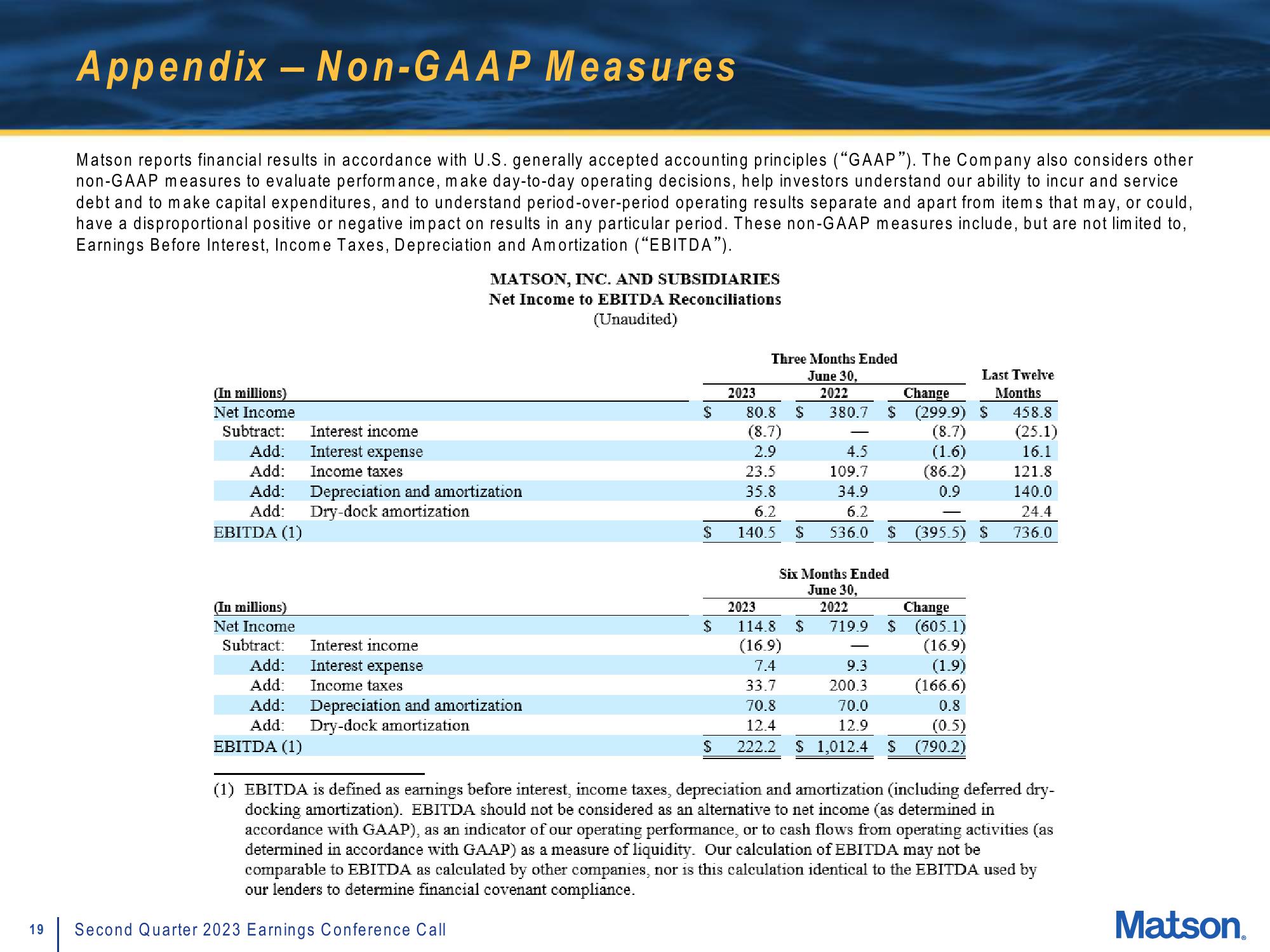

Appendix -Non-GAAP Measures

Matson reports financial results in accordance with U.S. generally accepted accounting principles ("GAAP"). The Company also considers other

non-GAAP measures to evaluate performance, make day-to-day operating decisions, help investors understand our ability to incur and service

debt and to make capital expenditures, and to understand period-over-period operating results separate and apart from items that may, or could,

have a disproportional positive or negative impact on results in any particular period. These non-GAAP measures include, but are not limited to,

Earnings Before Interest, Income Taxes, Depreciation and Amortization ("EBITDA").

(In millions)

Net Income

Subtract:

Add:

Add:

Add:

Add:

EBITDA (1)

(In millions)

Net Income

Subtract:

Add:

Add:

Add:

Add:

EBITDA (1)

Interest income

Interest expense

Income taxes

Depreciation and amortization

Dry-dock amortization

Interest income

Interest expense

Income taxes

MATSON, INC. AND SUBSIDIARIES

Net Income to EBITDA Reconciliations

(Unaudited)

Depreciation and amortization

Dry-dock amortization

Second Quarter 2023 Earnings Conference Call

$

$

$

2023

Three Months Ended

June 30,

2022

380.7

80.8 $

(8.7)

2.9

2023

4.5

23.5

109.7

35.8

34.9

6.2

6.2

140.5 $ 536.0 $ (395.5) $

Six Months Ended

June 30,

114.8 $

(16.9)

7.4

2022

719.9

Change

$ (299.9) $

(8.7)

(1.6)

(86.2)

0.9

9.3

200.3

70.0

12.9

Last Twelve

Months

458.8

(25.1)

16.1

121.8

140.0

24.4

736.0

Change

$ (605.1)

(16.9)

(1.9)

33.7

(166.6)

70.8

0.8

12.4

(0.5)

222.2 $ 1,012.4 S (790.2)

(1) EBITDA is defined as earnings before interest, income taxes, depreciation and amortization (including deferred dry-

docking amortization). EBITDA should not be considered as an alternative to net income (as determined in

accordance with GAAP), as an indicator of our operating performance, or to cash flows from operating activities (as

determined in accordance with GAAP) as a measure of liquidity. Our calculation of EBITDA may not be

comparable to EBITDA as calculated by other companies, nor is this calculation identical to the EBITDA used by

our lenders to determine financial covenant compliance.

Matson.View entire presentation