J.P.Morgan Investment Banking Pitch Book

KEY TRANSACTION CONSIDERATIONS

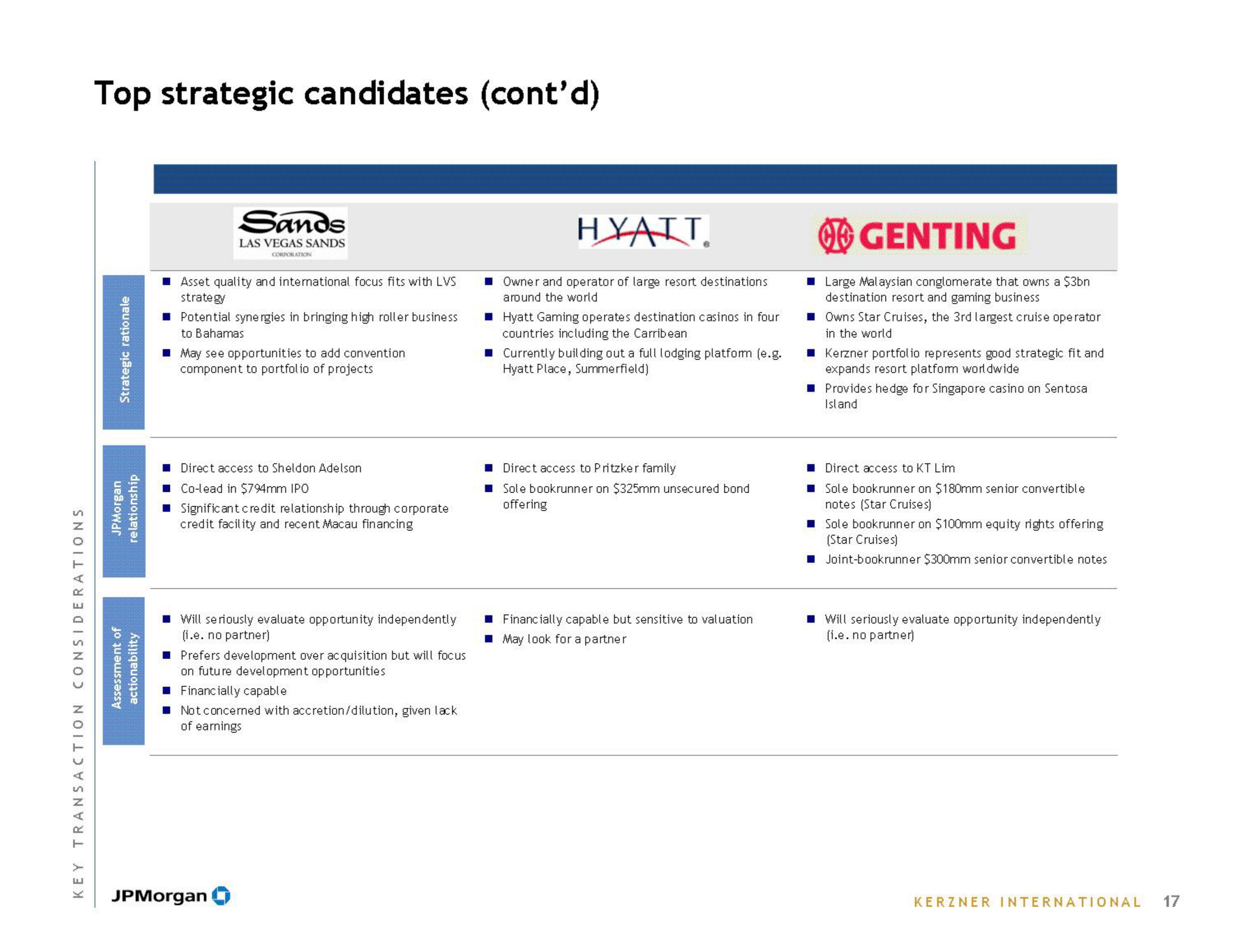

Top strategic candidates (cont'd)

Strategic rationale

JPMorgan

relationship

Assessment of

actionability

Sands

LAS VEGAS SANDS

CORPORATION

Asset quality and international focus fits with LVS

strategy

■ Potential synergies in bringing high roller business

to Bahamas

May see opportunities to add convention

component to portfolio of projects

Direct access to Sheldon Adelson

Co-lead in $794mm IPO

Significant credit relationship through corporate

credit facility and recent Macau financing

Will seriously evaluate opportunity independently

(i.e. no partner)

■ Prefers development over acquisition but will focus

on future development opportunities

Financially capable

■ Not concerned with accretion/dilution, given lack

of earnings

JPMorgan

HYATT

Owner and operator of large resort destinations

around the world

Hyatt Gaming operates destination casinos in four

countries including the Carribean

Currently building out a full lodging platform (e.g.

Hyatt Place, Summerfield)

■ Direct access to Pritzker family

Sole bookrunner on $325mm unsecured bond

offering

Financially capable but sensitive to valuation

May look for a partner

GENTING

■ Large Malaysian conglomerate that owns a $3bn

destination resort and gaming business

■Owns Star Cruises, the 3rd largest cruise operator

in the world

■Kerzner portfolio represents good strategic fit and

expands resort platform worldwide

■ Provides hedge for Singapore casino on Sentosa

Island

Direct access to KT Lim

Sole bookrunner on $180mm senior convertible

notes (Star Cruises)

Sole bookrunner on $100mm equity rights offering

(Star Cruises)

Joint-bookrunner $300mm senior convertible notes

■Will seriously evaluate opportunity independently

(i.e. no partner)

KERZNER INTERNATIONAL 17View entire presentation