Commercial Metals Company Investor Presentation Deck

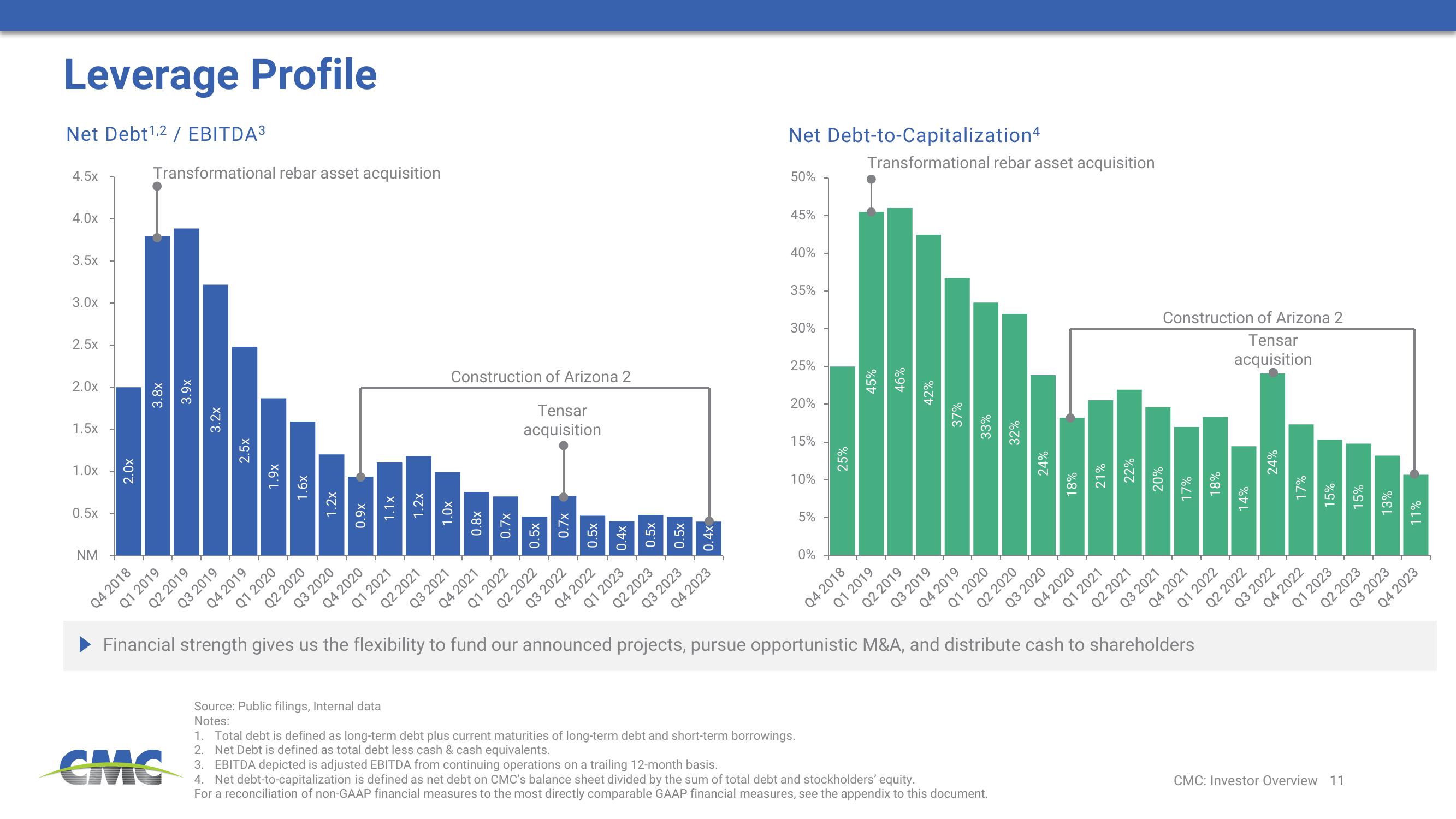

Leverage Profile

Net Debt¹,2 / EBITDA³

4.5x

4.0x

3.5x

3.0x

2.5x

2.0x

1.5x

1.0x

0.5x

NM

2.0x

Q4 2018

Transformational rebar asset acquisition

3.8x

Q1 2019

3.9x

CMC

Q2 2019

3.2x

2.5x

Q3 2019

Q4 2019

X6 L

Q1 2020

1.6x

Q2 2020

1.2x

Q3 2020

0.9x

Q4 2020

1.1x

Source: Public filings, Internal data

Notes:

Q1 2021

1.2x

Q2 2021

Construction of Arizona 2

Tensar

acquisition

1.0x

Q3 2021

0.8x

0.7x

0.5x

0.7x

0.5x

0.4x

Q4 2021

Q1 2022

Q2 2022

Q3 2022

Q4 2022

01 2023

Q2 2023

Q3 2023

Q4 2023

Net Debt-to-Capitalization4

50%

45%

40%

35%

30%

25%

20%

15%

10%

5%

1. Total debt is defined as long-term debt plus current maturities of long-term debt and short-term borrowings.

2. Net Debt is defined as total debt less cash & cash equivalents.

0%

25%

Q4 2018

Transformational rebar asset acquisition

45%

46%

Q1 2019

Q2 2019

42%

Q3 2019

37%

Q4 2019

33%

Q1 2020

32%

3. EBITDA depicted is adjusted EBITDA from continuing operations on a trailing 12-month basis.

4. Net debt-to-capitalization is defined as net debt on CMC's balance sheet divided by the sum of total debt and stockholders' equity.

For a reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures, see the appendix to this document.

Q2 2020

24%

Q3 2020

18%

Q4 2020

Q1 2021

Q2 2021

Financial strength gives us the flexibility to fund our announced projects, pursue opportunistic M&A, and distribute cash to shareholders

Construction of Arizona 2

Tensar

acquisition

04 2021

Q3 2021

Q1 2022

14%

Q2 2022

24%

Q3 2022

17%

04 2022

Q1 2023

CMC: Investor Overview 11

02 2023

03 2023

Q4 2023View entire presentation