Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

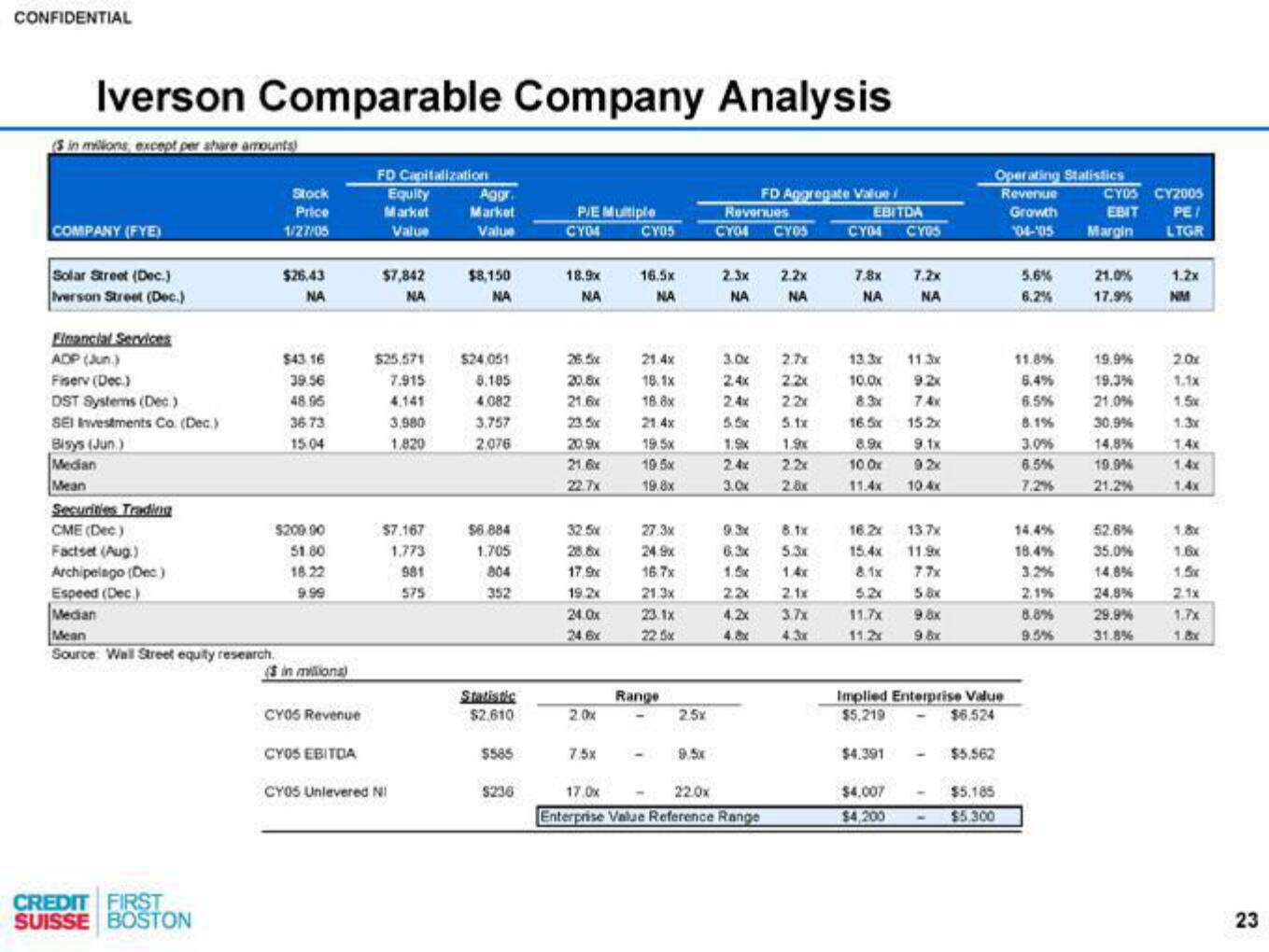

Iverson Comparable Company Analysis

Sin millions, except per share amounts)

COMPANY (FYE)

Solar Street (Dec.)

Iverson Street (Dec.)

Financial Services

ADP (Jun)

Fiserv (Dec.)

DST Systems (Dec )

SEI Investments Co. (Dec.)

Bisys (Jun.)

Median

Mean

Securities Trading

CME (Dec.)

Factset (Aug.)

Archipelago (Dec)

Espeed (Dec.)

Median

Mean

Source: Wall Street equity research.

CREDIT FIRST

SUISSE BOSTON

Stock

Price

1/27/05

$26.43

NA

$43.16

39.56

48.95

36.73

15.04

$209.90

51.80

18.22

9.99

($ in millions)

CY05 Revenue

CY05 EBITDA

FD Capitalization

Equity

Market

Value

$7,842

NA

$25,571

7.915

4.141

3,980

1.820

$7.167

1.773

981

575

CY05 Unlevered NI

Aggr.

Market

Value

$8,150

NA

$24,051

8.185

4.082

3.757

2076

$6,884

1.705

804

352

Statistic

$2,610

$585

$236

P/E Multiple

CY04

18.9x

NA

750

20.8x

21.6x

73100

20.9x

21.6x

22.7x

325

28.8x

17,9

19.2x

24.0x

24.6x

2.0x

7.5x

CYOS

16598

ΝΑ

21.4x

18.1x

18.8x

21.4x

1950

1950

19.8x

27.3x

24.9x

16.7x

21.3x

23.1x

225x

Range

2.5x

9.5x

Revenues

CY04 CYOS

FD Aggregate Value /

2.3x 2.2x

NA NA

3.0x 2.7x

2.4x

22x

2.4x 22x

5.5x

5.1x

1.9x

1.9x

2.4x

2.2x

3.0x

2.8x

9.3x

17.0x

22.0x

Enterprise Value Reference Range

8.1x

5.3x

1.4x

1.5x

22x 2.1x

4.2x

3.7x

4.8x

4.3x

EBITDA

CY04 CYOS

7.8x 7.2x

NA ΝΑ

13.3x 11.3x

10.0x 9.2x

8.3x 74x

TEL 15.2x

8.9x

9.1x

10.0x

9.2x

11.4x 10.4x

16.2x 13.7x

15.4x

11.9x

8.1x

77x

5.2x

5.8x

11.7x 9.8x

11.2x 9,8x

Implied Enterprise Value

$5,219

$6.524

$4.391

$4,007

$4,200

-

Operating Statistics

Revenue

Growth

04-'05

-

$5.562

$5.185

$5.300

5.6%

6.2%

11.8%

5.4%

6.5%

8.1%

3.0%

6.5%

7.2%

14.4%

18.4%

3.2%

2.1%

8.8%

9.5%

CYOS CY2005

EBIT PE/

LTGR

Margin

21.0%

17.9%

19.9%

19.3%

21.0%

30,9%

14.8%

19.9%

21.2%

52.6%

35.0%

14.8%

24.8%

29.9%

31.8%

1.2x

NM

2.0x

1.1x

1.5x

1.3x

1.4x

1.4x

1.4x

1.5x

2.1x

1.7x

1.8x

23View entire presentation