HBT Financial Results Presentation Deck

Deposit Overview

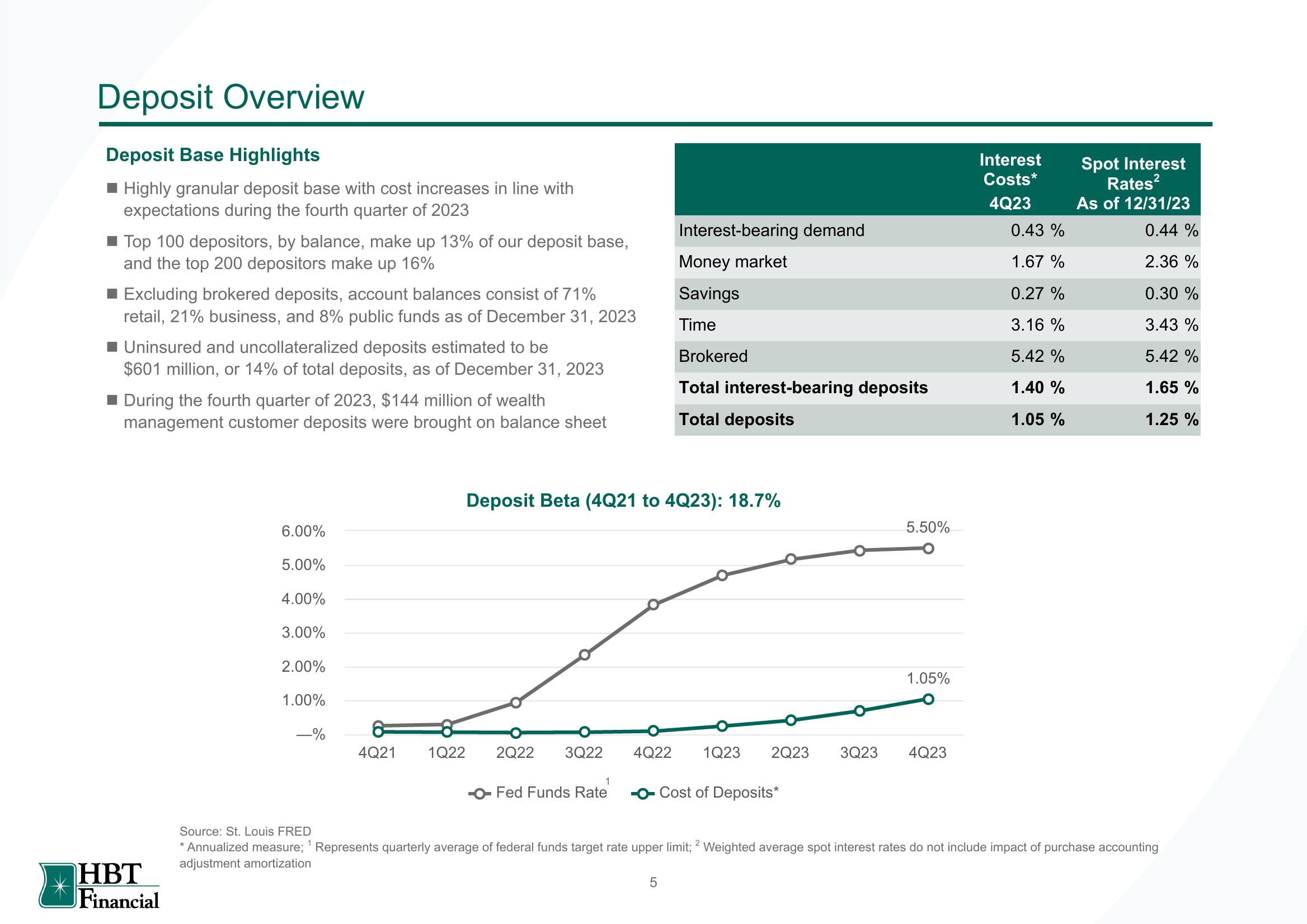

Deposit Base Highlights

Highly granular deposit base with cost increases in line with

expectations during the fourth quarter of 2023

Top 100 depositors, by balance, make up 13% of our deposit base,

and the top 200 depositors make up 16%

Excluding brokered deposits, account balances consist of 71%

retail, 21% business, and 8% public funds as of December 31, 2023

Uninsured and uncollateralized deposits estimated to be

$601 million, or 14% of total deposits, as of December 31, 2023

During the fourth quarter of 2023, $144 million of wealth

management customer deposits were brought on balance sheet

HBT

Financial

6.00%

5.00%

4.00%

3.00%

2.00%

1.00%

-%

4Q21

1Q22 2Q22 3Q22

Deposit Beta (4Q21 to 4Q23): 18.7%

1

-O-Fed Funds Rate

Interest-bearing demand

Money market

Savings

Time

Brokered

Total interest-bearing deposits

Total deposits

4Q22 1Q23 2Q23 3Q23

-O-Cost of Deposits*

5

5.50%

1.05%

4Q23

Interest

Costs*

4Q23

0.43 %

1.67 %

0.27 %

3.16%

5.42 %

1.40 %

1.05 %

Spot Interest

Rates²

As of 12/31/23

0.44 %

2.36%

0.30 %

3.43 %

5.42 %

1.65 %

1.25 %

Source: St. Louis FRED

* Annualized measure; ¹ Represents quarterly average of federal funds target rate upper limit; 2 Weighted average spot interest rates do not include impact of purchase accounting

adjustment amortizationView entire presentation