Confluent Investor Presentation Deck

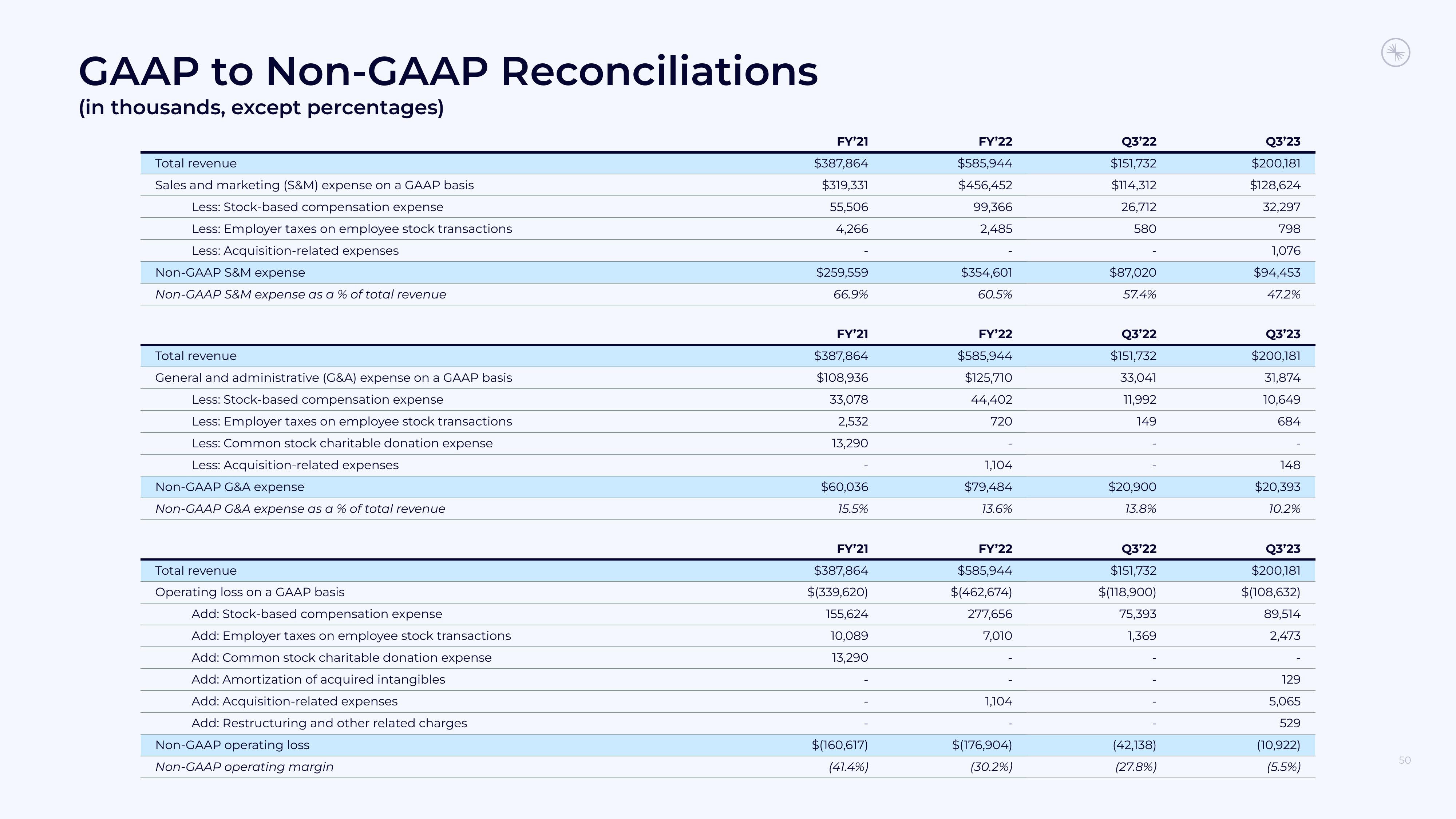

GAAP to Non-GAAP Reconciliations

(in thousands, except percentages)

Total revenue

Sales and marketing (S&M) expense on a GAAP basis

Less: Stock-based compensation expense

Less: Employer taxes on employee stock transactions

Less: Acquisition-related expenses

Non-GAAP S&M expense

Non-GAAP S&M expense as a % of total revenue

Total revenue

General and administrative (G&A) expense on a GAAP basis

Less: Stock-based compensation expense

Less: Employer taxes on employee stock transactions

Less: Common stock charitable donation expense

Less: Acquisition-related expenses

Non-GAAP G&A expense

Non-GAAP G&A expense as a % of total revenue

Total revenue

Operating loss on a GAAP basis.

Add: Stock-based compensation expense

Add:

taxes employee stock transactions

Add: Common stock charitable donation expense

Add: Amortization of acquired intangibles

Add: Acquisition-related expenses

Add: Restructuring and other related charges

Non-GAAP operating loss

Non-GAAP operating margin

FY'21

$387,864

$319,331

55,506

4,266

$259,559

66.9%

FY'21

$387,864

$108,936

33,078

2,532

13,290

$60,036

15.5%

FY'21

$387,864

$(339,620)

155,624

10,089

13,290

$(160,617)

(41.4%)

FY'22

$585,944

$456,452

99,366

2,485

$354,601

60.5%

FY'22

$585,944

$125,710

44,402

720

1,104

$79,484

13.6%

FY'22

$585,944

$(462,674)

277,656

7,010

1,104

$(176,904)

(30.2%)

Q3'22

$151,732

$114,312

26,712

580

$87,020

57.4%

Q3'22

$151,732

33,041

11,992

149

$20,900

13.8%

Q3'22

$151,732

$(118,900)

75,393

1,369

(42,138)

(27.8%)

Q3'23

$200,181

$128,624

32,297

798

1,076

$94,453

47.2%

Q3'23

$200,181

31,874

10,649

684

148

$20,393

10.2%

Q3'23

$200,181

$(108,632)

89,514

2,47

129

5,065

529

(10,922)

(5.5%)

50View entire presentation