Babylon Investor Day Presentation Deck

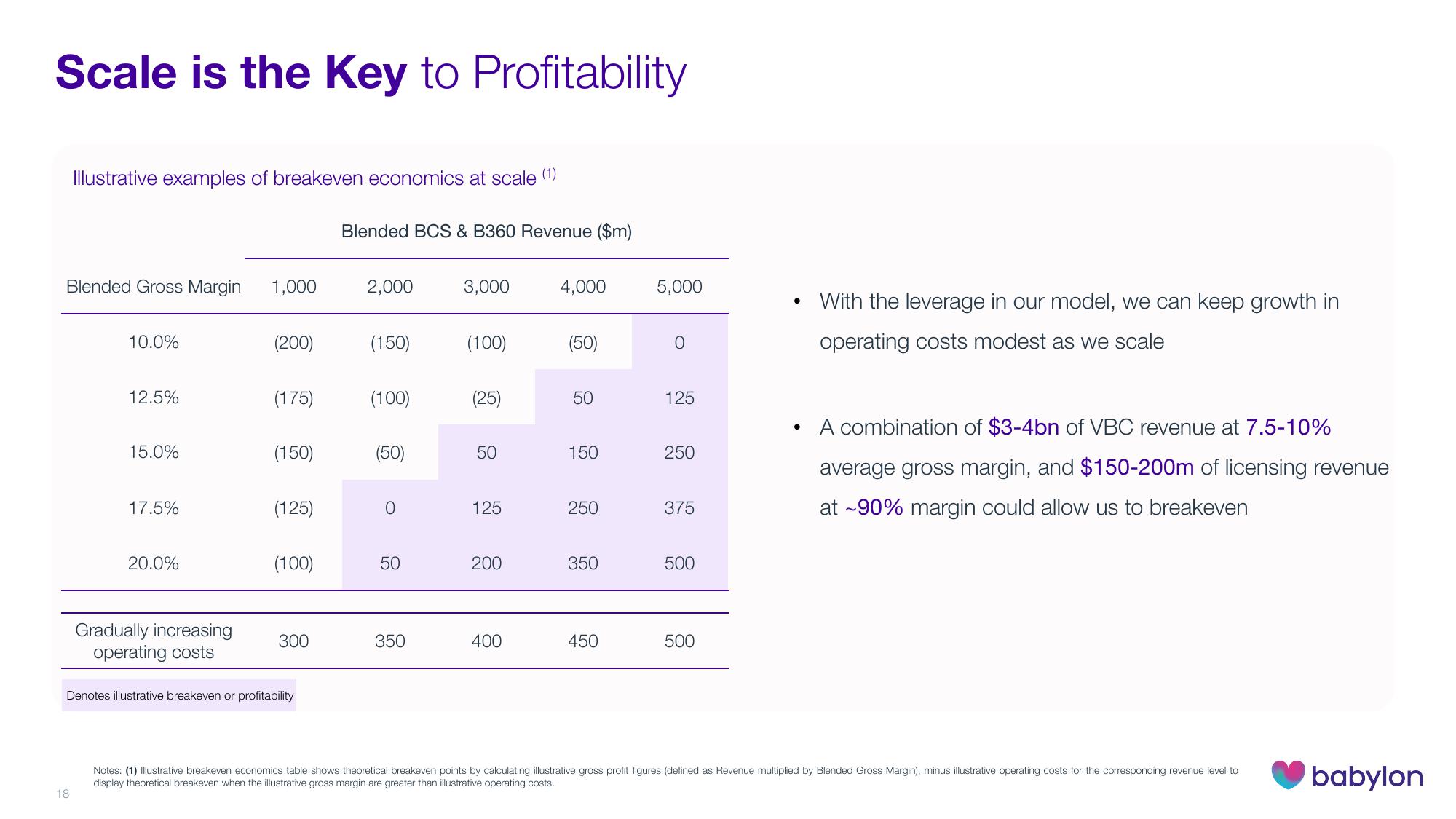

Scale is the Key to Profitability

Illustrative examples of breakeven economics at scale (1)

Blended Gross Margin 1,000

18

10.0%

12.5%

15.0%

17.5%

20.0%

Gradually increasing

operating costs

(200)

(175)

(150)

(125)

(100)

300

Denotes illustrative breakeven or profitability

Blended BCS & B360 Revenue ($m)

2,000

(150)

(100)

(50)

0

50

350

3,000

(100)

(25)

50

125

200

400

4,000

(50)

50

150

250

350

450

5,000

0

125

250

375

500

500

●

●

With the leverage in our model, we can keep growth in

operating costs modest as we scale

A combination of $3-4bn of VBC revenue at 7.5-10%

average gross margin, and $150-200m of licensing revenue

at ~90% margin could allow us to breakeven

Notes: (1) Illustrative breakeven economics table shows theoretical breakeven points by calculating illustrative gross profit figures (defined as Revenue multiplied by Blended Gross Margin), minus illustrative operating costs for the corresponding revenue level to

display theoretical breakeven when the illustrative gross margin are greater than illustrative operating costs.

babylonView entire presentation