Sezzle Results Presentation Deck

NET INCOME AND ADJUSTED EBITDA

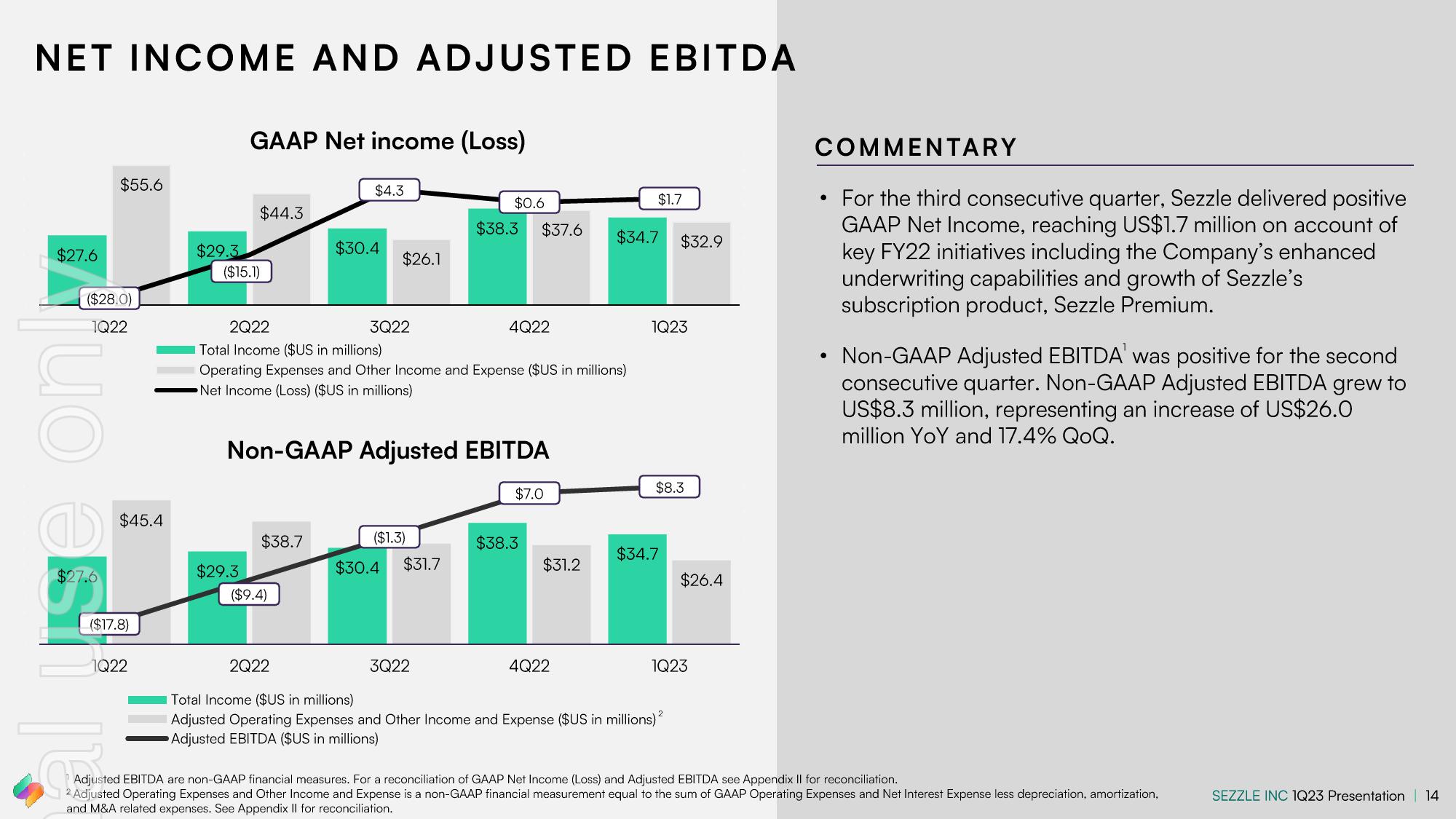

$27.6

$55.6

($28.0)

1Q22

$27.6

$45.4

($17.8)

1Q22

$29.3

GAAP Net income (Loss)

$44.3

($15.1)

$29.3

$38.7

$4.3

($9.4)

$30.4

2Q22

$26.1

2Q22

Total Income ($US in millions)

Operating Expenses and Other Income and Expense ($US in millions)

Net Income (Loss) ($US in millions)

3Q22

Non-GAAP Adjusted EBITDA

($1.3)

$0.6

$30.4 $31.7

$38.3 $37.6

3Q22

4Q22

$7.0

$38.3

$31.2

4Q22

$1.7

$34.7

1Q23

$32.9

$8.3

$34.7

Total Income ($US in millions)

Adjusted Operating Expenses and Other Income and Expense ($US in millions) ²

Adjusted EBITDA ($US in millions)

$26.4

1Q23

COMMENTARY

For the third consecutive quarter, Sezzle delivered positive

GAAP Net Income, reaching US$1.7 million on account of

key FY22 initiatives including the Company's enhanced

underwriting capabilities and growth of Sezzle's

subscription product, Sezzle Premium.

●

●

Non-GAAP Adjusted EBITDA' was positive for the second

consecutive quarter. Non-GAAP Adjusted EBITDA grew to

US$8.3 million, representing an increase of US$26.0

million YoY and 17.4% QoQ.

Adjusted EBITDA are non-GAAP financial measures. For a reconciliation of GAAP Net Income (Loss) and Adjusted EBITDA see Appendix II for reconciliation.

2 Adjusted Operating Expenses and Other Income and Expense is a non-GAAP financial measurement equal to the sum of GAAP Operating Expenses and Net Interest Expense less depreciation, amortization,

and M&A related expenses. See Appendix II for reconciliation.

SEZZLE INC 1Q23 Presentation 14View entire presentation