Sonder Restructuring Presentation Deck

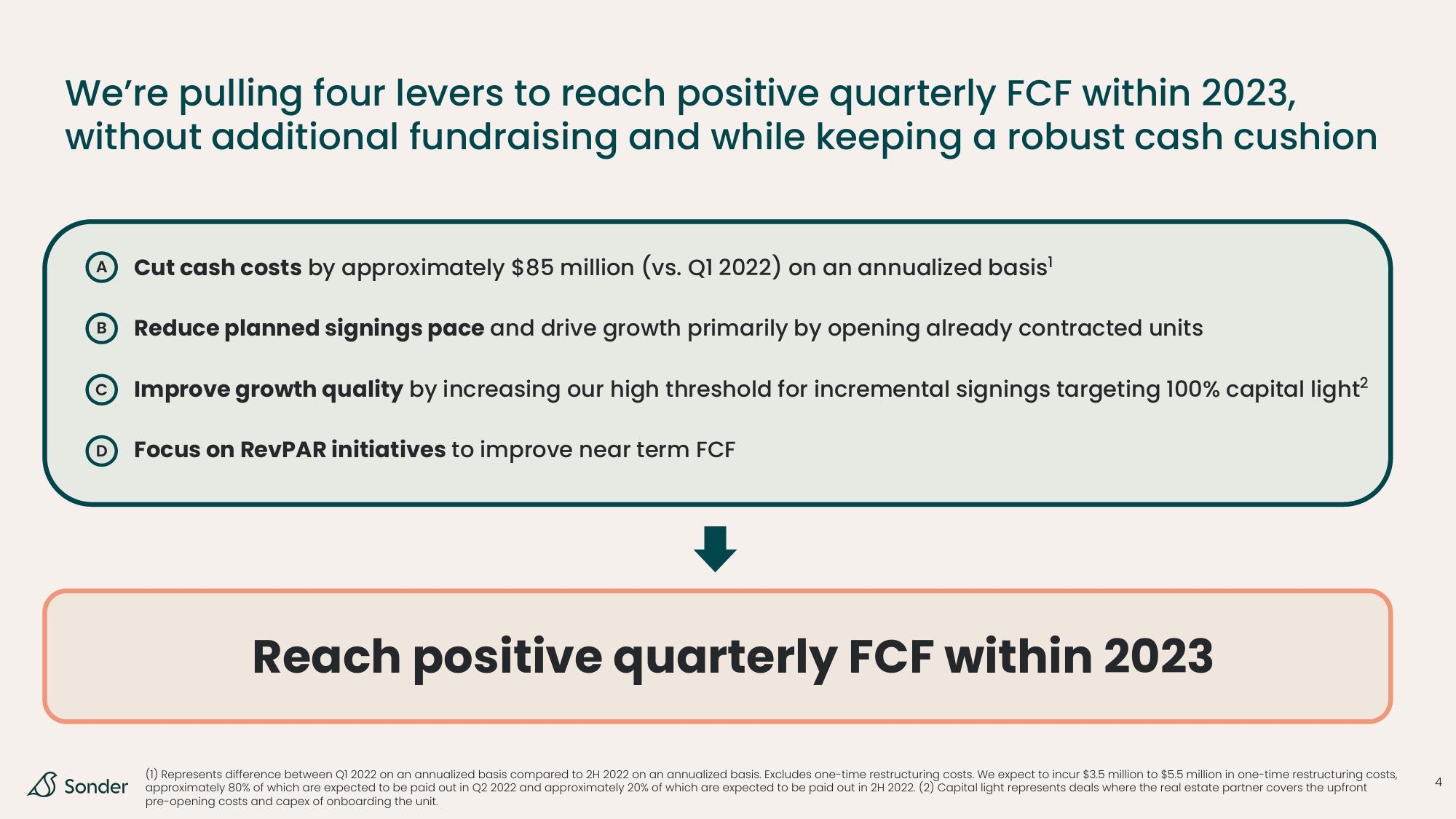

We're pulling four levers to reach positive quarterly FCF within 2023,

without additional fundraising and while keeping a robust cash cushion

A Cut cash costs by approximately $85 million (vs. Q1 2022) on an annualized basis¹

B Reduce planned signings pace and drive growth primarily by opening already contracted units

C Improve growth quality by increasing our high threshold for incremental signings targeting 100% capital light²

Focus on RevPAR initiatives to improve near term FCF

D

Sonder

Reach positive quarterly FCF within 2023

(1) Represents difference between Q1 2022 on an annualized basis compared to 2H 2022 on an annualized basis. Excludes one-time restructuring costs. We expect to incur $3.5 million to $5.5 million in one-time restructuring costs,

80% of which are expected to be paid out in Q2 2022 approximately 20% of which are expected to be paid out in 2H 2022. Capital light represents deals where the real estate partner covers the

pre-opening costs and capex of onboarding the unit.View entire presentation