HireRight Results Presentation Deck

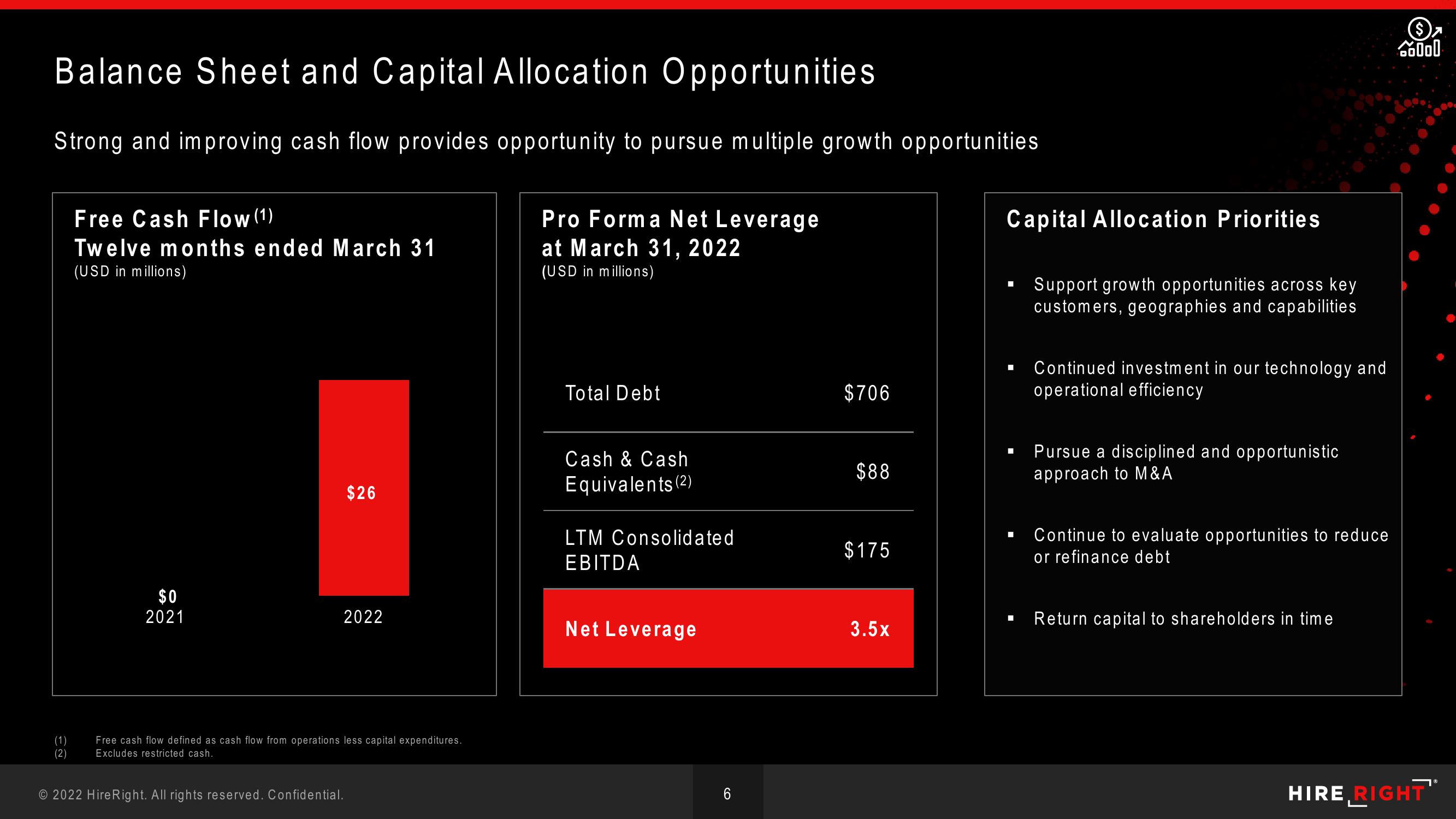

Balance Sheet and Capital Allocation Opportunities

Strong and improving cash flow provides opportunity to pursue multiple growth opportunities

(1)

(2)

Free Cash Flow (1)

Twelve months ended March 31

(USD in millions)

$0

2021

$26

2022

Free cash flow defined as cash flow from operations less capital expenditures.

Excludes restricted cash.

© 2022 Hire Right. All rights reserved. Confidential.

Pro Forma Net Leverage

at March 31, 2022

(USD in millions)

Total Debt

Cash & Cash

Equivalents (2)

LTM Consolidated

EBITDA

Net Leverage

SO

$706

$88

$175

3.5x

Capital Allocation Priorities

■

■

Support growth opportunities across key

customers, geographies and capabilities

Continued investment in our technology and

operational efficiency

Pursue a disciplined and opportunistic

approach to M&A

Continue to evaluate opportunities to reduce

or refinance debt

Return capital to shareholders in time

§₂

50000

HIRE RIGHT™View entire presentation