Bank of America Investment Banking Pitch Book

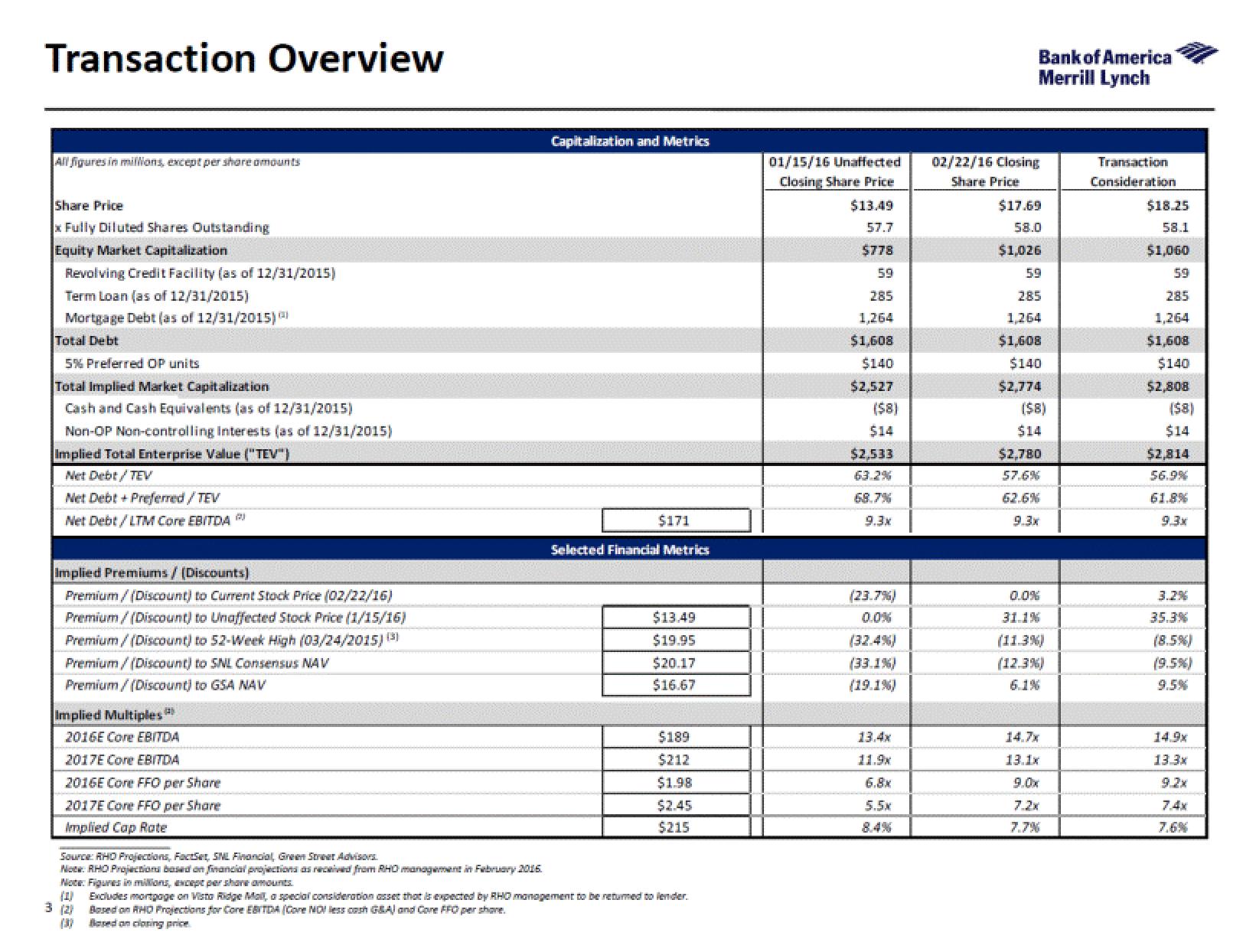

Transaction Overview

All figures in millions, except per share amounts

Share Price

x Fully Diluted Shares Outstanding

Equity Market Capitalization

Revolving Credit Facility (as of 12/31/2015)

Term Loan (as of 12/31/2015)

Mortgage Debt (as of 12/31/2015)

Total Debt

5% Preferred OP units

Total Implied Market Capitalization

Cash and Cash Equivalents (as of 12/31/2015)

Non-OP Non-controlling Interests (as of 12/31/2015)

Implied Total Enterprise Value ("TEV")

Net Debt/ TEV

Net Debt + Preferred / TEV

Net Debt/LTM Core EBITDA

Implied Premiums / (Discounts)

Premium/(Discount) to Current Stock Price (02/22/16)

Premium/(Discount) to Unaffected Stock Price (1/15/16)

Premium/(Discount) to 52-Week High (03/24/2015) (3)

Premium/(Discount) to SNL Consensus NAV

Premium/(Discount) to GSA NAV

Implied Multiples

2016E Core EBITDA

2017E Core EBITDA

2016E Core FFO per Share

2017E Core FFO per Share

Implied Cap Rate

Capitalization and Metrics

(1)

3 (2)

$171

Selected Financial Metrics

$13.49

$19.95

$20.17

$16.67

$189

$212

$1.98

$2.45

$215

Source: RHO Projections, FactSet, SNL Financial, Green Street Advisors.

Note: RHO Projections based on financial projections as received from RHO management in February 2016

Note: Figures in millions, except per share amounts

Excludes mortgage on Visto Ridge Mall, a special consideration asset that is expected by RHO management to be returned to lender.

Based on RHD Projections for Core EBITDA (Core NO! less cash GEA) and Care FFO per share.

Based on closing price

01/15/16 Unaffected

Closing Share Price

$13.49

57.7

$778

59

285

1,264

$1,608

$140

$2,527

($8)

$14

$2,533

9.3x

(23.7%)

0.0%

(32.4%)

(33.1%)

(19.1%)

13.4x

6.8x

5.5x

Bank of America

Merrill Lynch

02/22/16 Closing

Share Price

$17.69

58.0

$1,026

59

285

1,264

$1,608

$140

$2,774

($8)

$14

$2,780

57.6%

62.6%

9.3x

0.0%

31.1%

(11.3%)

(12.3%)

13.1x

9.0x

7.7%

Transaction

Consideration

$18.25

58.1

$1,060

59

285

1,264

$1,608

$140

$2,808

($8)

$14

$2,814

56.9%

61.8%

9.3x

35.3%

(8.5%)

(9.5%)

9.5%

14.9x

13.3x

7.4xView entire presentation