Acies SPAC Presentation Deck

Illustrative Offering Summary

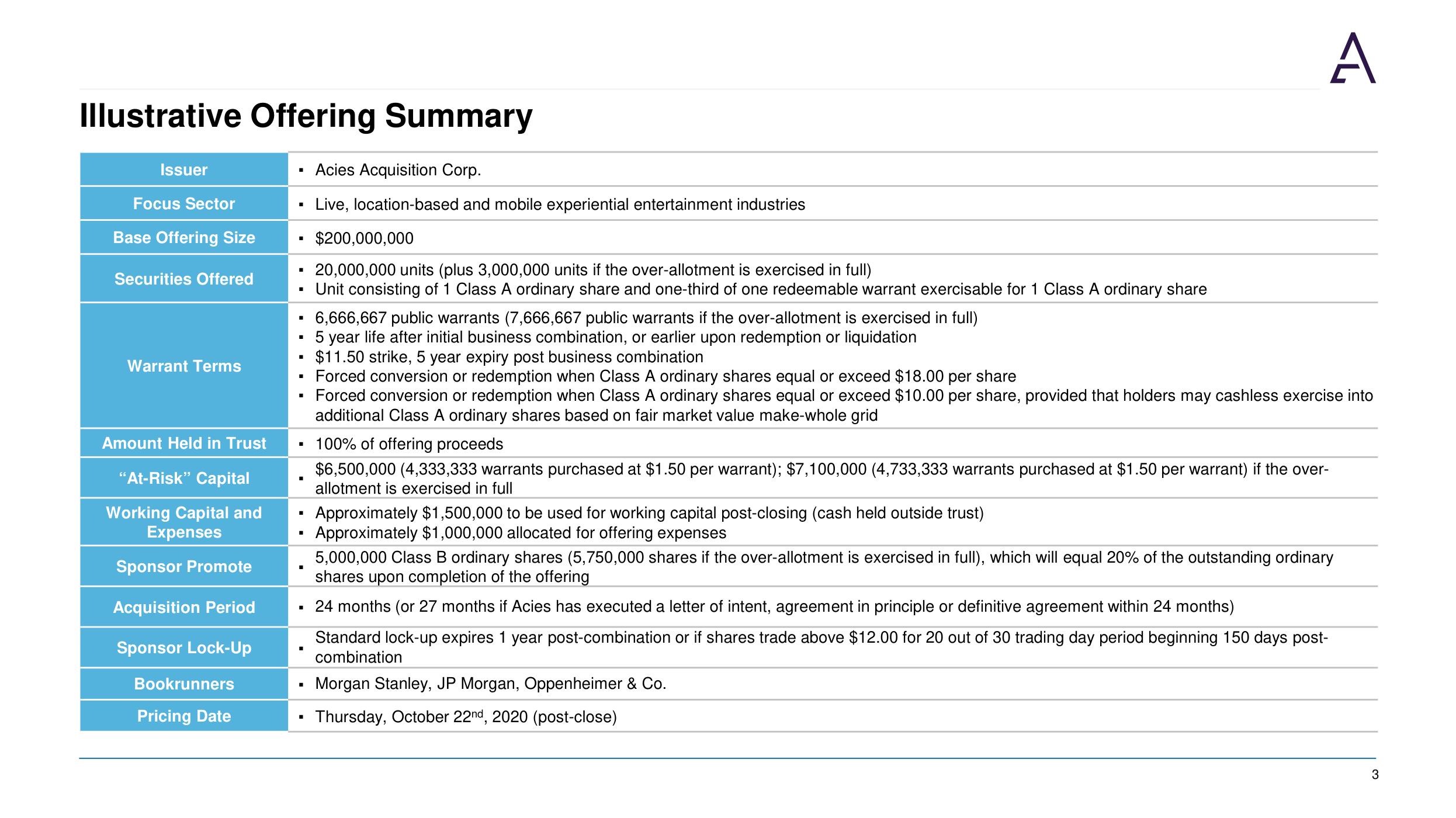

Acies Acquisition Corp.

Live, location-based and mobile experiential entertainment industries

Issuer

Focus Sector

Base Offering Size

Securities Offered

Warrant Terms

Amount Held in Trust

"At-Risk" Capital

Working Capital and

Expenses

Sponsor Promote

Acquisition Period

Sponsor Lock-Up

Bookrunners

Pricing Date

$200,000,000

20,000,000 units (plus 3,000,000 units if the over-allotment is exercised in full)

▪ Unit consisting of 1 Class A ordinary share and one-third of one redeemable warrant exercisable for 1 Class A ordinary share

■

■

6,666,667 public warrants (7,666,667 public warrants if the over-allotment is exercised in full)

5 year life after initial business combination, or earlier upon redemption or liquidation

$11.50 strike, 5 year expiry post business combination

Forced conversion or redemption when Class A ordinary shares equal or exceed $18.00 per share

▪ Forced conversion or redemption when Class A ordinary shares equal or exceed $10.00 per share, provided that holders may cashless exercise into

additional Class A ordinary shares based on fair market value make-whole grid

100% of offering proceeds

■

■

■

I

■

■

■

I

A

$6,500,000 (4,333,333 warrants purchased at $1.50 per warrant); $7,100,000 (4,733,333 warrants purchased at $1.50 per warrant) if the over-

allotment is exercised in full

Approximately $1,500,000 to be used for working capital post-closing (cash held outside trust)

Approximately $1,000,000 allocated for offering expenses

5,000,000 Class B ordinary shares (5,750,000 shares if the over-allotment is exercised in full), which will equal 20% of the outstanding ordinary

shares upon completion of the offering

24 months (or 27 months if Acies has executed a letter of intent, agreement in principle or definitive agreement within 24 months)

Standard lock-up expires 1 year post-combination or if shares trade above $12.00 for 20 out of 30 trading day period beginning 150 days post-

combination

Morgan Stanley, JP Morgan, Oppenheimer & Co.

Thursday, October 22nd, 2020 (post-close)

3View entire presentation