Barclays Capital 2010 Global Financial Services Conference

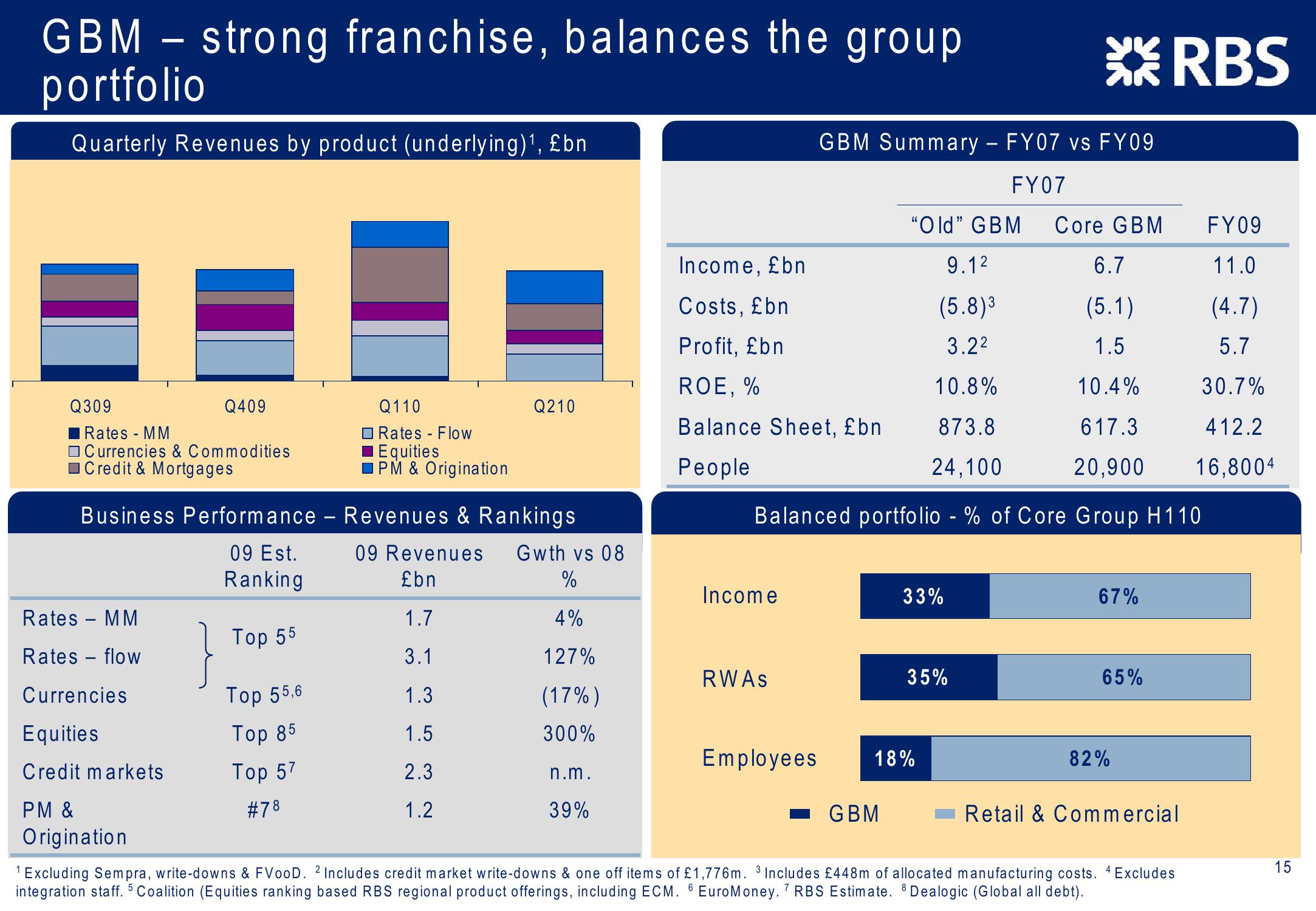

GBM - strong franchise, balances the group

portfolio

Quarterly Revenues by product (underlying)¹, £bn

GBM Summary - FY07 vs FY09

RBS

FY07

"Old" GBM

Core GBM

FY09

Income, £bn

9.12

6.7

11.0

Costs, £bn

(5.8)³

(5.1)

(4.7)

Profit, £bn

3.22

1.5

5.7

ROE, %

10.8%

10.4%

30.7%

Q309

Rates - MM

Q409

Q110

Q210

□ Rates - Flow

Balance Sheet, £bn

873.8

617.3

412.2

Currencies & Commodities

Equities

Credit & Mortgages

IPM & Origination

People

24,100

20,900

16,8004

Business Performance

-

Revenues & Rankings

Balanced portfolio - % of Core Group H110

09 Est.

09 Revenues

Gwth vs 08

Ranking

£bn

%

Income

33%

67%

Rates - MM

1.7

4%

Top 55

Rates - flow

3.1

127%

RWAs

35%

65%

Currencies

Top 55,6

1.3

(17%)

Equities

Top 85

1.5

300%

Credit markets

Top 57

Employees

18%

82%

2.3

n.m.

PM &

#78

1.2

39%

GBM

Retail & Commercial

Origination

1 Excluding Sempra, write-downs & FVooD. 2 Includes credit market write-downs & one off items of £1,776m. 3 Includes £448m of allocated manufacturing costs. 4 Excludes

integration staff. 5 Coalition (Equities ranking based RBS regional product offerings, including ECM. 6 EuroMoney. 7 RBS Estimate. 8 Dealogic (Global all debt).

15View entire presentation