Ginkgo Results Presentation Deck

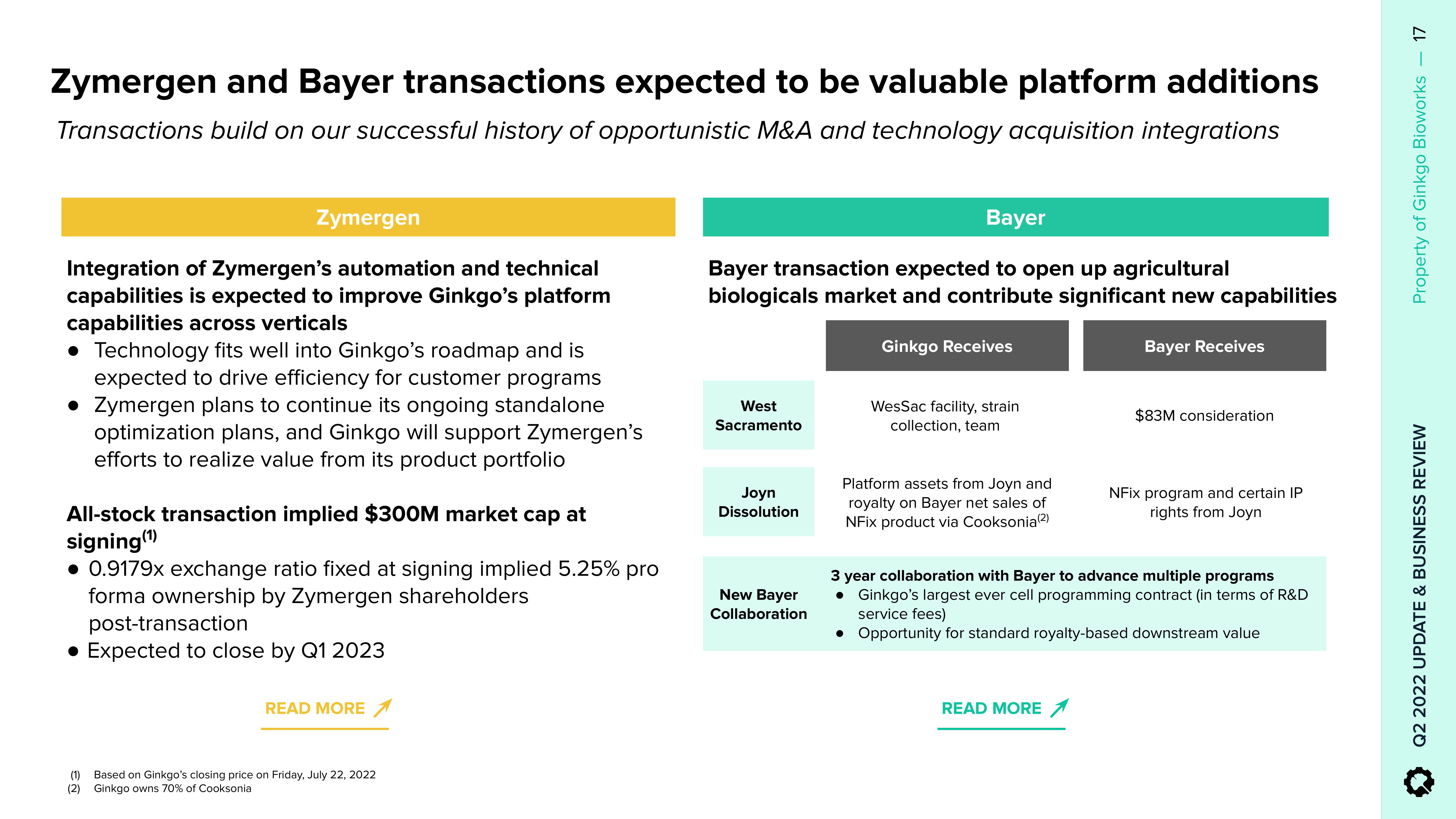

Zymergen and Bayer transactions expected to be valuable platform additions

Transactions build on our successful history of opportunistic M&A and technology acquisition integrations

Zymergen

Integration of Zymergen's automation and technical

capabilities is expected to improve Ginkgo's platform

capabilities across verticals

• Technology fits well into Ginkgo's roadmap and is

expected to drive efficiency for customer programs

• Zymergen plans to continue its ongoing standalone

optimization plans, and Ginkgo will support Zymergen's

efforts to realize value from its product portfolio

All-stock transaction implied $300M market cap at

signing (¹)

● 0.9179x exchange ratio fixed at signing implied 5.25% pro

forma ownership by Zymergen shareholders

post-transaction

• Expected to close by Q1 2023

READ MORE

(1)

Based on Ginkgo's closing price on Friday, July 22, 2022

(2) Ginkgo owns 70% of Cooksonial

Bayer

Bayer transaction expected to open up agricultural

biologicals market and contribute significant new capabilities

West

Sacramento

Joyn

Dissolution

New Bayer

Collaboration

Ginkgo Receives

WesSac facility, strain

collection, team

Platform assets from Joyn and

royalty on Bayer net sales of

NFix product via Cooksonia (2)

Bayer Receives

READ MORE

$83M consideration

NFix program and certain IP

rights from Joyn

3 year collaboration with Bayer to advance multiple programs

• Ginkgo's largest ever cell programming contract (in terms of R&D

service fees)

• Opportunity for standard royalty-based downstream value

17

Property of Ginkgo Bioworks

Q2 2022 UPDATE & BUSINESS REVIEWView entire presentation