Yatsen IPO Presentation Deck

Offering Summary

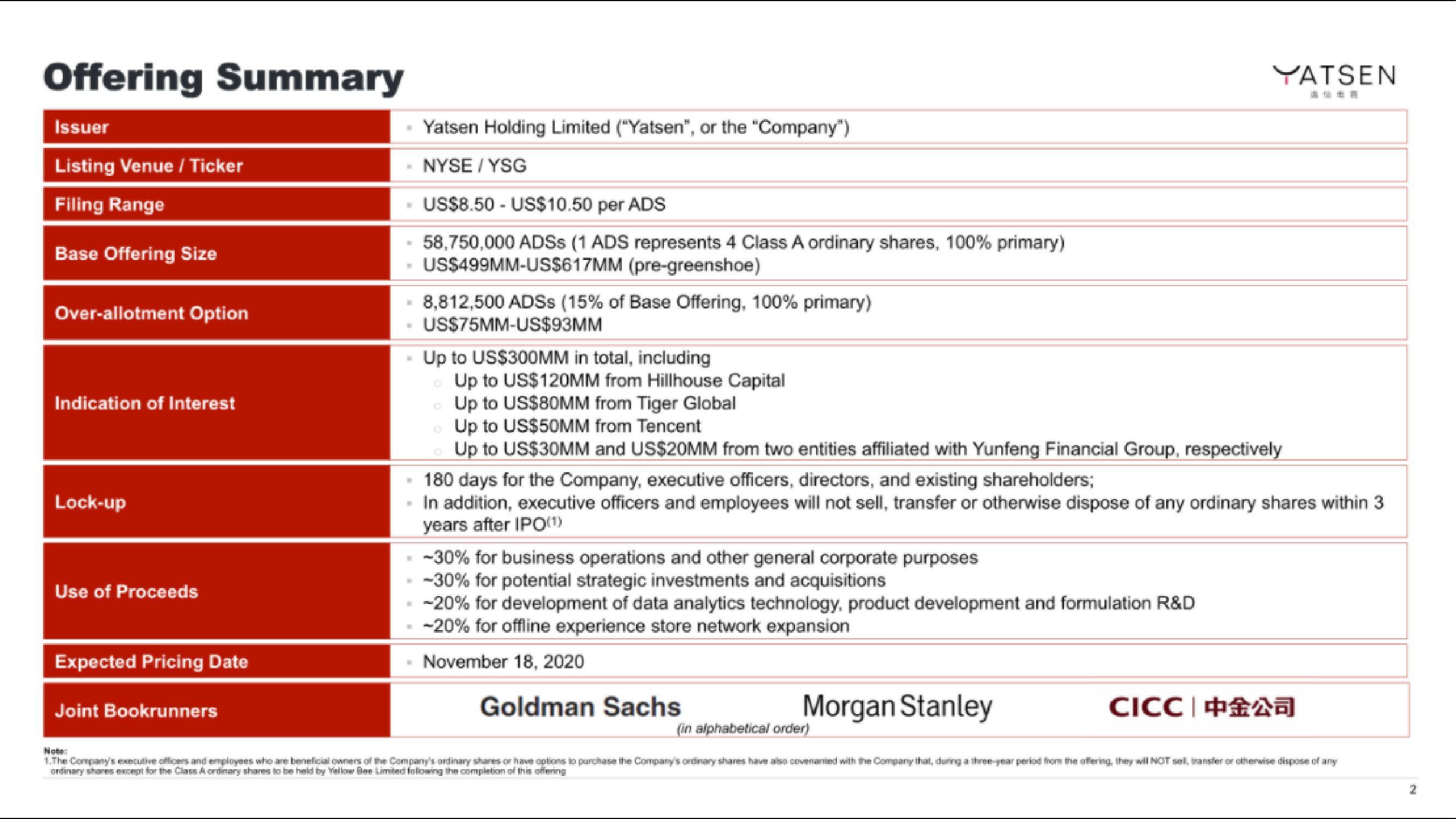

Issuer

Listing Venue / Ticker

Filing Range

Base Offering Size

Over-allotment Option

Indication of Interest

Lock-up

Use of Proceeds

Expected Pricing Date

H

Joint Bookrunners

H

H

H

H

Yatsen Holding Limited ("Yatsen", or the "Company")

NYSE / YSG

US$8.50 - US$10.50 per ADS

58,750,000 ADSS (1 ADS represents 4 Class A ordinary shares, 100% primary)

US$499MM-US$617MM (pre-greenshoe)

8,812,500 ADSs (15% of Base Offering, 100% primary)

US$75MM-US$93MM

Up to US$300MM in total, including

Up to US$120MM from Hillhouse Capital

Up to US$80MM from Tiger Global

Up to US$50MM from Tencent

Up to US$30MM and US$20MM from two entities affiliated with Yunfeng Financial Group, respectively

0

YATSEN

180 days for the Company, executive officers, directors, and existing shareholders;

In addition, executive officers and employees will not sell, transfer or otherwise dispose of any ordinary shares within 3

years after IPO(1)

-30% for business operations and other general corporate purposes

-30% for potential strategic investments and acquisitions

-20% for development of data analytics technology, product development and formulation R&D

-20% for offline experience store network expansion

November 18, 2020

Morgan Stanley

CICC|中金公司

(in alphabetical order)

Note:

1.The Company's executive officers and employees who are beneficial owners of the Company's ordinary shares or have options to purchase the Company's ordinary shares have also covenanted with the Company that, during a three-year period from the offering, they will NOT sell, transfer or otherwise dispose of any

ordinary shares except for the Class A ordinary shares to be held by Yellow Bon Limited following the completion of this offering

Goldman Sachs

2View entire presentation