Engine No. 1 Activist Presentation Deck

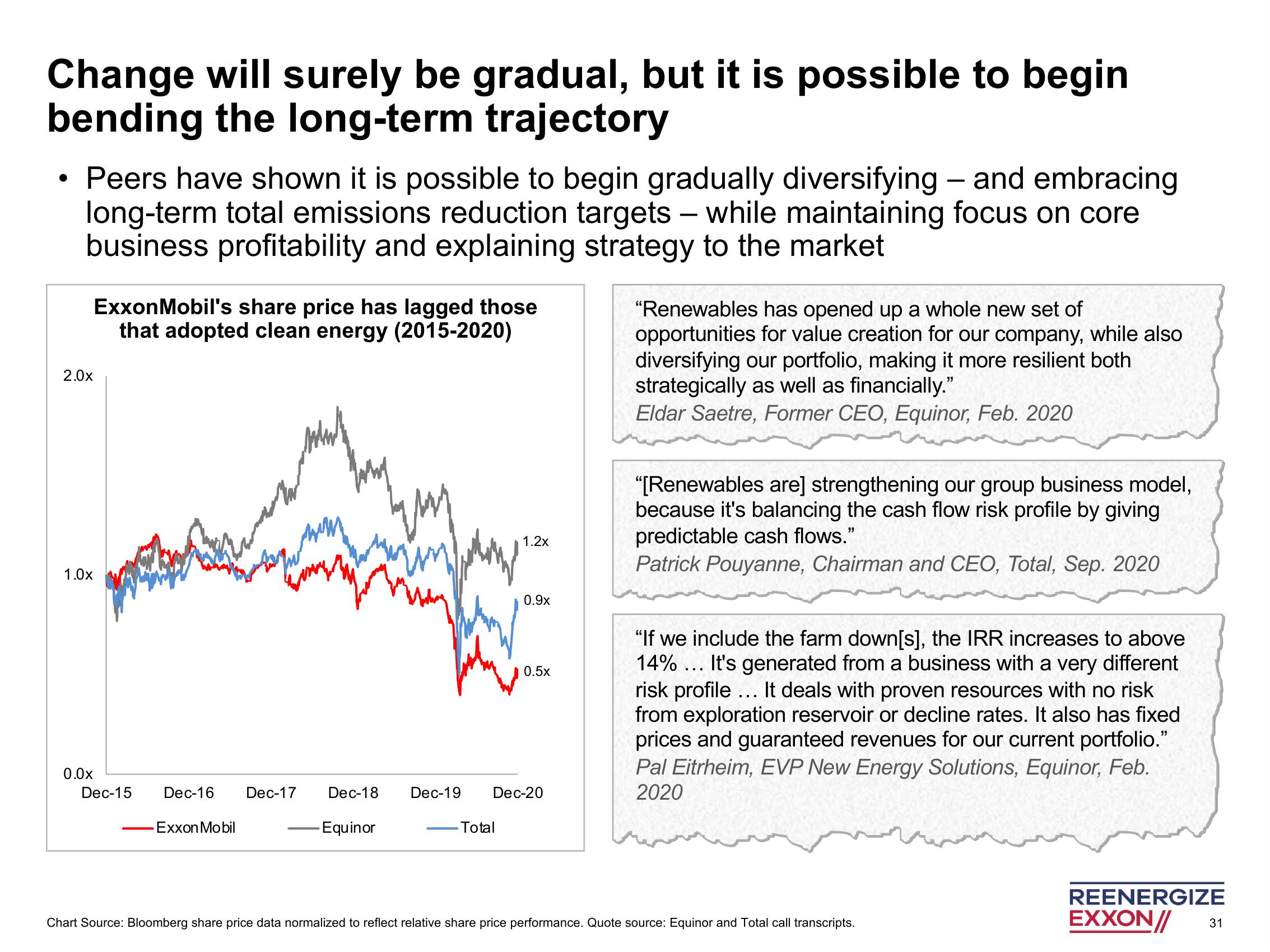

Change will surely be gradual, but it is possible to begin

bending the long-term trajectory

●

Peers have shown it is possible to begin gradually diversifying - and embracing

long-term total emissions reduction targets - while maintaining focus on core

business profitability and explaining strategy to the market

2.0x

1.0x

0.0x

ExxonMobil's share price has lagged those

that adopted clean energy (2015-2020)

Dec-15

Dec-16 Dec-17

Exxon Mobil

Jong

qay

Dec-18 Dec-19

-Equinor

1.2x

Total

0.9x

0.5x

Dec-20

"Renewables has opened up a whole new set of

opportunities for value creation for our company, while also

diversifying our portfolio, making it more resilient both

strategically as well as financially."

Eldar Saetre, Former CEO, Equinor, Feb. 2020

"[Renewables are] strengthening our group business model,

because it's balancing the cash flow risk profile by giving

predictable cash flows."

Patrick Pouyanne, Chairman and CEO, Total, Sep. 2020

"If we include the farm down[s], the IRR increases to above

14% ... It's generated from a business with a very different

risk profile ... It deals with proven resources with no risk

from exploration reservoir or decline rates. It also has fixed

prices and guaranteed revenues for our current portfolio."

Pal Eitrheim, EVP New Energy Solutions, Equinor, Feb.

2020

Chart Source: Bloomberg share price data normalized to reflect relative share price performance. Quote source: Equinor and Total call transcripts.

REENERGIZE

EXXON//

31View entire presentation