Paysafe SPAC Presentation Deck

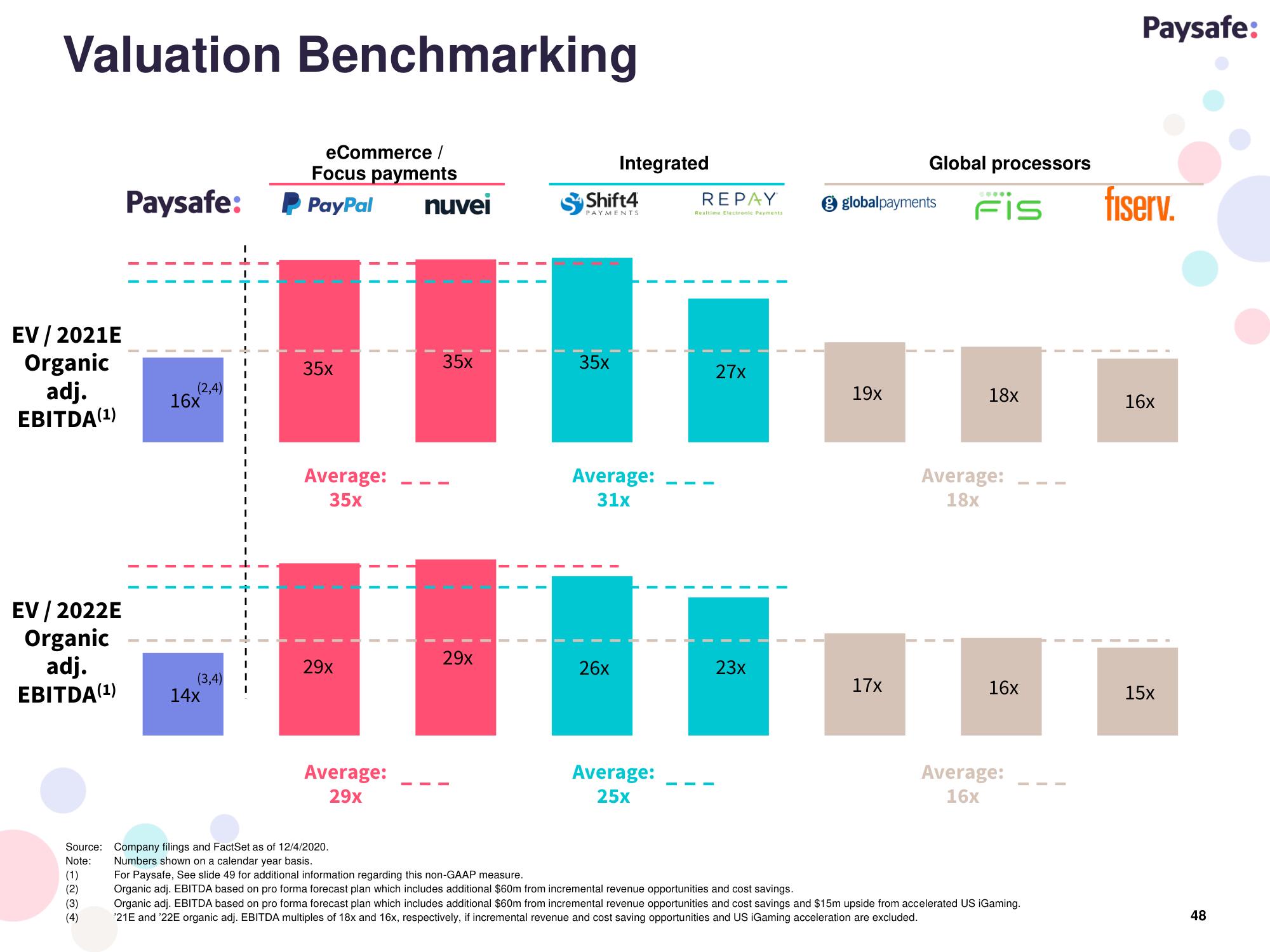

Valuation Benchmarking

eCommerce /

Focus payments

PayPal nuvei

EV / 2021E

Organic

adj.

EBITDA (¹)

EV/2022E

Organic

adj.

EBITDA(¹)

(1)

(2)

Paysafe:

(3)

(4)

(2,4)

16x

(3,4)

14x

1

I

I

I

J

I

I

I

I

I

I

I

I

I

T

I

I

35x

Average:

35x

29x

Average:

29x

35x

29x

II

Shift4

PAYMENTS

35x

Integrated

Average:

31x

26x

Average:

25x

REPAY

Realtime Electronic Payments

27x

23x

globalpayments

19x

Global processors

17x

FIS fiserv.

18x

Average:

18x

16x

Source: Company filings and FactSet as of 12/4/2020.

Note:

Numbers shown on a calendar year basis.

For Paysafe, See slide 49 for additional information regarding this non-GAAP measure.

Organic adj. EBITDA based on pro forma forecast plan which includes additional $60m from incremental revenue opportunities and cost savings.

Organic adj. EBITDA based on pro forma forecast plan which includes additional $60m from incremental revenue opportunities and cost savings and $15m upside from accelerated US iGaming.

'21E and '22E organic adj. EBITDA multiples of 18x and 16x, respectively, if incremental revenue and cost saving opportunities and US iGaming acceleration are excluded.

Average:

16x

Paysafe:

16x

15x

48View entire presentation