Shift SPAC Presentation Deck

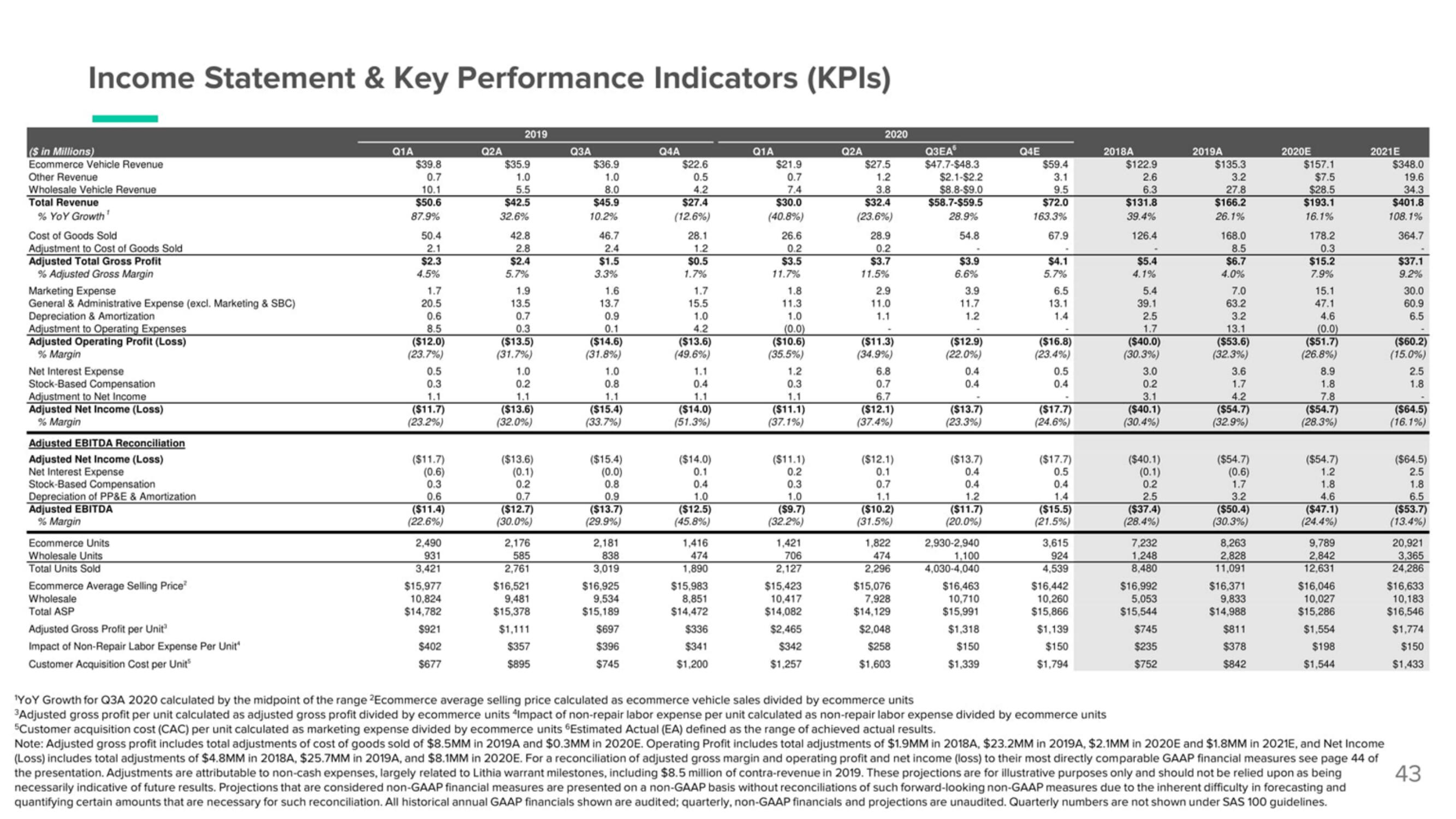

Income Statement & Key Performance Indicators (KPIs)

($ in Millions)

Ecommerce Vehicle Revenue

Other Revenue

Wholesale Vehicle Revenue

Total Revenue

% YoY Growth¹

Cost of Goods Sold

Adjustment to Cost of Goods Sold

Adjusted Total Gross Profit

% Adjusted Gross Margin

Marketing Expense

General & Administrative Expense (excl. Marketing & SBC)

Depreciation & Amortization

Adjustment to Operating Expenses

Adjusted Operating Profit (Loss)

% Margin

Net Interest Expense

Stock-Based Compensation

Adjustment to Net Income

Adjusted Net Income (Loss)

% Margin

Adjusted EBITDA Reconciliation

Adjusted Net Income (Loss)

Net Interest Expense

Stock-Based Compensation

Depreciation of PP&E & Amortization

Adjusted EBITDA

% Margin

Ecommerce Units

Wholesale Units

Total Units Sold

Ecommerce Average Selling Price

Wholesale

Total ASP

Adjusted Gross Profit per Unit

Impact of Non-Repair Labor Expense Per Unit

Customer Acquisition Cost per Unit

Q1A

$39.8

0.7

10.1

$50.6

87.9%

50.4

2.1

$2.3

4.5%

1.7

20.5

0.6

8.5

($12.0)

(23.7%)

0.5

0.3

1.1

($11.7)

(23.2%)

($11.7)

(0.6)

0.3

0.6

($11.4)

(22.6%)

2,490

931

3,421

$15,977

10,824

$14,782

$921

$402

$677

Q2A

2019

$35.9

1.0

5.5

$42.5

32.6%

42.8

2.8

$2.4

5.7%

1.9

13.5

0.7

0.3

($13.5)

(31.7%)

1.0

0.2

1.1

($13.6)

(32.0%)

($13.6)

(0.1)

0.2

0.7

($12.7)

(30.0%)

2,176

585

2,761

$16,521

9,481

$15,378

$1,111

$357

$895

Q3A

$36.9

1.0

8.0

$45.9

10.2%

46.7

2.4

$1.5

3.3%

1.6

13.7

0.9

0.1

($14.6)

(31.8%)

1.0

0.8

1.1

($15.4)

(33.7%)

($15.4)

(0.0)

0.8

0.9

($13.7)

(29.9%)

2,181

838

3,019

$16,925

9,534

$15,189

$697

$396

$745

Q4A

$22.6

0.5

4.2

$27.4

(12.6%)

28.1

1.2

$0.5

1.7%

1.7

15.5

1.0

4.2

($13.6)

(49.6%)

1.1

0.4

1.1

($14.0)

(51.3%)

($14.0)

0.1

0.4

1.0

($12.5)

(45.8%)

1,416

474

1,890

$15,983

8,851

$14,472

$336

$341

$1,200

Q1A

$21.9

0.7

7.4

$30.0

(40.8%)

26.6

0.2

$3.5

11.7%

1.8

11.3

1.0

(0.0)

($10.6)

(35.5%)

1.2

0.3

1.1

($11.1)

(37.1%)

($11.1)

0.2

0.3

1.0

($9.7)

(32.2%)

1,421

706

2,127

$15,423

10,417

$14,082

$2,465

$342

$1,257

Q2A

2020

$27.5

1.2

3.8

$32.4

(23.6%)

28.9

0.2

$3.7

11.5%

2.9

11.0

1.1

($11.3)

(34.9%)

6.8

0.7

6.7

($12.1)

(37.4%)

($12.1)

0.1

0.7

1.1

($10.2)

(31.5%)

1,822

474

2,296

$15,076

7,928

$14,129

$2,048

$258

$1,603

Q3EA

$47.7-$48.3

$2.1-$2.2

$8.8-$9.0

$58.7-$59.5

28.9%

54.8

$3.9

6.6%

3.9

11.7

1.2

($12.9)

(22.0%)

0.4

0.4

($13.7)

(23.3%)

($13.7)

0.4

0.4

1.2

($11.7)

(20.0%)

2,930-2,940

1,100

4,030-4,040

$16,463

10,710

$15,991

$1,318

$150

$1,339

Q4E

$59.4

3.1

9.5

$72.0

163.3%

67.9

$4.1

5.7%

6.5

13.1

1.4

($16.8)

(23.4%)

0.5

0.4

($17.7)

(24.6%)

($17.7)

0.5

0.4

1.4

($15.5)

(21.5%)

3,615

924

4,539

$16,442

10,260

$15,866

$1,139

$150

$1,794

2018A

$122.9

2.6

6.3

$131.8

39.4%

126.4

$5.4

4.1%

5.4

39.1

2.5

1.7

($40.0)

(30.3%)

3.0

0.2

3.1

($40.1)

(30.4%)

OS

($40.1)

(0.1)

0.2

2.5

($37.4)

(28.4%)

7,232

1,248

8,480

$16,992

5,053

$15,544

$745

$235

$752

2019A

$135.3

3.2

27.8

$166.2

26.1%

168.0

8.5

$6.7

4.0%

7.0

63.2

3.2

13.1

($53.6)

(32.3%)

3.6

1.7

4.2

($54.7)

(32.9%)

($54.7)

(0.6)

1.7

3.2

($50.4)

(30.3%)

8,263

2,828

11,091

$16,371

9,833

$14,988

$811

$378

$842

2020E

$157.1

$7.5

$28.5

$193.1

16.1%

178.2

0.3

$15.2

7.9%

15.1

47.1

4.6

(0.0)

($51.7)

(26.8%)

8.9

1.8

7.8

($54.7)

(28.3%)

($54.7)

1.2

1.8

4.6

($47.1)

(24.4%)

9,789

2,842

12,631

$16,046

10,027

$15,286

$1,554

$198

$1,544

2021E

$348.0

19.6

34.3

$401.8

108.1%

364.7

$37.1

9.2%

30.0

60.9

6.5

($60.2)

(15.0%)

2.5

1.8

($64.5)

(16.1%)

($64.5)

2.5

1.8

6.5

($53.7)

(13.4%)

20,921

3,365

24,286

$16,633

10,183

$16,546

$1,774

$150

$1,433

¹YOY Growth for Q3A 2020 calculated by the midpoint of the range ²Ecommerce average selling price calculated as ecommerce vehicle sales divided by ecommerce units

3Adjusted gross profit per unit calculated as adjusted gross profit divided by ecommerce units "Impact of non-repair labor expense per unit calculated as non-repair labor expense divided by ecommerce units

5Customer acquisition cost (CAC) per unit calculated as marketing expense divided by ecommerce units Estimated Actual (EA) defined as the range of achieved actual results.

Note: Adjusted gross profit includes total adjustments of cost of goods sold of $8.5MM in 2019A and $0.3MM in 2020E. Operating Profit includes total adjustments of $1.9MM in 2018A, $23.2MM in 2019A, $2.1MM in 2020E and $1.8MM in 2021E, and Net Income

(Loss) includes total adjustments of $4.8MM in 2018A, $25.7MM in 2019A, and $8.1MM in 2020E. For a reconciliation of adjusted gross margin and operating profit and net income (loss) to their most directly comparable GAAP financial measures see page 44 of

the presentation. Adjustments are attributable to non-cash expenses, largely related to Lithia warrant milestones, including $8.5 million of contra-revenue in 2019. These projections are for illustrative purposes only and should not be relied upon as being 43

necessarily indicative of future results. Projections that are considered non-GAAP financial measures are presented on a non-GAAP basis without reconciliations of such forward-looking non-GAAP measures due to the inherent difficulty in forecasting and

quantifying certain amounts that are necessary for such reconciliation. All historical annual GAAP financials shown are audited; quarterly, non-GAAP financials and projections are unaudited. Quarterly numbers are not shown under SAS 100 guidelines.View entire presentation