Rubicon Technologies SPAC Presentation Deck

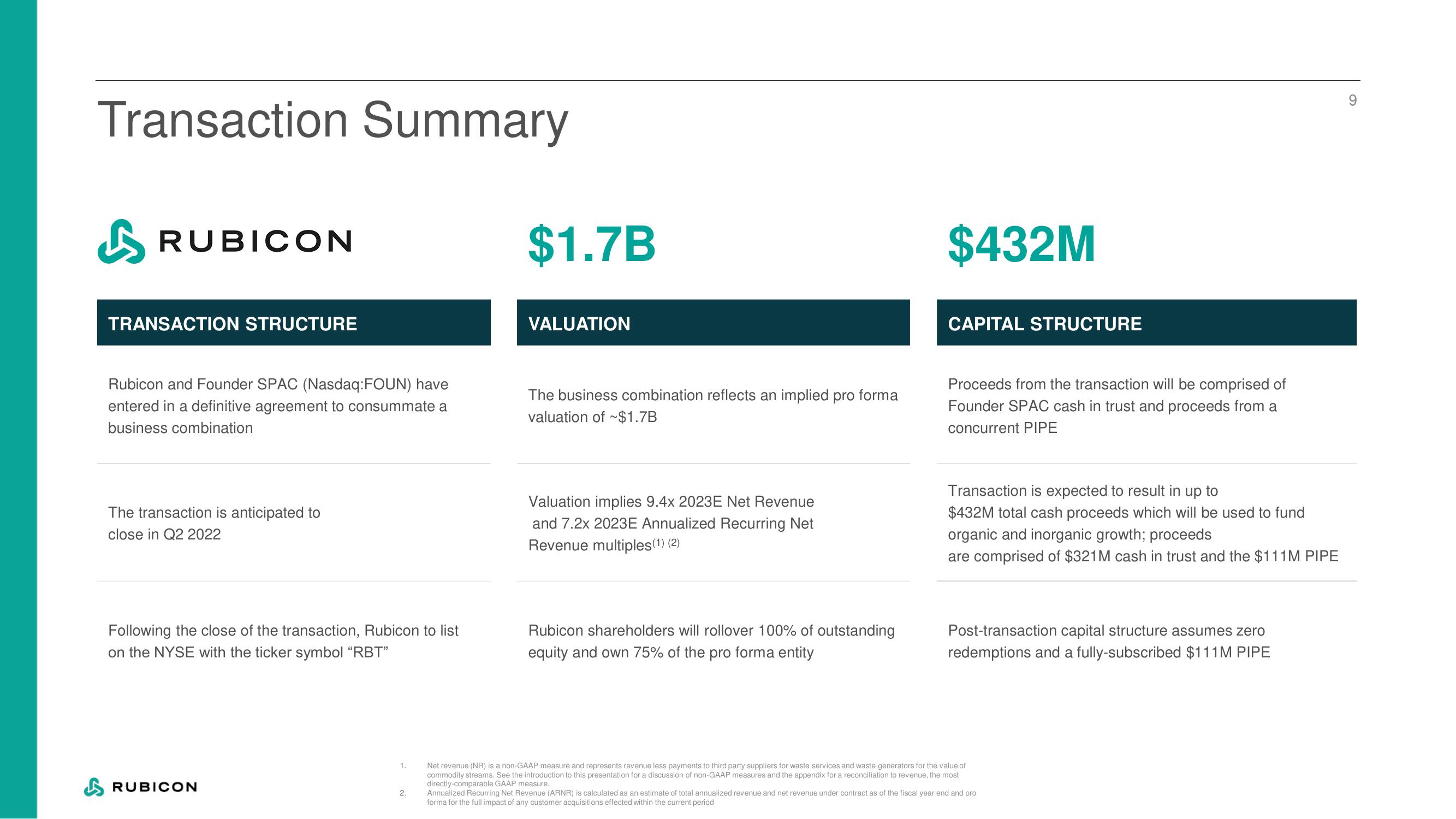

Transaction Summary

RUBICON

TRANSACTION STRUCTURE

Rubicon and Founder SPAC (Nasdaq: FOUN) have

entered in a definitive agreement to consummate a

business combination

The transaction is anticipated to

close in Q2 2022

Following the close of the transaction, Rubicon to list

on the NYSE with the ticker symbol "RBT"

RUBICON

1.

2.

$1.7B

VALUATION

The business combination reflects an implied pro forma

valuation of ~$1.7B

Valuation implies 9.4x 2023E Net Revenue

and 7.2x 2023E Annualized Recurring Net

Revenue multiples(1) (2)

Rubicon shareholders will rollover 100% of outstanding

equity and own 75% of the pro forma entity

$432M

CAPITAL STRUCTURE

Proceeds from the transaction will be comprised of

Founder SPAC cash in trust and proceeds from a

concurrent PIPE

Transaction is expected to result in up to

$432M total cash proceeds which will be used to fund

organic and inorganic growth; proceeds

are comprised of $321M cash in trust and the $111M PIPE

Post-transaction capital structure assumes zero

redemptions and a fully-subscribed $111M PIPE

Net revenue (NR) is a non-GAAP measure and represents revenue less payments to third party suppliers for waste services and waste generators for the value of

commodity streams. See the introduction to this presentation for a discussion of non-GAAP measures and the appendix for a reconciliation to revenue, the most

directly-comparable GAAP measure.

Annualized Recurring Net Revenue (ARNR) is calculated as an estimate of total annualized revenue and net revenue under contract as of the fiscal year end and pro

forma for the full impact of any customer acquisitions effected within the current period

9View entire presentation