Vici Investor Presentation

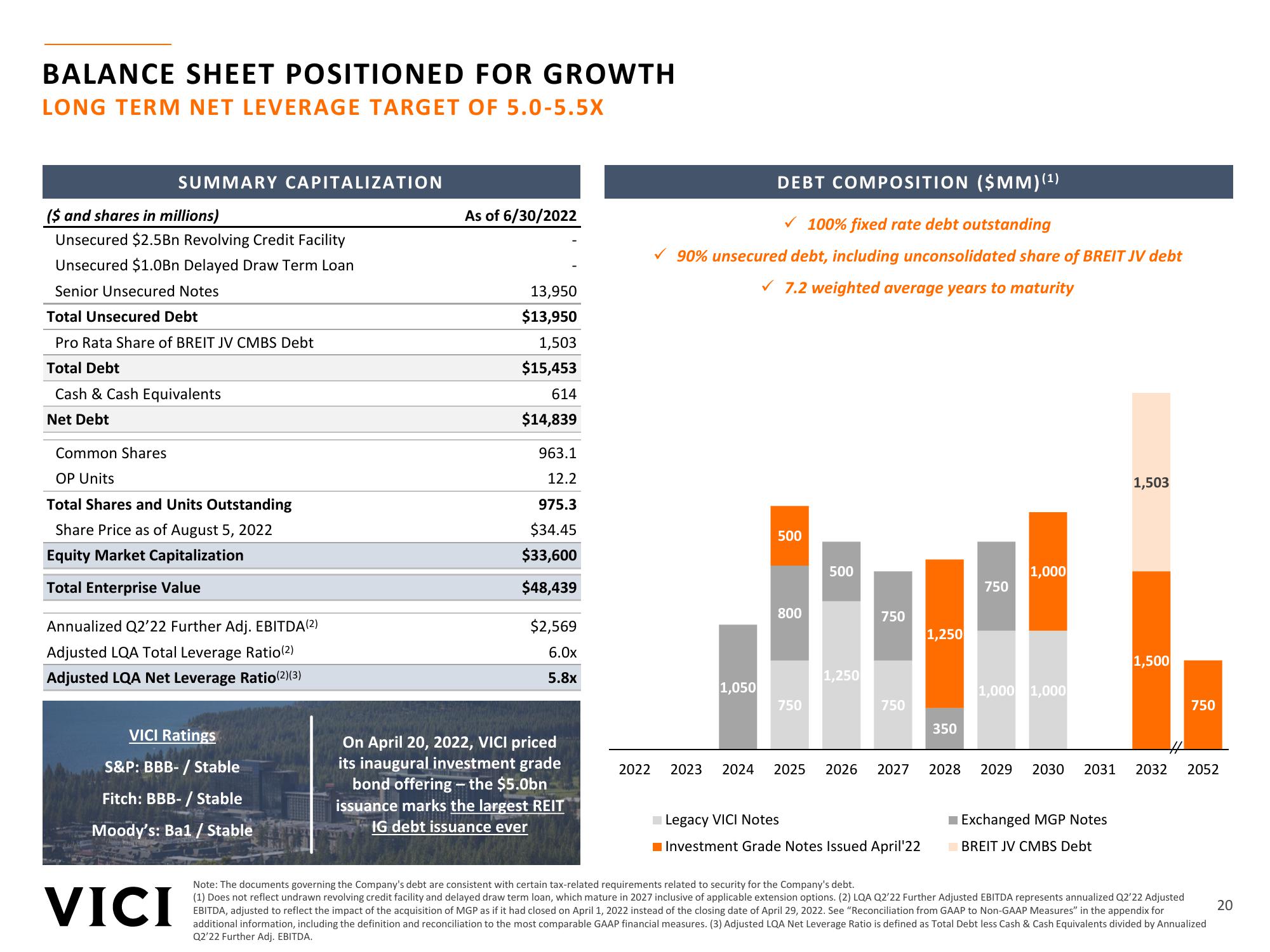

BALANCE SHEET POSITIONED FOR GROWTH

LONG TERM NET LEVERAGE TARGET OF 5.0-5.5X

SUMMARY CAPITALIZATION

($ and shares in millions)

Unsecured $2.5Bn Revolving Credit Facility

Unsecured $1.0Bn Delayed Draw Term Loan

Senior Unsecured Notes

Total Unsecured Debt

Pro Rata Share of BREIT JV CMBS Debt

Total Debt

Cash & Cash Equivalents

Net Debt

Common Shares

OP Units

Total Shares and Units Outstanding

Share Price as of August 5, 2022

Equity Market Capitalization

Total Enterprise Value

Annualized Q2'22 Further Adj. EBITDA (2)

Adjusted LQA Total Leverage Ratio (2)

Adjusted LQA Net Leverage Ratio (2)(3)

VICI Ratings

his tim

S&P: BBB-/Stable

Fitch: BBB-/Stable

Moody's: Ba1 / Stable

VICI

As of 6/30/2022

13,950

$13,950

1,503

$15,453

614

$14,839

963.1

12.2

975.3

$34.45

$33,600

$48,439

$2,569

6.0x

5.8x

On April 20, 2022, VICI priced

its inaugural investment grade

bond offering - the $5.0bn

issuance marks the largest REIT

IG debt issuance ever

2022

DEBT COMPOSITION ($MM)(¹)

✓100% fixed rate debt outstanding

90% unsecured debt, including unconsolidated share of BREIT JV debt

✓ 7.2 weighted average years to maturity

1,050

500

800

750

500

1,250

750

750

2023 2024 2025 2026 2027

Legacy VICI Notes

Investment Grade Notes Issued April 22

1,250

350

2028

750

1,000

1,000 1,000

1,503

Exchanged MGP Notes

BREIT JV CMBS Debt

1,500

750

2029 2030 2031 2032 2052

Note: The documents governing the Company's debt are consistent with certain tax-related requirements related to security for the Company's debt.

(1) Does not reflect undrawn revolving credit facility and delayed draw term loan, which mature in 2027 inclusive of applicable extension options. (2) LQA Q2'22 Further Adjusted EBITDA represents annualized Q2'22 Adjusted

EBITDA, adjusted to reflect the impact of the acquisition of MGP as if it had closed on April 1, 2022 instead of the closing date of April 29, 2022. See "Reconciliation from GAAP to Non-GAAP Measures" in the appendix for

additional information, including the definition and reconciliation to the most comparable GAAP financial measures. (3) Adjusted LQA Net Leverage Ratio is defined as Total Debt less Cash & Cash Equivalents divided by Annualized

Q2'22 Further Adj. EBITDA.

20View entire presentation