NuStar Energy Investor Conference Presentation Deck

NuStar

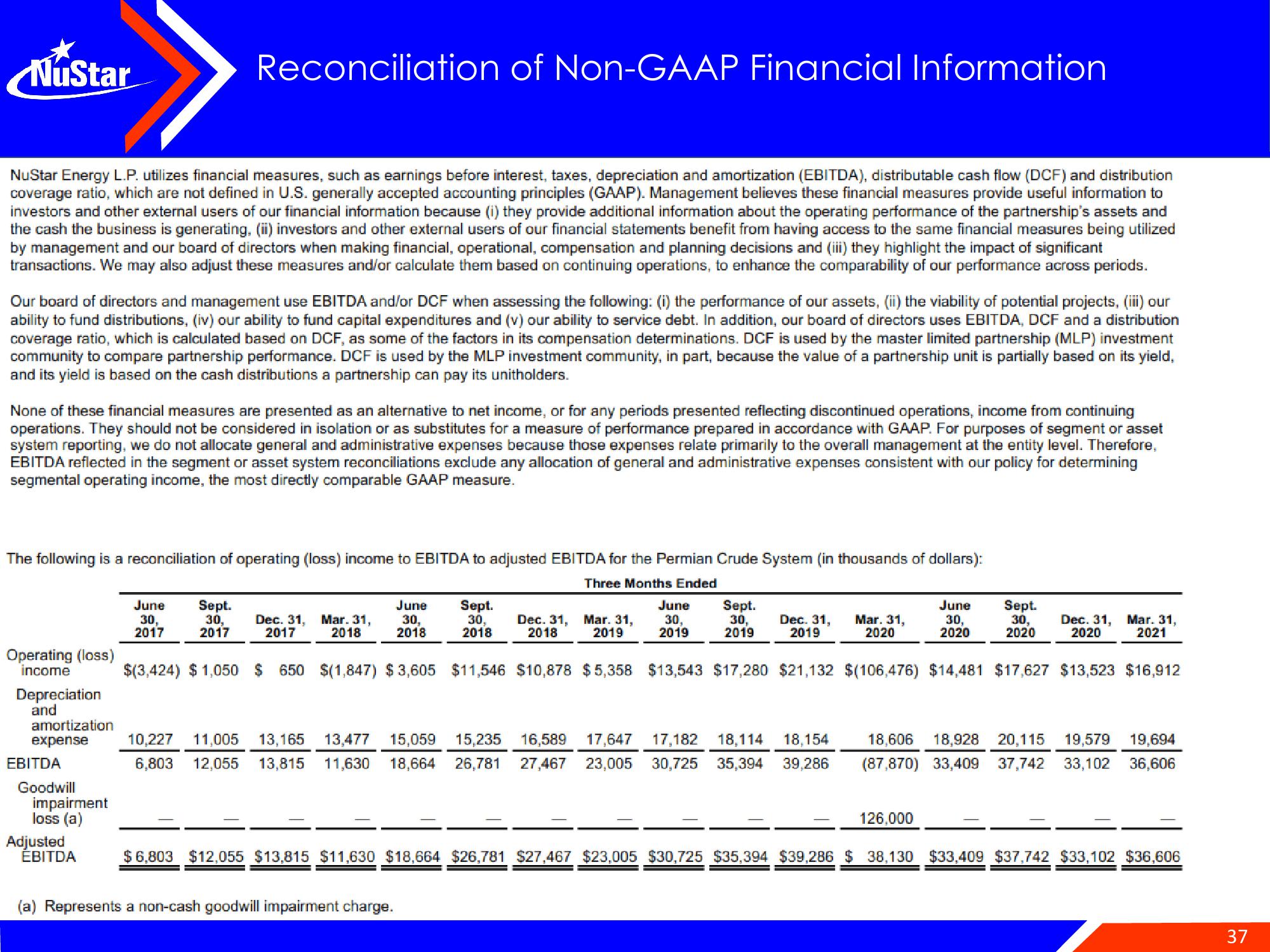

NuStar Energy L.P. utilizes financial measures, such as earnings before interest, taxes, depreciation and amortization (EBITDA), distributable cash flow (DCF) and distribution

coverage ratio, which are not defined in U.S. generally accepted accounting principles (GAAP). Management believes these financial measures provide useful information to

investors and other external users of our financial information because (i) they provide additional information about the operating performance of the partnership's assets and

the cash the business is generating, (ii) investors and other external users of our financial statements benefit from having access to the same financial measures being utilized

by management and our board of directors when making financial, operational, compensation and planning decisions and (iii) they highlight the impact of significant

transactions. We may also adjust these measures and/or calculate them based on continuing operations, to enhance the comparability of our performance across periods.

Our board of directors and management use EBITDA and/or DCF when assessing the following: (i) the performance of our assets, (ii) the viability of potential projects, (iii) our

ability to fund distributions, (iv) our ability to fund capital expenditures and (v) our ability to service debt. In addition, our board of directors uses EBITDA, DCF and a distribution

coverage ratio, which is calculated based on DCF, as some of the factors in its compensation determinations. DCF is used by the master limited partnership (MLP) investment

community to compare partnership performance. DCF is used by the MLP investment community, in part, because the value of a partnership unit is partially based on its yield,

and its yield is based on the cash distributions a partnership can pay its unitholders.

None of these financial measures are presented as an alternative to net income, or for any periods presented reflecting discontinued operations, income from continuing

operations. They should not be considered in isolation or as substitutes for a measure of performance prepared in accordance with GAAP. For purposes of segment or asset

system reporting, we do not allocate general and administrative expenses because those expenses relate primarily to the overall management at the entity level. Therefore,

EBITDA reflected in the segment or asset system reconciliations exclude any allocation of general and administrative expenses consistent with our policy for determining

segmental operating income, the most directly comparable GAAP measure.

The following is a reconciliation of operating (loss) income to EBITDA to adjusted EBITDA for the Permian Crude System (in thousands of dollars):

Three Months Ended

Operating (loss)

income

Depreciation

and

amortization

expense

Reconciliation of Non-GAAP Financial Information

EBITDA

Goodwill

impairment

loss (a)

Adjusted

EBITDA

June

30,

2017

Sept.

30,

2017

June

30,

2018

Dec. 31, Mar. 31,

2017

Sept.

30,

2018

Dec. 31,

2018

June Sept.

30,

30,

2019

Mar. 31,

2019

Dec. 31,

2019

Mar. 31,

2020

Dec. 31, Mar. 31,

2020

2021

2018

2019

$(3,424) $1,050 $ 650 $(1,847) $3,605 $11,546 $10,878 $5,358 $13,543 $17,280 $21,132 $(106,476) $14,481 $17,627 $13,523 $16,912

10,227 11,005 13,165 13,477 15,059 15,235 16,589 17,647 17,182 18,114 18,154

6,803 12,055 13,815 11,630 18,664 26,781 27,467 23,005 30,725 35,394 39,286

(a) Represents a non-cash goodwill impairment charge.

June

30,

2020

126,000

Sept.

30,

2020

18,606 18,928 20,115 19,579 19,694

(87,870) 33,409 37,742 33,102 36,606

$6,803 $12,055 $13,815 $11,630 $18,664 $26,781 $27,467 $23,005 $30,725 $35,394 $39,286 $ 38,130 $33,409 $37,742 $33,102 $36,606

37View entire presentation