Snap Inc Results Presentation Deck

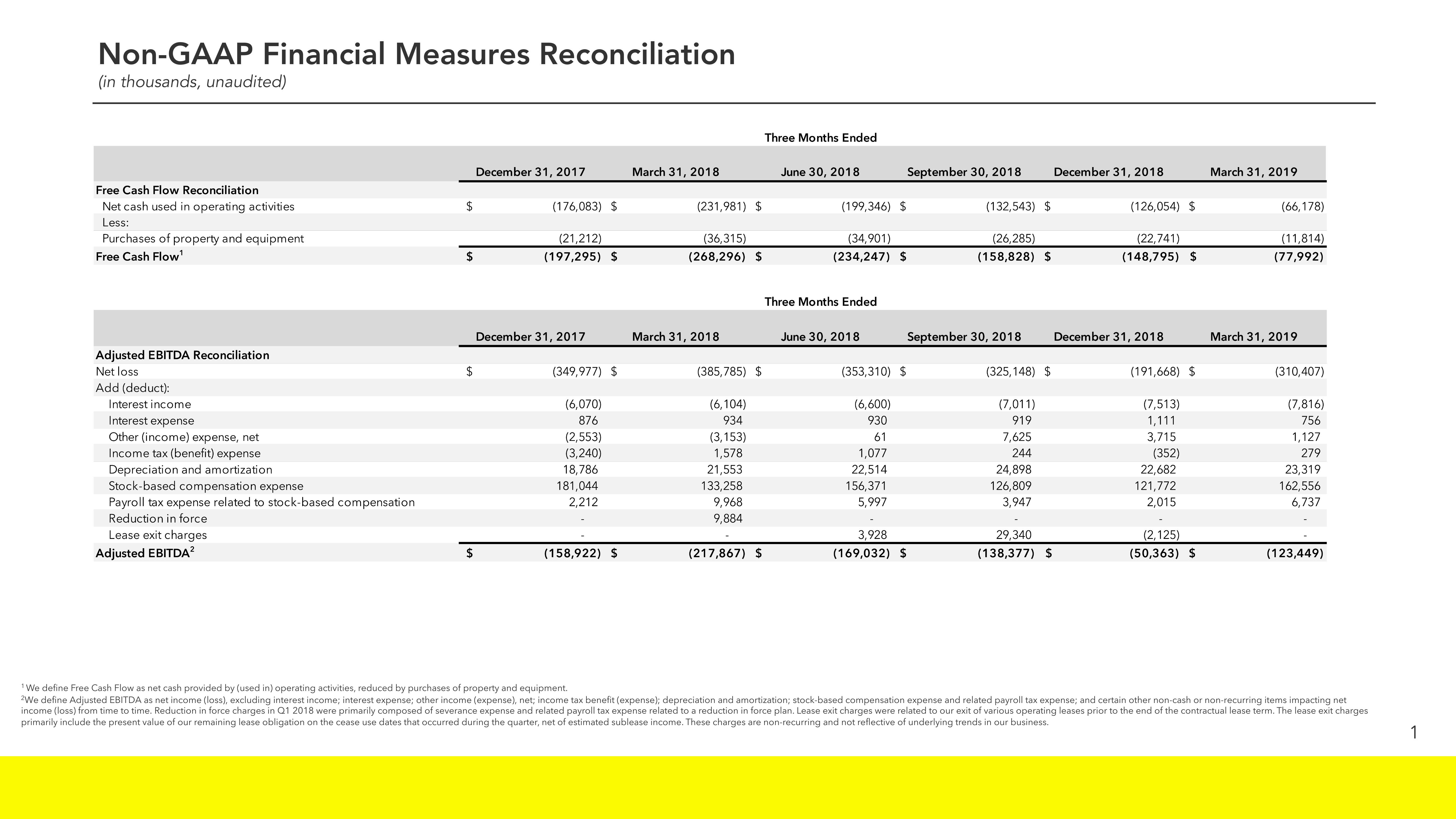

Non-GAAP Financial Measures Reconciliation

(in thousands, unaudited)

Free Cash Flow Reconciliation

Net cash used in operating activities

Less:

Purchases of property and equipment

Free Cash Flow¹

Adjusted EBITDA Reconciliation

Net loss

Add (deduct):

Interest income

Interest expense

Other (income) expense, net

Income tax (benefit) expense

Depreciation and amortization

Stock-based compensation expense

Payroll tax expense related to stock-based compensation

Reduction in force

Lease exit charges

Adjusted EBITDA²

$

$

December 31, 2017

December

(176,083) $

(21,212)

(197,295) $

2017

(349,977) $

(6,070)

876

(2,553)

(3,240)

18,786

181,044

2,212

(158,922) $

March 31, 2018

(231,981) $

(36,315)

(268,296) $

March 31, 2018

(385,785) $

(6,104)

934

(3,153)

1,578

21,553

133,258

9,968

9,884

(217,867) $

Three Months Ended

June 30, 2018

(199,346) $

(34,901)

(234,247) $

Three Months Ended

September 30, 2018

June 30, 2018

(6,600)

930

61

1,077

22,514

156,371

5,997

(353,310) $

(132,543) $

September 30, 2018

3,928

(169,032) $

(26,285)

(158,828) $

(325,148) $

(7,011)

919

7,625

244

24,898

126,809

3,947

29,340

(138,377) $

December 31, 2018

(126,054) $

(22,741)

(148,795) $

December 31, 2

(191,668) $

(7,513)

1,111

3,715

(352)

22,682

121,772

2,015

(2,125)

(50,363) $

March 31, 2019

(66,178)

(11,814)

(77,992)

March 31, 2019

(310,407)

(7,816)

756

1,127

279

23,319

162,556

6,737

(123,449)

¹ We define Free Cash Flow as net cash provided by (used in) operating activities, reduced by purchases of property and equipment.

2We define Adjusted EBITDA as net income (loss), excluding interest income; interest expense; other income (expense), net; income tax benefit (expense); depreciation and amortization; stock-based compensation expense and related payroll tax expense; and certain other non-cash or non-recurring items impacting net

income (loss) from time to time. Reduction in force charges in Q1 2018 were primarily composed of severance expense and related payroll tax expense related to a reduction in force plan. Lease exit charges were related to our exit of various operating leases prior to the end of the contractual lease term. The lease exit charges

primarily include the present value of our remaining lease obligation on the cease use dates that occurred during the quarter, net of estimated sublease income. These charges are non-recurring and not reflective of underlying trends in our business.

1View entire presentation