Arrival SPAC Presentation Deck

FINANCIALS AND TRANSACTION OVERVIEW

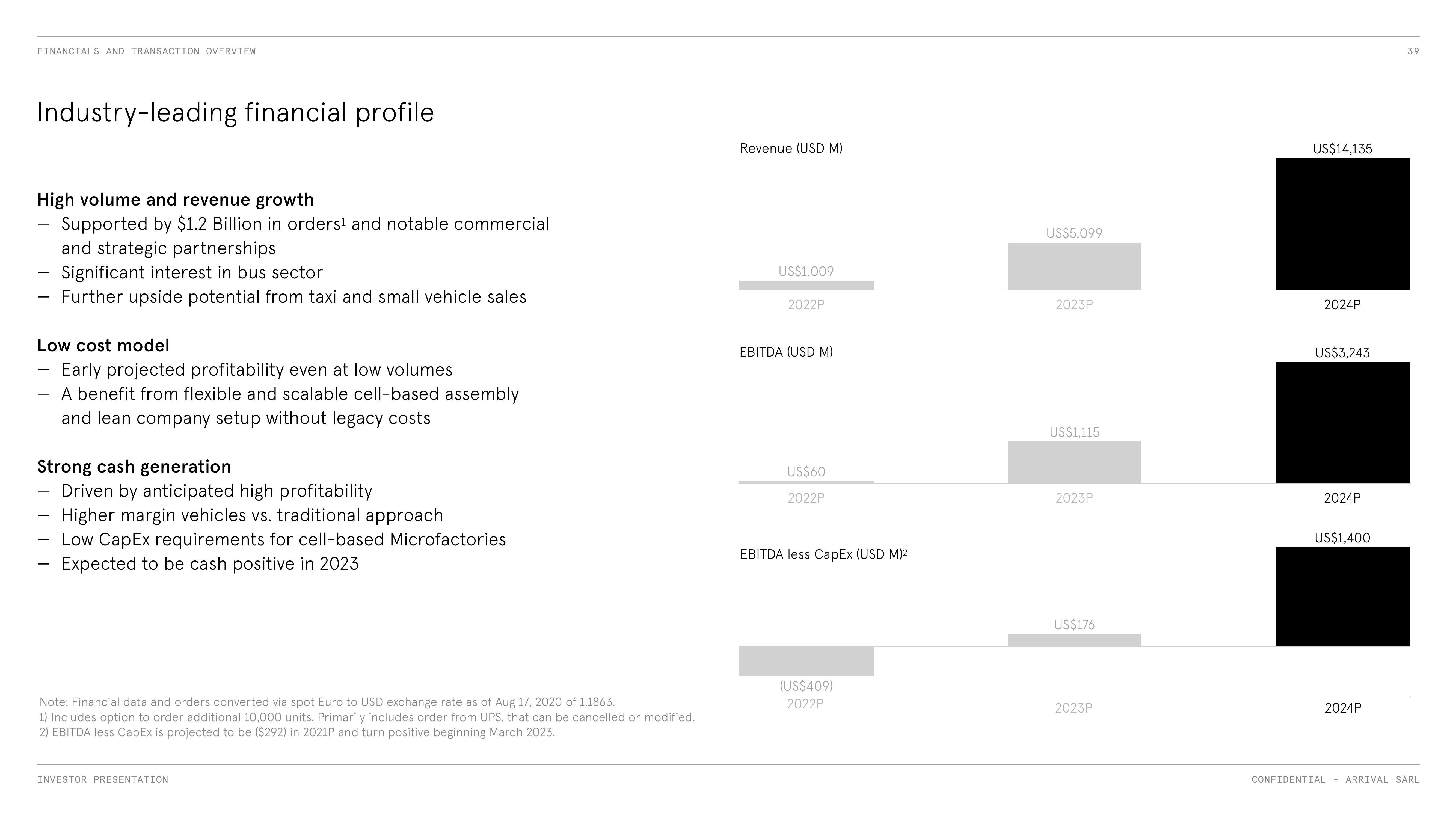

Industry-leading financial profile

High volume and revenue growth

Supported by $1.2 Billion in orders¹ and notable commercial

and strategic partnerships

Significant interest in bus sector

Further upside potential from taxi and small vehicle sales

Low cost model

Early projected profitability even at low volumes

A benefit from flexible and scalable cell-based assembly

and lean company setup without legacy costs

Strong cash generation

Driven by anticipated high profitability

Higher margin vehicles vs. traditional approach

Low CapEx requirements for cell-based Microfactories

- Expected to be cash positive in 2023

Note: Financial data and orders converted via spot Euro to USD exchange rate as of Aug 17, 2020 of 1.1863.

1) Includes option to order additional 10,000 units. Primarily includes order from UPS, that can be cancelled or modified.

2) EBITDA less CapEx is projected to be ($292) in 2021P and turn positive beginning March 2023.

INVESTOR PRESENTATION

Revenue (USD M)

US$1,009

2022P

EBITDA (USD M)

US$60

2022P

EBITDA less CapEx (USD M)²

(US$409)

2022P

US$5,099

2023P

US$1,115

2023P

US$176

2023P

US$14,135

2024P

US$3,243

2024P

US$1,400

2024P

39

CONFIDENTIAL - ARRIVAL SARLView entire presentation