Kinnevik Results Presentation Deck

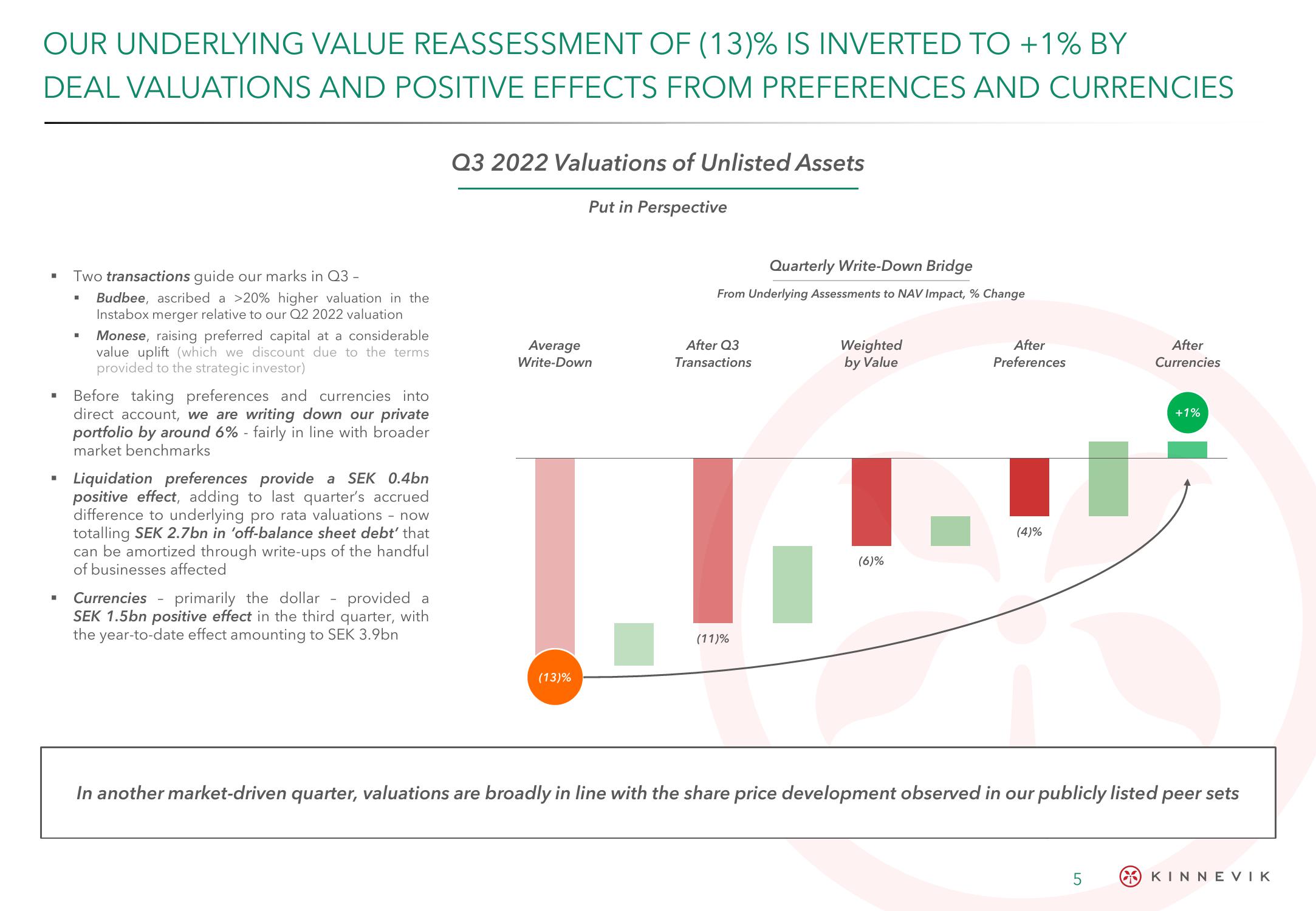

OUR UNDERLYING VALUE REASSESSMENT OF (13) % IS INVERTED TO +1% BY

DEAL VALUATIONS AND POSITIVE EFFECTS FROM PREFERENCES AND CURRENCIES

■

Two transactions guide our marks in Q3 -

Budbee, ascribed a >20% higher valuation in the

Instabox merger relative to our Q2 2022 valuation

M

■

Monese, raising preferred capital at a considerable

value uplift (which we discount due to the terms

provided to the strategic investor)

Before taking preferences and currencies into

direct account, we are writing down our private

portfolio by around 6% - fairly in line with broader

market benchmarks

Liquidation preferences provide a SEK 0.4bn

positive effect, adding to last quarter's accrued

difference to underlying pro rata valuations - now

totalling SEK 2.7bn in 'off-balance sheet debt' that

can be amortized through write-ups of the handful

of businesses affected

■ Currencies primarily the dollar provided a

SEK 1.5bn positive effect in the third quarter, with

the year-to-date effect amounting to SEK 3.9bn

-

Q3 2022 Valuations of Unlisted Assets

Put in Perspective

Average

Write-Down

(13)%

Quarterly Write-Down Bridge

From Underlying Assessments to NAV Impact, % Change

After Q3

Transactions

(11)%

Weighted

by Value

(6)%

After

Preferences

(4)%

After

Currencies

5

+1%

In another market-driven quarter, valuations are broadly in line with the share price development observed in our publicly listed peer sets

KINNEVIKView entire presentation