Apollo Global Management Investor Day Presentation Deck

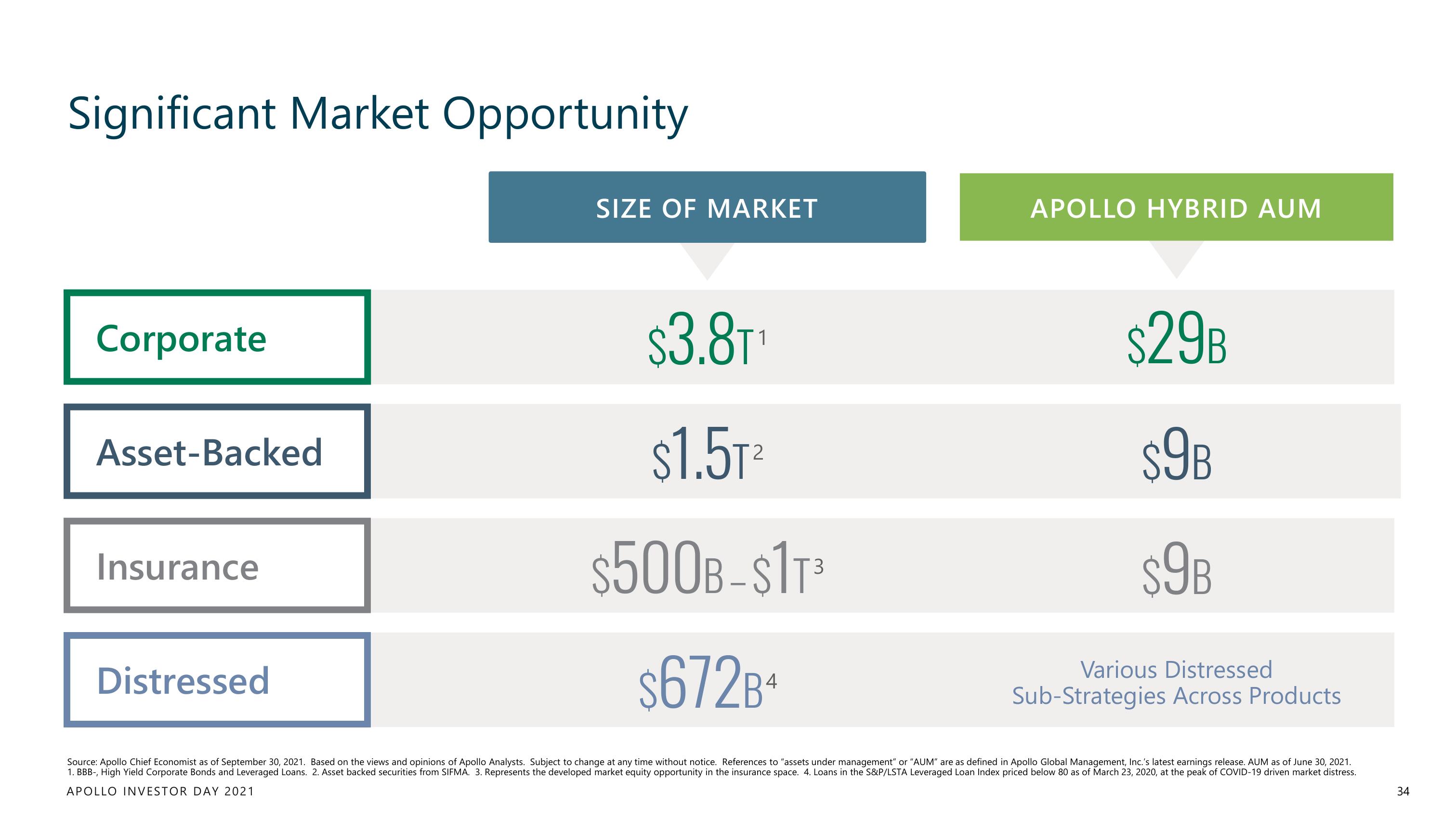

Significant Market Opportunity

Corporate

Asset-Backed

$3.8T¹

$1.5T²

$500B-$1T³

$672B4

Source: Apollo Chief Economist as of September 30, 2021. Based on the views and opinions of Apollo Analysts. Subject to change at any time without notice. References to "assets under management" or "AUM" are as defined in Apollo Global Management, Inc.'s latest earnings release. AUM as of June 30, 2021.

1. BBB-, High Yield Corporate Bonds and Leveraged Loans. 2. Asset backed securities from SIFMA. 3. Represents the developed market equity opportunity in the insurance space. 4. Loans in the S&P/LSTA Leveraged Loan Index priced below 80 as of March 23, 2020, at the peak of COVID-19 driven market distress.

APOLLO INVESTOR DAY 2021

Insurance

SIZE OF MARKET

Distressed

APOLLO HYBRID AUM

$29B

$9B

$9B

Various Distressed

Sub-Strategies Across Products

34View entire presentation