J.P.Morgan Results Presentation Deck

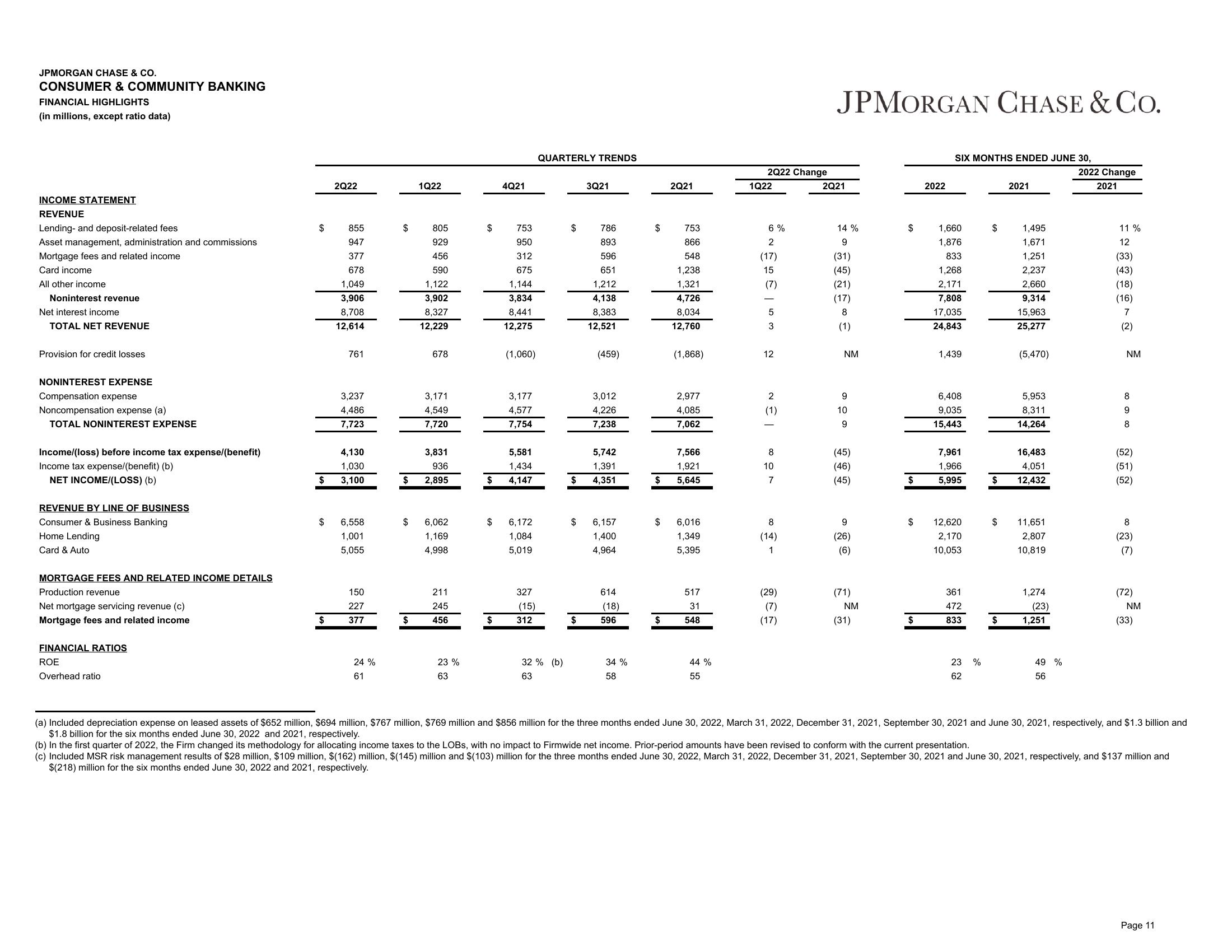

JPMORGAN CHASE & CO.

CONSUMER & COMMUNITY BANKING

FINANCIAL HIGHLIGHTS

(in millions, except ratio data)

INCOME STATEMENT

REVENUE

Lending- and deposit-related fees

Asset management, administration and commissions

Mortgage fees and related income

Card income

All other income

Noninterest revenue

Net interest income

TOTAL NET REVENUE

Provision for credit losses

NONINTEREST EXPENSE

Compensation expense

Noncompensation expense (a)

TOTAL NONINTEREST EXPENSE

Income/(loss) before income tax expense/(benefit)

Income tax expense/(benefit) (b)

NET INCOME/(LOSS) (b)

REVENUE BY LINE OF BUSINESS

Consumer & Business Banking

Home Lending

Card & Auto

MORTGAGE FEES AND RELATED INCOME DETAILS

Production revenue

Net mortgage servicing revenue (c)

Mortgage fees and related income

FINANCIAL RATIOS

ROE

Overhead ratio

$

$

$

$

2Q22

855

947

377

678

1,049

3,906

8,708

12,614

761

3,237

4,486

7,723

4,130

1,030

3,100

6,558

1,001

5,055

150

227

377

24 %

61

$

$

1Q22

$

805

929

456

590

1,122

3,902

8,327

12,229

678

3,831

936

$ 2,895

3,171

4,549

7,720

6,062

1,169

4,998

211

245

456

23 %

63

$

$

$

4Q21

753

950

312

675

1,144

3,834

8,441

12,275

(1,060)

3,177

4,577

7,754

5,581

1,434

4,147

6,172

1,084

5,019

327

(15)

$ 312

QUARTERLY TRENDS

32% (b)

63

$

$

3Q21

$

786

893

596

651

1,212

4,138

8,383

12,521

(459)

5,742

1,391

$ 4,351

3,012

4,226

7,238

6,157

1,400

4,964

614

(18)

596

34 %

58

$

2Q21

753

866

548

$

1,238

1,321

4,726

8,034

12,760

(1,868)

2,977

4,085

7,062

7,566

1,921

$ 5,645

$ 6,016

1,349

5,395

517

31

548

44%

55

2Q22 Change

1Q22

6%

walang

(17)

12

2

(1)

8

10

7

܂

8

(14)

1

(29)

(7)

(17)

JPMORGAN CHASE & Co.

2Q21

14 %

9

(31)

(45)

(21)

(17)

8

(1)

NM

9

10

9

(45)

(46)

(45)

9

(26)

(6)

(71)

NM

(31)

$

$

2022

$

SIX MONTHS ENDED JUNE 30,

1,660

1,876

833

1,268

2,171

7,808

17,035

24,843

1,439

6,408

9,035

15,443

7,961

1,966

5,995

$ 12,620

2,170

10,053

361

472

833

23 %

62

$

$

$

$

2021

1,495

1,671

1,251

2,237

2,660

9,314

15,963

25,277

(5,470)

5,953

8,311

14,264

16,483

4,051

12,432

11,651

2,807

10,819

1,274

(23)

1,251

49 %

56

2022 Change

2021

11 %

12

(33)

(43)

(18)

(16)

7

(2)

NM

8

9

8

(52)

(51)

(52)

8

(23)

(7)

(72)

NM

(33)

(a) Included depreciation expense on leased assets of $652 million, $694 million, $767 million, $769 million and $856 million for the three months ended June 30, 2022, March 31, 2022, December 31, 2021, September 30, 2021 and June 30, 2021, respectively, and $1.3 billion and

$1.8 billion for the six months ended June 30, 2022 and 2021, respectively.

(b) In the first quarter of 2022, the Firm changed its methodology for allocating income taxes to the LOBS, with no impact to Firmwide net income. Prior-period amounts have been revised to conform with the current presentation.

(c) Included MSR risk management results of $28 million, $109 million, $(162) million, $(145) million and $(103) million for the three months ended June 30, 2022, March 31, 2022, December 31, 2021, September 30, 2021 and June 30, 2021, respectively, and $137 million and

$(218) million for the six months ended June 30, 2022 and 2021, respectively.

Page 11View entire presentation