Evercore Investment Banking Pitch Book

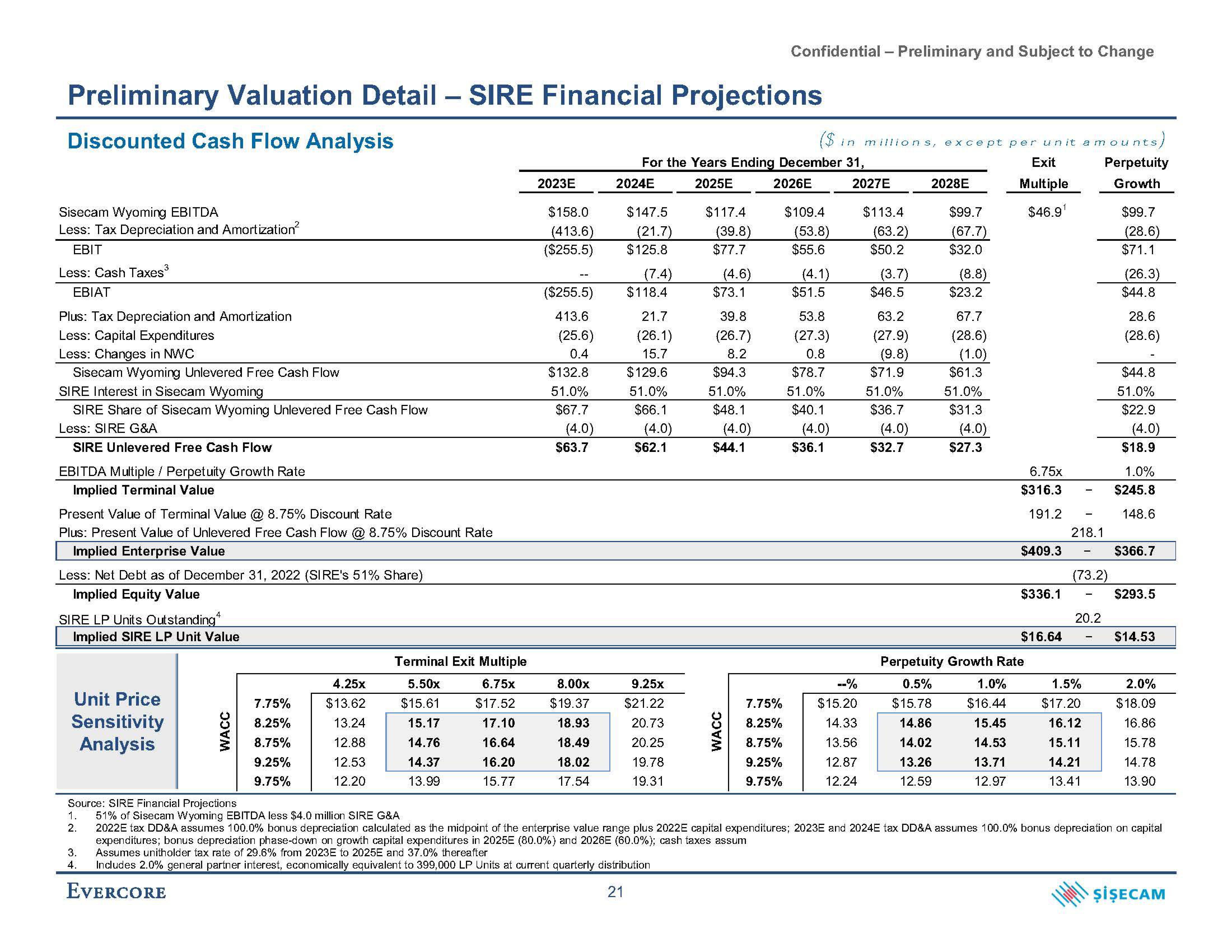

Preliminary Valuation Detail - SIRE Financial Projections

Discounted Cash Flow Analysis

Sisecam Wyoming EBITDA

Less: Tax Depreciation and Amortization²

EBIT

Less: Cash Taxes³

EBIAT

Plus: Tax Depreciation and Amortization

Less: Capital Expenditures

Less: Changes in NWC

Sisecam Wyoming Unlevered Free Cash Flow

SIRE Interest in Sisecam Wyoming

SIRE Share of Sisecam Wyoming Unlevered Free Cash Flow

Less: SIRE G&A

SIRE Unlevered Free Cash Flow

EBITDA Multiple / Perpetuity Growth Rate

Implied Terminal Value

Present Value of Terminal Value @ 8.75% Discount Rate

Plus: Present Value of Unlevered Free Cash Flow @ 8.75% Discount Rate

Implied Enterprise Value

Less: Net Debt as of December 31, 2022 (SIRE's 51% Share)

Implied Equity Value

SIRE LP Units Outstanding

Implied SIRE LP Unit Value

Unit Price

Sensitivity

Analysis

WACC

7.75%

8.25%

8.75%

9.25%

9.75%

4.25x

$13.62

13.24

12.88

12.53

12.20

Terminal Exit Multiple

5.50x

6.75x

$15.61

$17.52

15.17

17.10

14.76

16.64

14.37

16.20

13.99

15.77

2023E

$158.0

(413.6)

($255.5)

($255.5)

413.6

(25.6)

0.4

$132.8

51.0%

$67.7

(4.0)

$63.7

8.00x

$19.37

18.93

18.49

18.02

17.54

2024E

For the Years Ending December 31,

2026E

2025E

$147.5

(21.7)

$125.8

(7.4)

$118.4

21.7

(26.1)

15.7

$129.6

51.0%

$66.1

(4.0)

$62.1

9.25x

$21.22

20.73

20.25

19.78

19.31

$117.4

(39.8)

$77.7

(4.6)

$73.1

39.8

(26.7)

8.2

$94.3

51.0%

$48.1

WACC

(4.0)

$44.1

Confidential - Preliminary and Subject to Change

7.75%

8.25%

8.75%

9.25%

9.75%

($ in millions, except per unit amounts,

$109.4

(53.8)

$55.6

(4.1)

$51.5

53.8

(27.3)

0.8

$78.7

51.0%

$40.1

(4.0)

$36.1

2027E

--%

$15.20

14.33

13.56

12.87

12.24

$113.4

(63.2)

$50.2

(3.7)

$46.5

63.2

(27.9)

(9.8)

$71.9

51.0%

$36.7

(4.0)

$32.7

2028E

$99.7

(67.7)

$32.0

(8.8)

$23.2

67.7

(28.6)

(1.0)

$61.3

51.0%

$31.3

(4.0)

$27.3

Exit

Multiple

$46.9

1.0%

$16.44

15.45

14.53

13.71

12.97

6.75x

$316.3

191.2

$409.3

$336.1

$16.64

Perpetuity Growth Rate

0.5%

$15.78

14.86

14.02

13.26

12.59

218.1

(73.2)

20.2

1.5%

$17.20

16.12

15.11

Perpetuity

Growth

14.21

13.41

$99.7

(28.6)

$71.1

(26.3)

$44.8

28.6

(28.6)

$44.8

51.0%

$22.9

(4.0)

$18.9

1.0%

$245.8

148.6

$366.7

$293.5

$14.53

2.0%

$18.09

16.86

15.78

14.78

13.90

Source: SIRE Financial Projections

2.

1. 51% of Sisecam Wyoming EBITDA less $4.0 million SIRE G&A

2022E tax DD&A assumes 100.0% bonus depreciation calculated as the midpoint of the enterprise value range plus 2022E capital expenditures; 2023E and 2024E tax DD&A assumes 100.0% bonus depreciation on capital

expenditures; bonus depreciation phase-down on growth capital expenditures in 2025E (80.0%) and 2026E (60.0%); cash taxes assum

3. Assumes unitholder tax rate of 29.6% from 2023E to 2025E and 37.0% thereafter

4.

Includes 2.0% general partner interest, economically equivalent to 399,000 LP Units at current quarterly distribution

EVERCORE

21

ŞİŞECAMView entire presentation