UBS ESG Presentation Deck

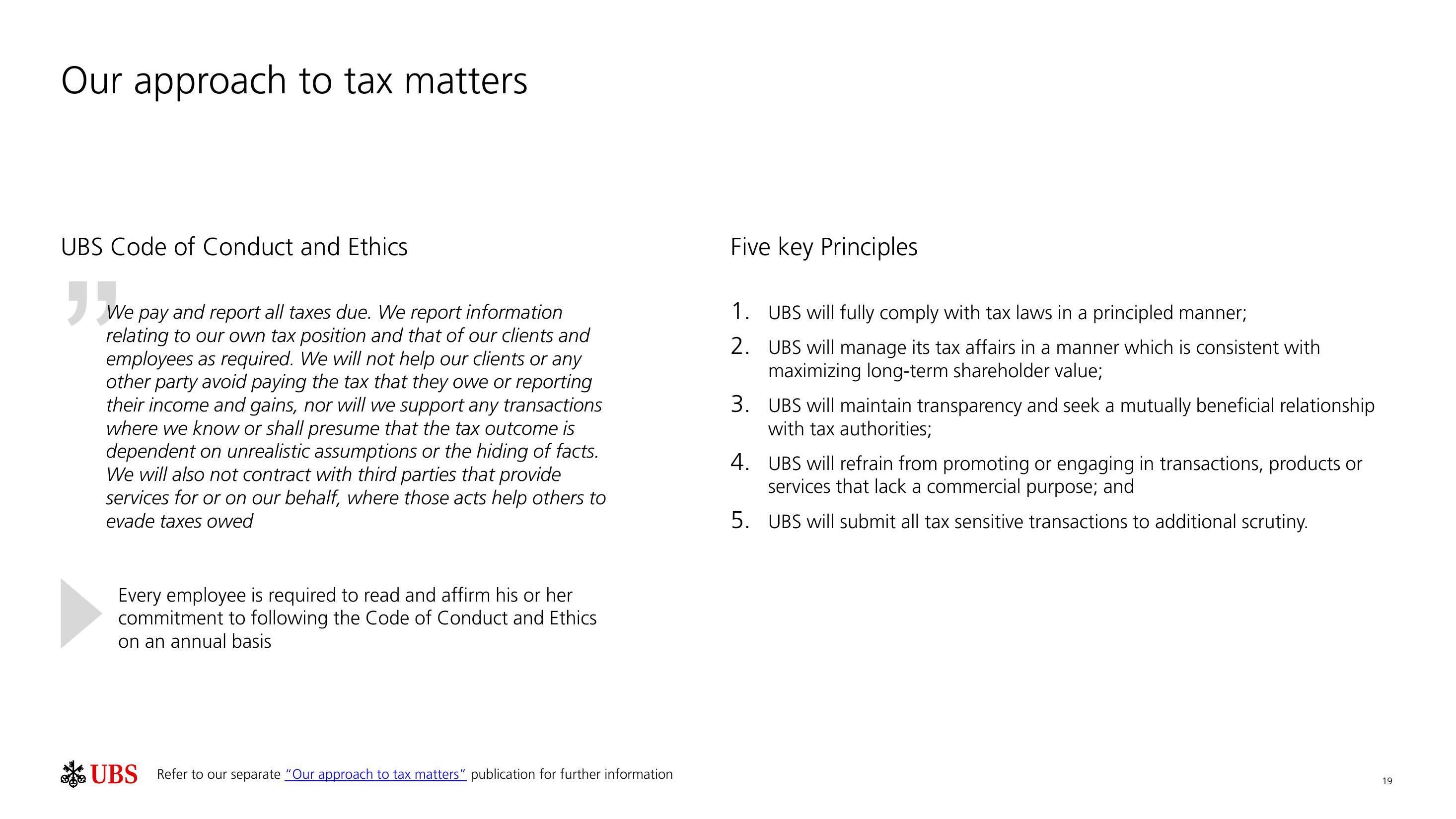

Our approach to tax matters

UBS Code of Conduct and Ethics

I'm

We pay and report all taxes due. We report information

relating to our own tax position and that of our clients and

employees as required. We will not help our clients or any

other party avoid paying the tax that they owe or reporting

their income and gains, nor will we support any transactions

where we know or shall presume that the tax outcome is

dependent on unrealistic assumptions or the hiding of facts.

We will also not contract with third parties that provide

services for or on our behalf, where those acts help others to

evade taxes owed

Every employee is required to read and affirm his or her

commitment to following the Code of Conduct and Ethics

on an annual basis

UBS Refer to our separate "Our approach to tax matters", publication for further information

Five key Principles

1. UBS will fully comply with tax laws in a principled manner;

2.

UBS will manage its tax affairs in a manner which is consistent with

maximizing long-term shareholder value;

3.

UBS will maintain transparency and seek a mutually beneficial relationship

with tax authorities;

4. UBS will refrain from promoting or engaging in transactions, products or

services that lack a commercial purpose; and

5. UBS will submit all tax sensitive transactions to additional scrutiny.

19View entire presentation