J.P.Morgan Investment Banking

PUBLIC MARKET OVERVIEW

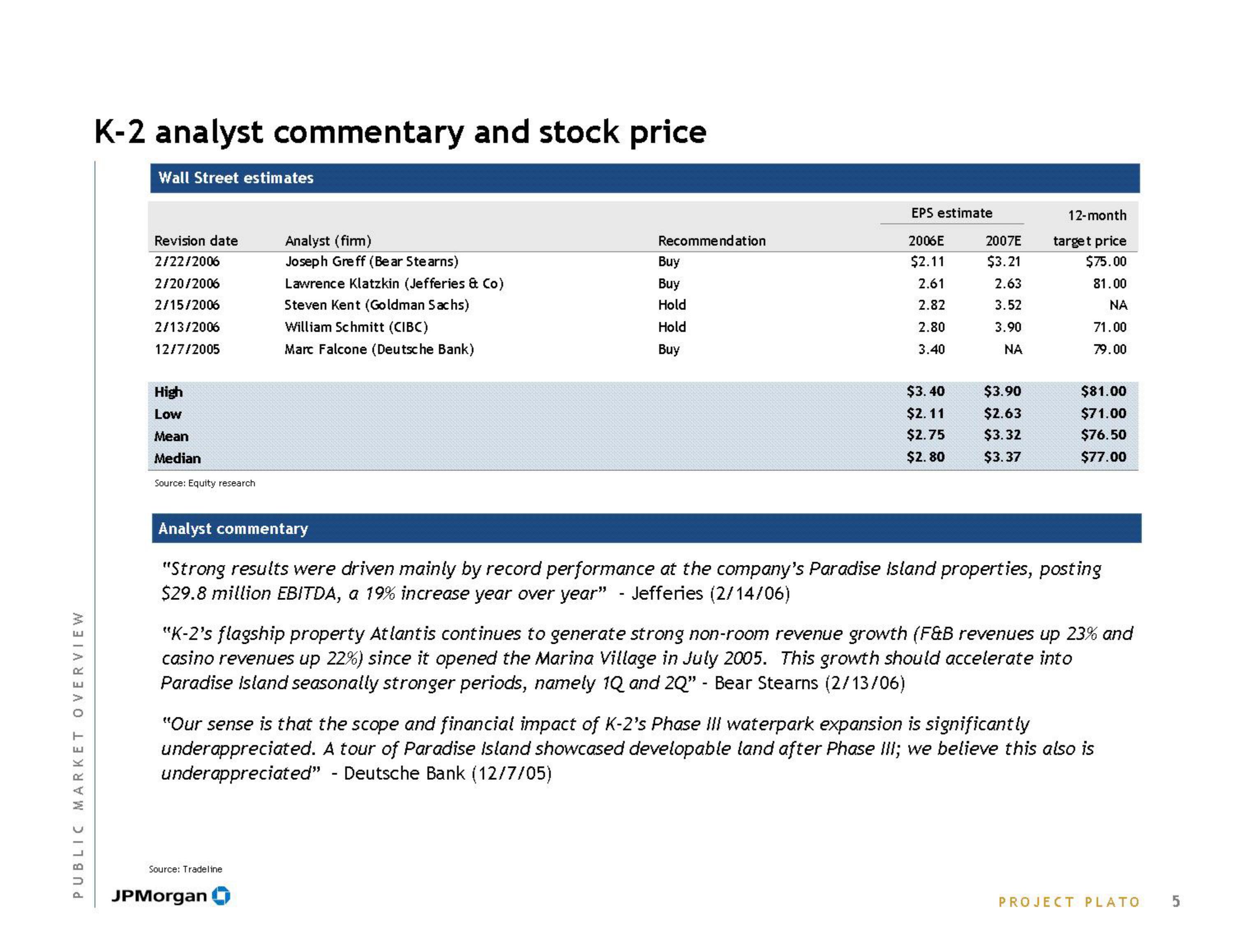

K-2 analyst commentary and stock price

Wall Street estimates

Revision date

2/22/2006

2/20/2006

2/15/2006

2/13/2006

12/7/2005

High

Low

Mean

Median

Source: Equity research

Analyst (firm)

Joseph Greff (Bear Stearns)

Lawrence Klatzkin (Jefferies & Co)

Steven Kent (Goldman Sachs)

William Schmitt (CIBC)

Marc Falcone (Deutsche Bank)

Recommendation

Source: Tradeline

Buy

Buy

Hold

Hold

Buy

JPMorgan

EPS estimate

2006E

$2.11

2.61

2.82

2.80

3.40

$3.40

$2.11

$2.75

$2.80

2007E

$3.21

2.63

3.52

3.90

ΝΑ

$3.90

$2.63

$3.32

$3.37

12-month

target price

$75.00

81.00

ΝΑ

71.00

79.00

Analyst commentary

"Strong results were driven mainly by record performance at the company's Paradise Island properties, posting

$29.8 million EBITDA, a 19% increase year over year" - Jefferies (2/14/06)

$81.00

$71.00

$76.50

$77.00

"K-2's flagship property Atlantis continues to generate strong non-room revenue growth (F&B revenues up 23% and

casino revenues up 22%) since it opened the Marina Village in July 2005. This growth should accelerate into

Paradise Island seasonally stronger periods, namely 1Q and 2Q" - Bear Stearns (2/13/06)

"Our sense is that the scope and financial impact of K-2's Phase III waterpark expansion is significantly

underappreciated. A tour of Paradise Island showcased developable land after Phase III; we believe this also is

underappreciated" - Deutsche Bank (12/7/05)

PROJECT PLATO

5View entire presentation