Clover Health Investor Presentation Deck

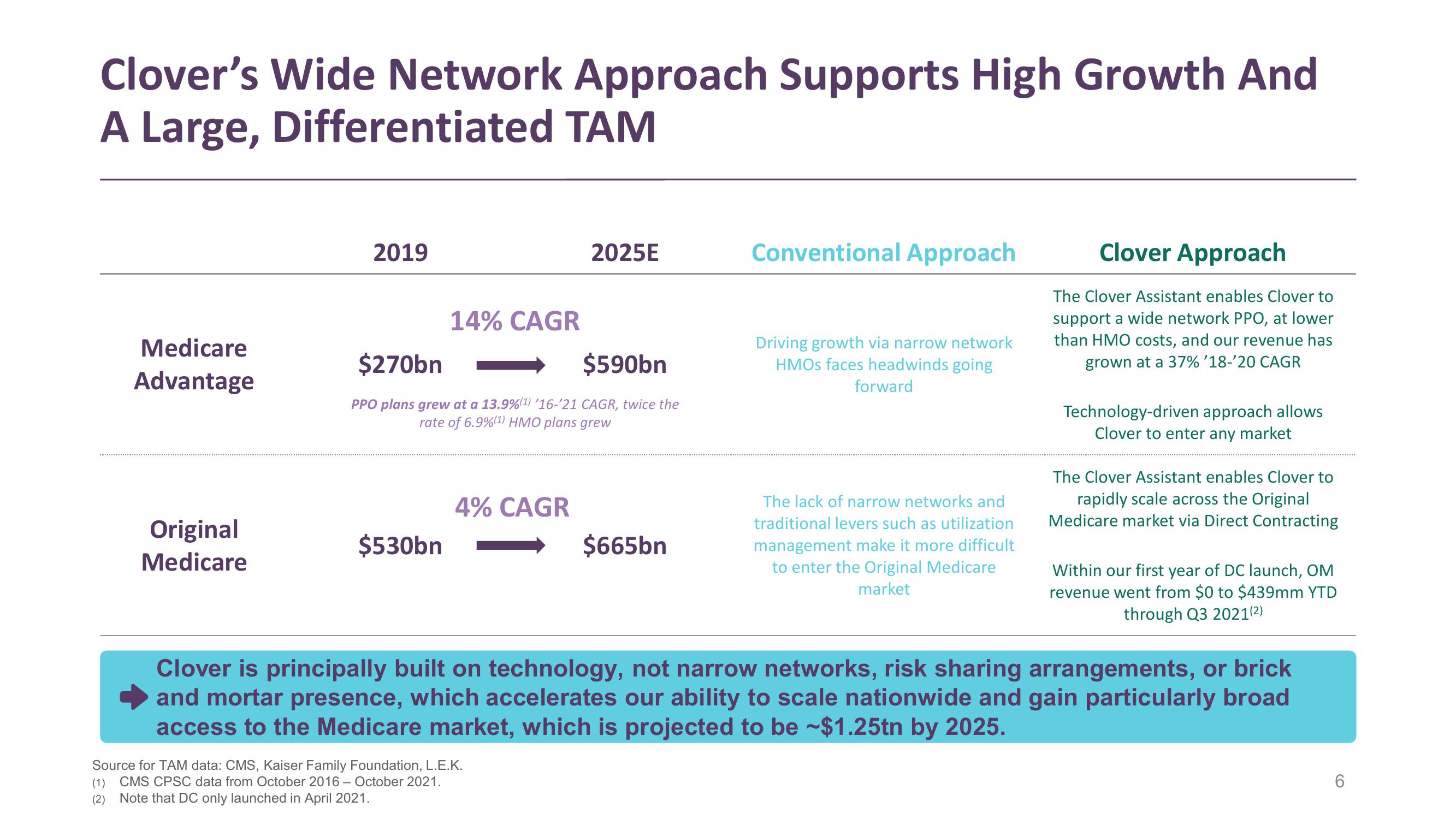

Clover's Wide Network Approach Supports High Growth And

A Large, Differentiated TAM

Medicare

Advantage

Original

Medicare

2019

14% CAGR

$530bn

$270bn

$590bn

PPO plans grew at a 13.9% (¹) '16-'21 CAGR, twice the

rate of 6.9%(¹) HMO plans grew

4% CAGR

2025E

Source for TAM data: CMS, Kaiser Family Foundation, L.E.K.

(1) CMS CPSC data from October 2016 October 2021.

(2) Note that DC only launched in April 2021.

$665bn

Conventional Approach

Driving growth via narrow network

HMOs faces headwinds going

forward

The lack of narrow networks and

traditional levers such as utilization

management make it more difficult

to enter the Original Medicare

market

Clover Approach

The Clover Assistant enables Clover to

support a wide network PPO, at lower

than HMO costs, and our revenue has

grown at a 37% '18-'20 CAGR

Technology-driven approach allows

Clover to enter any market

The Clover Assistant enables Clover to

rapidly scale across the Original

Medicare market via Direct Contracting

Within our first year of DC launch, OM

revenue went from $0 to $439mm YTD

through Q3 2021(²)

Clover is principally built on technology, not narrow networks, risk sharing arrangements, or brick

and mortar presence, which accelerates our ability to scale nationwide and gain particularly broad

access to the Medicare market, which is projected to be ~$1.25tn by 2025.

CO

6View entire presentation