Q2 Quarter 2023

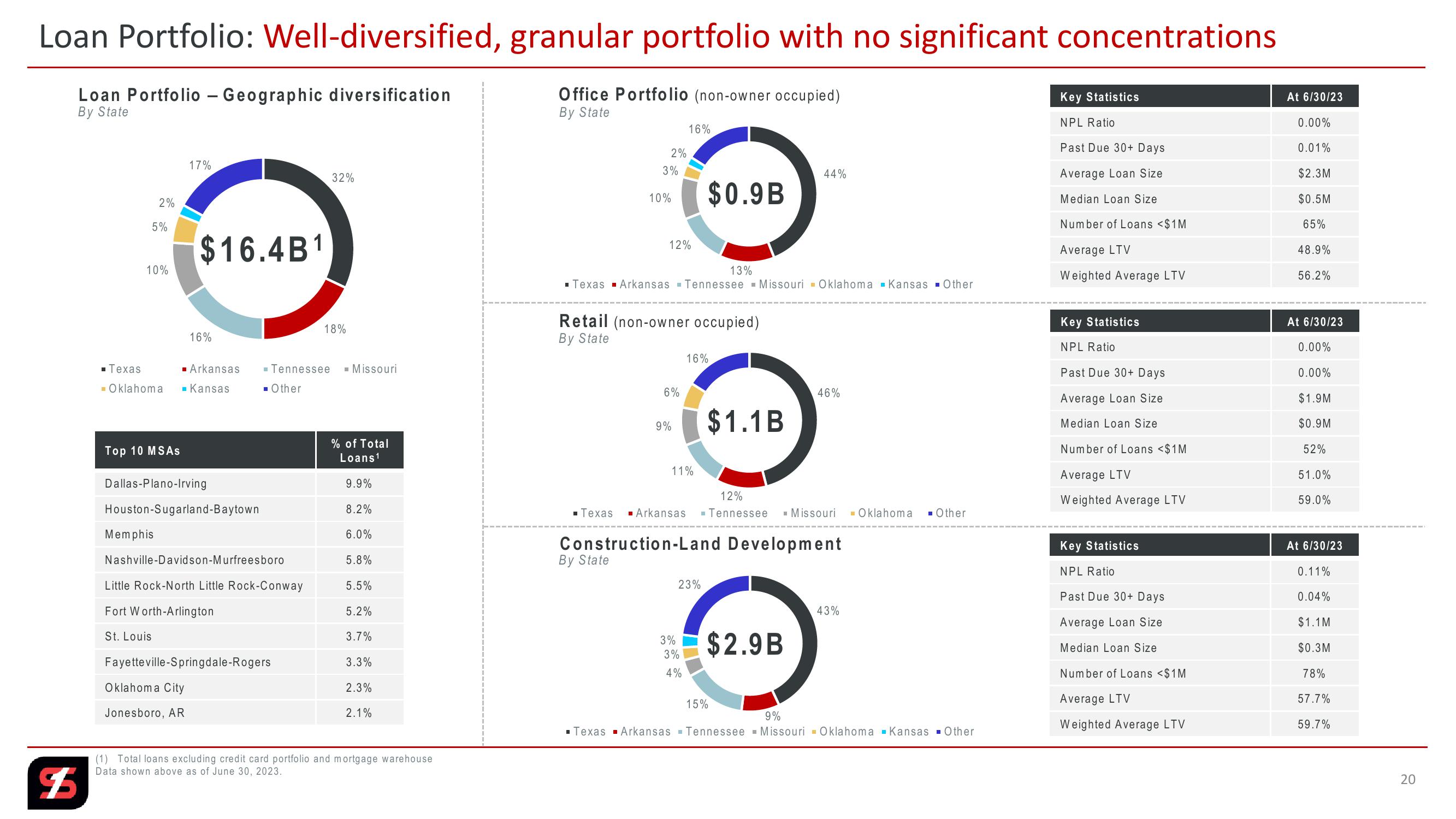

Loan Portfolio: Well-diversified, granular portfolio with no significant concentrations

Office Portfolio (non-owner occupied)

-

Loan Portfolio – Geographic diversification

By State

By State

Key Statistics

NPL Ratio

2%

5%

17%

32%

10%

$16.4B1

At 6/30/23

0.00%

16%

2%

3%

Past Due 30+ Days

0.01%

44%

Average Loan Size

$2.3M

10%

$0.9B

Median Loan Size

$0.5M

Number of Loans <$1M

65%

12%

Average LTV

48.9%

13%

Weighted Average LTV

56.2%

■ Texas Arkansas Tennessee Missouri Oklahoma Kansas ▪ Other

18%

16%

Retail (non-owner occupied)

By State

Key Statistics

At 6/30/23

NPL Ratio

0.00%

■ Texas

■ Arkansas

■ Tennessee ■ Missouri

■ Oklahoma

■ Kansas

■ Other

16%

6%

46%

9%

$1.1B

Past Due 30+ Days

0.00%

Average Loan Size

$1.9M

Median Loan Size

$0.9M

Top 10 MSAs

Dallas-Plano-Irving

Houston-Sugarland-Baytown

% of Total

Loans1

Number of Loans <$1M

52%

11%

Average LTV

51.0%

9.9%

12%

Weighted Average LTV

59.0%

8.2%

■ Texas ■ Arkansas ■ Tennessee ■ Missouri

■ Oklahoma

■ Other

Memphis

6.0%

Construction-Land Development

Key Statistics

At 6/30/23

Nashville-Davidson-Murfreesboro

5.8%

By State

NPL Ratio

0.11%

Little Rock-North Little Rock-Conway

5.5%

23%

Past Due 30+ Days

0.04%

Fort Worth-Arlington

5.2%

43%

Average Loan Size

$1.1M

St. Louis

3.7%

3%

3%

$2.9B

Median Loan Size

$0.3M

Fayetteville-Springdale-Rogers

3.3%

4%

Number of Loans <$1M

78%

Oklahoma City

2.3%

15%

Average LTV

57.7%

Jonesboro, AR

2.1%

9%

Weighted Average LTV

59.7%

■Texas Arkansas Tennessee Missouri Oklahoma Kansas Other

$

(1) Total loans excluding credit card portfolio and mortgage warehouse

Data shown above as of June 30, 2023.

20

20View entire presentation