KKR Real Estate Finance Trust Results Presentation Deck

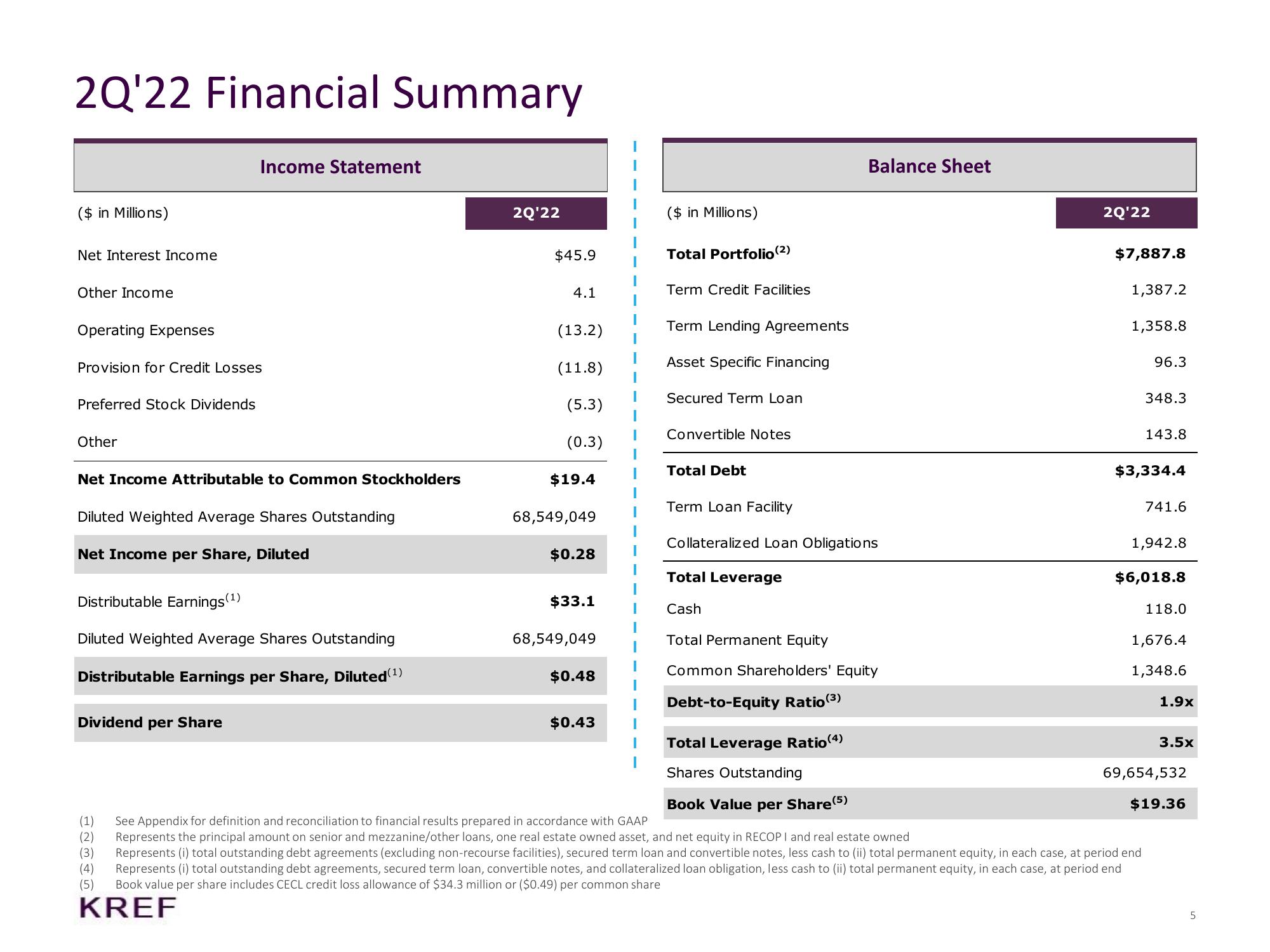

2Q'22 Financial Summary

($ in Millions)

Net Interest Income

Other Income

Operating Expenses

Provision for Credit Losses

Preferred Stock Dividends

Other

Net Income Attributable to Common Stockholders

Income Statement

Diluted Weighted Average Shares Outstanding

Net Income per Share, Diluted

Distributable Earnings (¹)

Diluted Weighted Average Shares Outstanding

Distributable Earnings per Share, Diluted (¹)

Dividend per Share

(1)

(2)

(3

(4)

(5)

2Q'22

$45.9

4.1

(13.2)

(11.8)

(5.3)

(0.3)

$19.4

68,549,049

$0.28

$33.1

68,549,049

$0.48

$0.43

($ in Millions)

Total Portfolio (2)

Term Credit Facilities

Term Lending Agreements

Asset Specific Financing

Secured Term Loan

Convertible Notes

Total Debt

Balance Sheet

Term Loan Facility

Collateralized Loan Obligations

Total Leverage

Cash

Total Permanent Equity

Common Shareholders' Equity

Debt-to-Equity Ratio (3)

2Q'22

$7,887.8

1,387.2

1,358.8

96.3

348.3

Total Leverage Ratio (4)

Shares Outstanding

Book Value per Share (5)

See Appendix for definition and reconciliation to financial results prepared in accordance with GAAP

Represents the principal amount on senior and mezzanine/other loans, one real estate owned asset, and net equity in RECOPI and real estate owned

Represents (i) total outstanding debt agreements (excluding non-recourse facilities), secured term loan and convertible notes, less cash to (ii) total permanent equity, in each case, at period end

Represents (i) total outstanding debt agreements, secured term loan, convertible notes, and collateralized loan obligation, less cash to (ii) total permanent equity, in each case, at period end

Book value per share includes CECL credit loss allowance of $34.3 million or ($0.49) per common share

KREF

143.8

$3,334.4

741.6

1,942.8

$6,018.8

118.0

1,676.4

1,348.6

1.9x

3.5x

69,654,532

$19.36

5View entire presentation