Maersk Investor Presentation Deck

Key statements

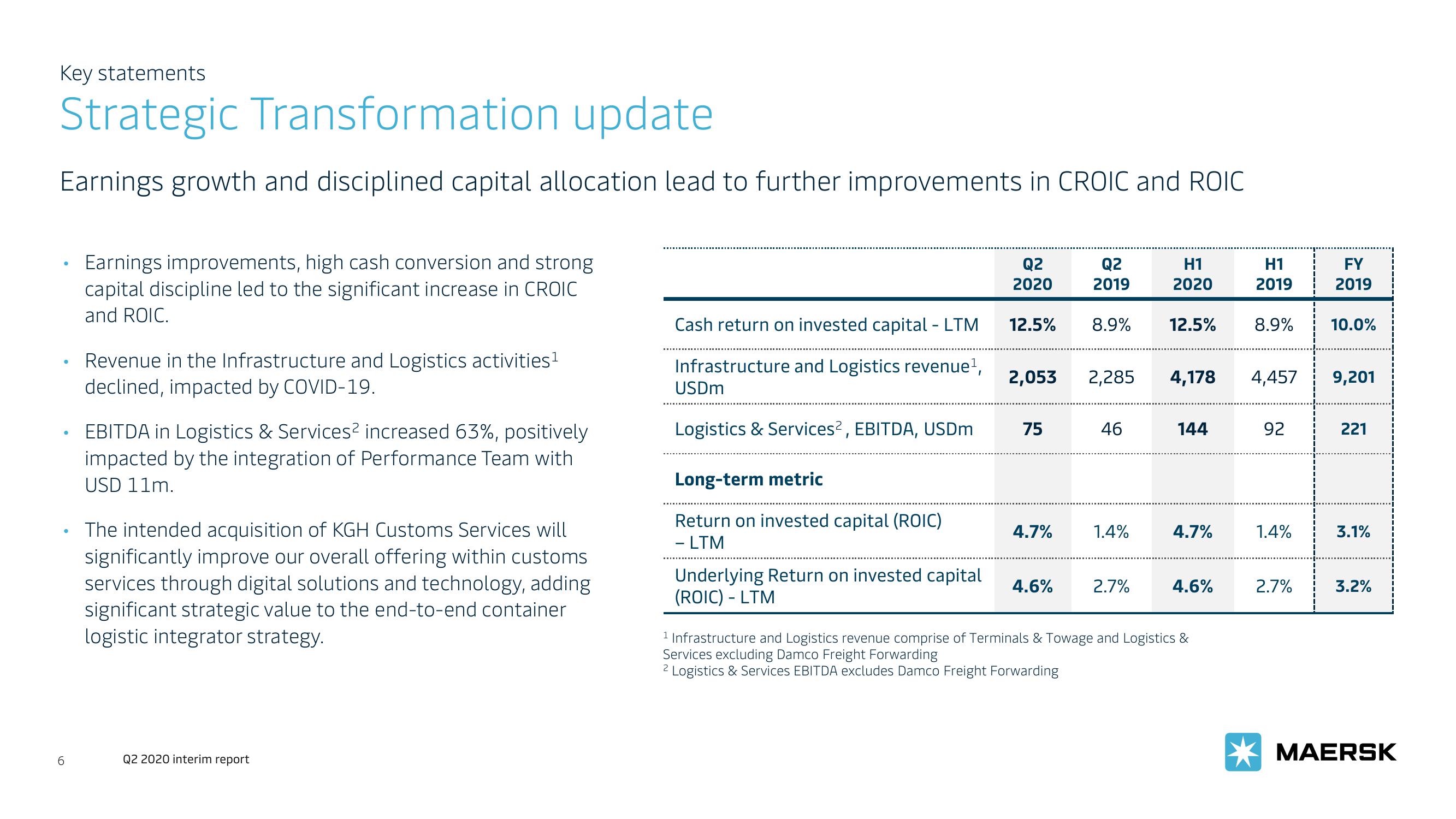

Strategic Transformation update

Earnings growth and disciplined capital allocation lead to further improvements in CROIC and ROIC

6

Earnings improvements, high cash conversion and strong

capital discipline led to the significant increase in CROIC

and ROIC.

Revenue in the Infrastructure and Logistics activities¹

declined, impacted by COVID-19.

EBITDA in Logistics & Services² increased 63%, positively

impacted by the integration of Performance Team with

USD 11m.

The intended acquisition of KGH Customs Services will

significantly improve our overall offering within customs

services through digital solutions and technology, adding

significant strategic value to the end-to-end container

logistic integrator strategy.

Q2 2020 interim report

Cash return on invested capital - LTM

Infrastructure and Logistics revenue ¹,

USDm

Logistics & Services2, EBITDA, USDm

Long-term metric

Return on invested capital (ROIC)

- LTM

Underlying Return on invested capital

(ROIC) - LTM

Q2

2020

12.5%

2,053

75

4.7%

4.6%

Q2

2019

8.9%

46

1.4%

H1

2020

2.7%

12.5%

2,285 4,178 4,457

144

4.7%

4.6%

H1

2019

¹ Infrastructure and Logistics revenue comprise of Terminals & Towage and Logistics &

Services excluding Damco Freight Forwarding

2 Logistics & Services EBITDA excludes Damco Freight Forwarding

8.9%

92

1.4%

2.7%

FY

2019

10.0%

9,201

221

3.1%

3.2%

MAERSKView entire presentation