J.P.Morgan Results Presentation Deck

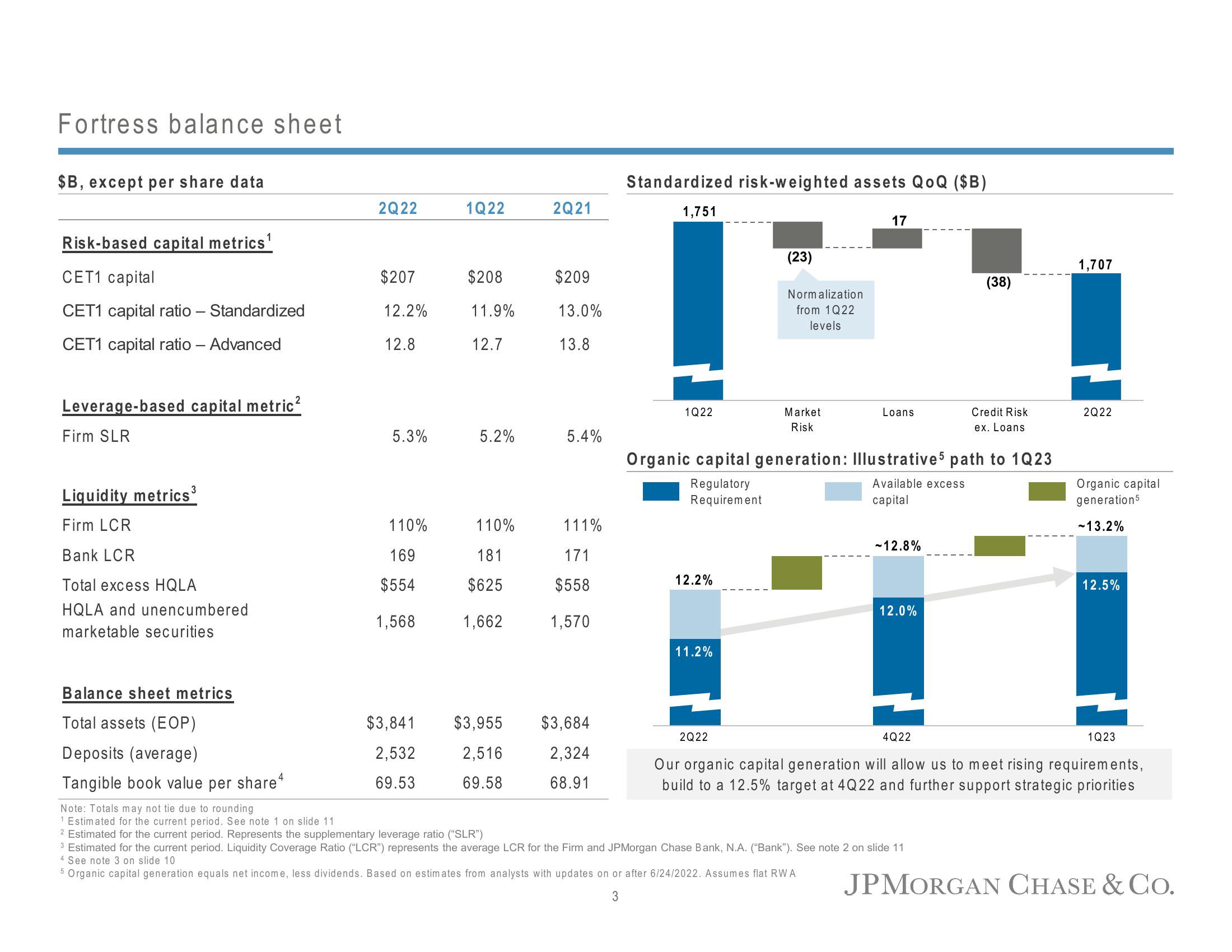

Fortress balance sheet

$B, except per share data

Risk-based capital metrics¹

CET1 capital

CET1 capital ratio - Standardized

CET1 capital ratio - Advanced

Leverage-based capital metric²

Firm SLR

Liquidity metrics ³

Firm LCR

Bank LCR

Total excess HQLA

HQLA and unencumbered

marketable securities

2Q22

$207

12.2%

12.8

5.3%

110%

169

$554

1,568

1Q22

$3,841

2,532

69.53

$208

11.9%

12.7

5.2%

110%

181

$625

1,662

Balance sheet metrics

Total assets (EOP)

Deposits (average)

Tangible book value per share4

Note: Totals may not tie due to rounding

1 Estimated for the current period. See note 1 on slide 11

2 Estimated for the current period. Represents the supplementary leverage ratio ("SLR")

2Q21

$209

13.0%

13.8

5.4%

111%

171

$558

1,570

$3,955 $3,684

2,516

2,324

69.58

68.91

Standardized risk-weighted assets QoQ ($B)

1,751

1Q22

12.2%

11.2%

(23)

2Q22

Normalization

from 1Q22

levels

Market

Risk

17

Loans

Organic capital generation: Illustrative 5 path to 1Q23

Available excess

Regulatory

Requirement

capital

-12.8%

12.0%

4Q22

(38)

Credit Risk

ex. Loans

3 Estimated for the current period. Liquidity Coverage Ratio ("LCR") represents the average LCR for the Firm and JPMorgan Chase Bank, N.A. ("Bank"). See note 2 on slide 11

4 See note 3 on slide 10

5 Organic capital generation equals net income, less dividends. Based on estimates from analysts with updates on or after 6/24/2022. Assumes flat RWA

3

1,707

2Q22

Organic capital

generation 5

-13.2%

12.5%

1Q23

Our organic capital generation will allow us to meet rising requirements,

build to a 12.5% target at 4Q22 and further support strategic priorities

JPMORGAN CHASE & Co.View entire presentation