Coppersmith Presentation to Alere Inc Stockholders

PAGE 28 |

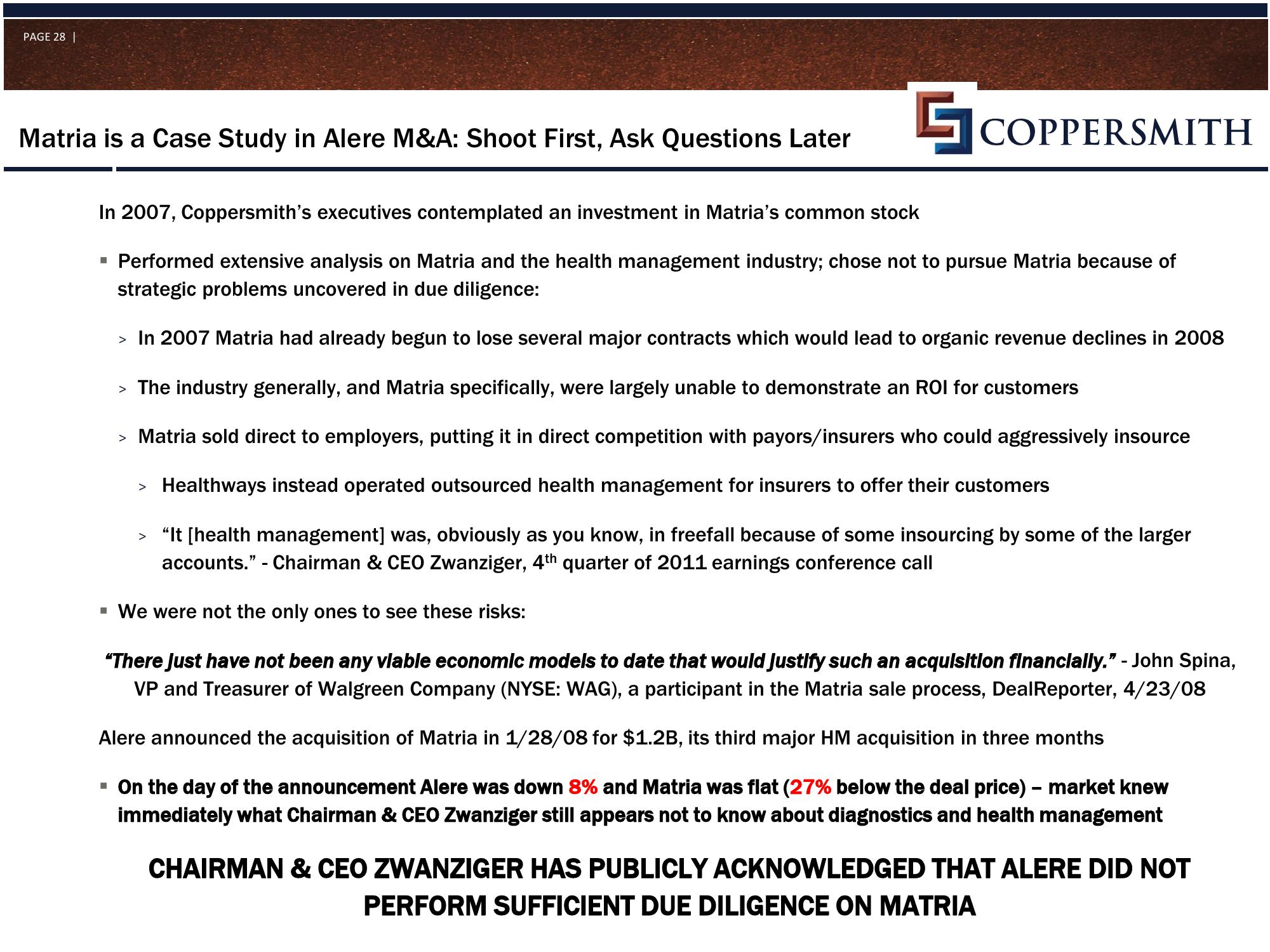

Matria is a Case Study in Alere M&A: Shoot First, Ask Questions Later

SCOPPERSMITH

In 2007, Coppersmith's executives contemplated an investment in Matria's common stock

▪ Performed extensive analysis on Matria and the health management industry; chose not to pursue Matria because of

strategic problems uncovered in due diligence:

> In 2007 Matria had already begun to lose several major contracts which would lead to organic revenue declines in 2008

> The industry generally, and Matria specifically, were largely unable to demonstrate an ROI for customers

> Matria sold direct to employers, putting it in direct competition with payors/insurers who could aggressively insource

Healthways instead operated outsourced health management for insurers to offer their customers

"It [health management] was, obviously as you know, in freefall because of some insourcing by some of the larger

accounts." - Chairman & CEO Zwanziger, 4th quarter of 2011 earnings conference call

▪ We were not the only ones to see these risks:

"There Just have not been any vlable economic models to date that would Justify such an acquisition financially." - John Spina,

VP and Treasurer of Walgreen Company (NYSE: WAG), a participant in the Matria sale process, DealReporter, 4/23/08

Alere announced the acquisition of Matria in 1/28/08 for $1.2B, its third major HM acquisition in three months

▪ On the day of the announcement Alere was down 8% and Matria was flat (27% below the deal price) - market knew

immediately what Chairman & CEO Zwanzig still appears not to know about diagnostics and health management

>

CHAIRMAN & CEO ZWANZIGER HAS PUBLICLY ACKNOWLEDGED THAT ALERE DID NOT

PERFORM SUFFICIENT DUE DILIGENCE ON MATRIAView entire presentation